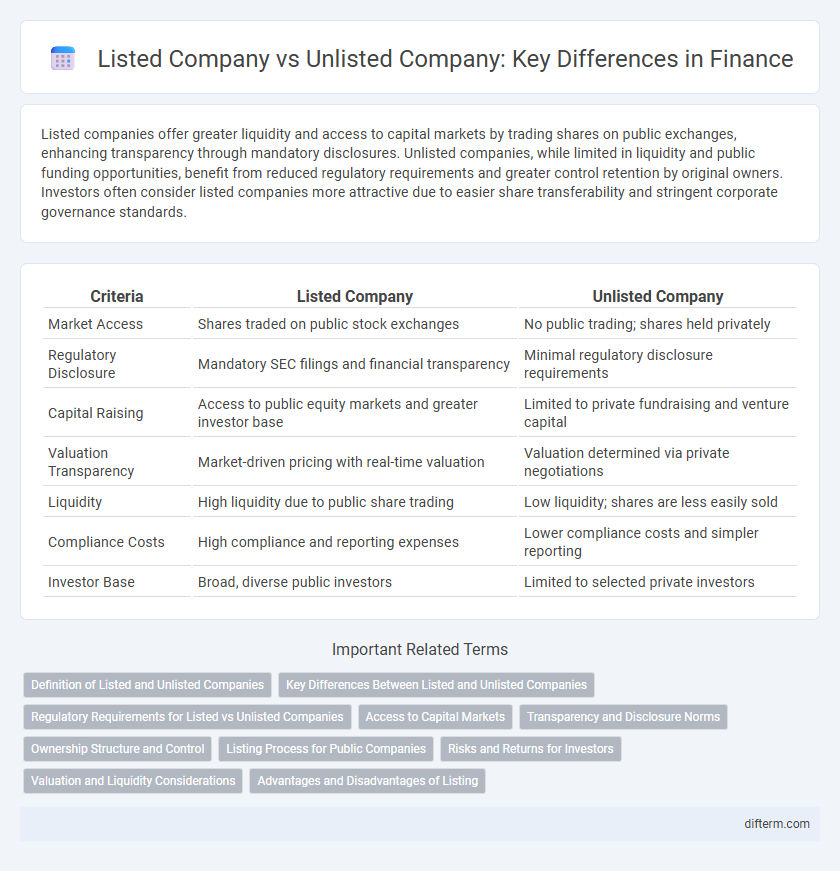

Listed companies offer greater liquidity and access to capital markets by trading shares on public exchanges, enhancing transparency through mandatory disclosures. Unlisted companies, while limited in liquidity and public funding opportunities, benefit from reduced regulatory requirements and greater control retention by original owners. Investors often consider listed companies more attractive due to easier share transferability and stringent corporate governance standards.

Table of Comparison

| Criteria | Listed Company | Unlisted Company |

|---|---|---|

| Market Access | Shares traded on public stock exchanges | No public trading; shares held privately |

| Regulatory Disclosure | Mandatory SEC filings and financial transparency | Minimal regulatory disclosure requirements |

| Capital Raising | Access to public equity markets and greater investor base | Limited to private fundraising and venture capital |

| Valuation Transparency | Market-driven pricing with real-time valuation | Valuation determined via private negotiations |

| Liquidity | High liquidity due to public share trading | Low liquidity; shares are less easily sold |

| Compliance Costs | High compliance and reporting expenses | Lower compliance costs and simpler reporting |

| Investor Base | Broad, diverse public investors | Limited to selected private investors |

Definition of Listed and Unlisted Companies

Listed companies are those whose shares are publicly traded on recognized stock exchanges, allowing investors to buy and sell equity with transparent pricing and regulatory oversight. Unlisted companies do not have their shares available on public exchanges, often relying on private funding or direct investor relationships, resulting in less liquidity and limited public disclosure. The distinction impacts capital accessibility, valuation, and investor protection within the financial markets.

Key Differences Between Listed and Unlisted Companies

Listed companies are publicly traded on stock exchanges, providing greater access to capital through equity markets and enhanced liquidity for shareholders. Unlisted companies operate privately without equity shares available on public exchanges, resulting in limited capital raising opportunities but more control retained by founders. Regulatory compliance and disclosure requirements are significantly higher for listed companies, ensuring transparency, whereas unlisted companies face fewer reporting obligations.

Regulatory Requirements for Listed vs Unlisted Companies

Listed companies must comply with stringent regulatory requirements, including regular financial disclosures, adherence to corporate governance standards, and oversight by securities regulators like the SEC. Unlisted companies face less rigorous regulations, often limited to local business laws and fewer mandatory public disclosures. This disparity impacts transparency, investor protection, and market confidence between the two types of companies.

Access to Capital Markets

Listed companies benefit from enhanced access to capital markets through public equity and debt offerings, allowing them to raise substantial funds from a broad investor base. Unlisted companies typically rely on private equity, venture capital, or bank loans, limiting their funding sources and potentially increasing capital costs. The liquidity and valuation transparency of listed companies also attract institutional investors and lower the cost of capital compared to unlisted firms.

Transparency and Disclosure Norms

Listed companies adhere to stringent transparency and disclosure norms mandated by stock exchanges and regulatory authorities, ensuring regular publication of financial reports, corporate governance practices, and material events. Unlisted companies face fewer disclosure requirements, often limiting transparency to shareholders and regulatory filings, which may hinder investor confidence and market visibility. Enhanced transparency in listed firms promotes better risk assessment and informed decision-making for investors.

Ownership Structure and Control

Listed companies feature widely dispersed ownership with shares traded publicly on stock exchanges, enabling diverse shareholder participation and enhanced liquidity. Unlisted companies typically maintain concentrated ownership, often held by founders, private investors, or family, which allows for tighter control and fewer regulatory disclosures. This concentrated ownership in unlisted firms facilitates quicker decision-making processes but limits access to broad equity financing compared to listed companies.

Listing Process for Public Companies

The listing process for public companies involves meeting stringent regulatory requirements, including filing a prospectus with securities regulators and undergoing rigorous financial audits to ensure transparency and investor protection. Public companies must then comply with stock exchange criteria such as minimum market capitalization, shareholder distribution, and corporate governance standards. This process contrasts with unlisted companies, which do not have to fulfill these public disclosure obligations, making listing a crucial step for gaining access to broader capital markets and enhancing liquidity.

Risks and Returns for Investors

Listed companies offer greater liquidity and transparency, enabling investors to buy and sell shares easily while benefiting from regulatory oversight that reduces information asymmetry. Unlisted companies often present higher risk due to limited financial disclosure and marketability, but they can provide potentially higher returns through early-stage growth opportunities and greater control over business decisions. Investors must balance the lower volatility and robust market data of listed companies against the illiquidity and uncertainty but possible outsized gains of unlisted companies.

Valuation and Liquidity Considerations

Listed companies generally exhibit higher valuation multiples due to greater market transparency and investor confidence, supported by public financial disclosures and regulatory compliance. In contrast, unlisted companies often face lower valuations stemming from limited marketability and information asymmetry, which increase perceived investment risk. Liquidity for listed companies is significantly higher as shares are traded on public exchanges, enabling easier entry and exit for investors, whereas unlisted companies experience restricted liquidity with transactions typically involving private negotiations and longer holding periods.

Advantages and Disadvantages of Listing

Listing on a stock exchange provides companies with access to a broader capital base, increased liquidity of shares, and enhanced public profile, which can facilitate growth and expansion. However, listed companies face stringent regulatory compliance, higher disclosure requirements, and vulnerability to market volatility impacting stock prices. Unlisted companies enjoy greater privacy and operational flexibility but may encounter difficulties in raising capital and providing shareholder liquidity.

Listed Company vs Unlisted Company Infographic

difterm.com

difterm.com