FIFO (First In, First Out) and LIFO (Last In, First Out) are two inventory valuation methods impacting cost of goods sold and tax liabilities. FIFO assumes older inventory is sold first, often resulting in higher net income during inflation, while LIFO accounts for the newest inventory, reducing taxable income by matching recent higher costs with current revenues. Choosing between FIFO and LIFO can significantly influence financial statements and cash flow management strategies.

Table of Comparison

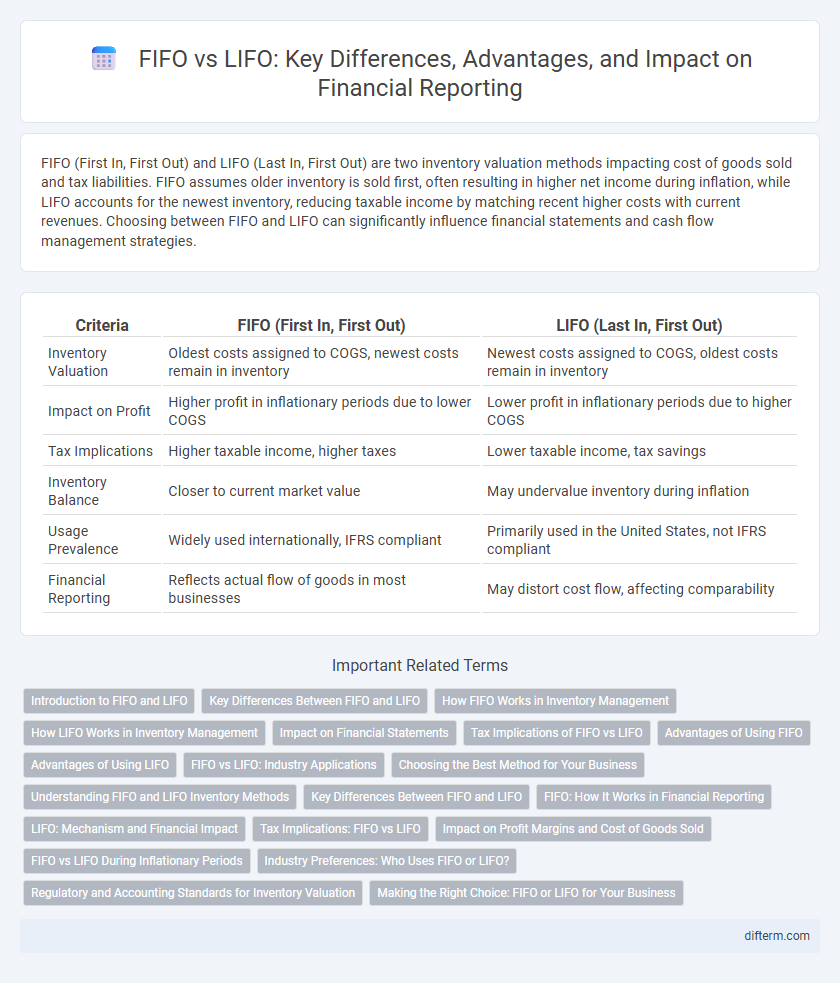

| Criteria | FIFO (First In, First Out) | LIFO (Last In, First Out) |

|---|---|---|

| Inventory Valuation | Oldest costs assigned to COGS, newest costs remain in inventory | Newest costs assigned to COGS, oldest costs remain in inventory |

| Impact on Profit | Higher profit in inflationary periods due to lower COGS | Lower profit in inflationary periods due to higher COGS |

| Tax Implications | Higher taxable income, higher taxes | Lower taxable income, tax savings |

| Inventory Balance | Closer to current market value | May undervalue inventory during inflation |

| Usage Prevalence | Widely used internationally, IFRS compliant | Primarily used in the United States, not IFRS compliant |

| Financial Reporting | Reflects actual flow of goods in most businesses | May distort cost flow, affecting comparability |

Introduction to FIFO and LIFO

FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two primary inventory valuation methods used in financial accounting to manage cost flow assumptions. FIFO assumes that the oldest inventory items are sold first, aligning with actual physical flow in many businesses and often resulting in lower cost of goods sold during inflationary periods. LIFO assumes the most recently acquired inventory is sold first, which can reduce taxable income by matching current costs with current revenues but may not reflect the actual physical flow of goods.

Key Differences Between FIFO and LIFO

FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, resulting in lower cost of goods sold and higher net income during inflationary periods. LIFO (Last-In, First-Out) assumes the most recent inventory is sold first, which typically leads to higher cost of goods sold and lower taxable income in times of rising prices. The choice between FIFO and LIFO significantly impacts financial statements, tax liabilities, and inventory valuation strategies.

How FIFO Works in Inventory Management

FIFO (First-In, First-Out) inventory management assumes the oldest stock is sold first, reflecting the actual flow of goods in many industries. This method ensures inventory on hand is valued at the most recent purchase costs, providing accurate cost of goods sold (COGS) and ending inventory valuation during periods of inflation. Companies using FIFO benefit from higher net income and improved balance sheet asset values compared to LIFO in most economic environments.

How LIFO Works in Inventory Management

LIFO (Last-In, First-Out) inventory management assumes the most recently acquired items are sold first, impacting cost of goods sold (COGS) by reflecting current market prices. This method often results in higher COGS and lower taxable income during inflationary periods, providing tax advantages for businesses. LIFO is advantageous for companies with fluctuating inventory costs, aligning expense recognition closer to current replacement costs.

Impact on Financial Statements

FIFO inventory valuation results in higher ending inventory values and lower cost of goods sold (COGS) during periods of rising prices, which increases net income and total assets on the balance sheet. Conversely, LIFO produces lower ending inventory and higher COGS, reducing taxable income and net income but providing tax benefits in inflationary environments. The choice between FIFO and LIFO directly affects key financial metrics such as gross profit, net income, and inventory turnover ratios, influencing investor decisions and financial analysis.

Tax Implications of FIFO vs LIFO

The tax implications of FIFO and LIFO inventory valuation methods significantly affect corporate financial statements and tax liability. FIFO generally results in higher taxable income during periods of rising prices because older, lower-cost inventory is expensed first, leading to increased tax payments. In contrast, LIFO reduces taxable income by matching recent higher costs against revenues, thereby deferring tax liability and improving cash flow, though it may lower reported earnings and inventory values on the balance sheet.

Advantages of Using FIFO

FIFO inventory accounting enhances financial reporting accuracy by matching older costs with current revenues, reflecting a more realistic profit margin during inflationary periods. It improves cash flow management through lower tax liabilities, as the cost of older, cheaper inventory reduces taxable income. FIFO also offers simpler inventory tracking and valuation, which increases transparency and aligns with actual physical stock rotation.

Advantages of Using LIFO

LIFO (Last In, First Out) accounting provides significant tax advantages by matching current higher costs against current revenues, thereby reducing taxable income during periods of inflation. It better reflects the actual flow of inventory costs in industries where prices regularly rise, allowing companies to report lower profits and defer tax liabilities. Furthermore, LIFO improves cash flow by decreasing the amount of taxes paid, aiding businesses in managing working capital more effectively.

FIFO vs LIFO: Industry Applications

FIFO is widely used in industries dealing with perishable goods, such as food and pharmaceuticals, where inventory turnover is rapid and product freshness is critical. LIFO is often favored in industries like oil and gas or manufacturing that experience inflationary cost environments, as it can reduce taxable income by matching recent higher costs against current revenues. Companies must evaluate their inventory management strategies carefully to optimize tax benefits and accurately reflect financial health based on industry-specific practices.

Choosing the Best Method for Your Business

Choosing between FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) depends on your business's inventory flow, tax strategy, and financial reporting goals. FIFO aligns inventory costs with actual sales by assuming the oldest items are sold first, often resulting in higher profits during inflation, while LIFO matches recent costs with current revenue, potentially reducing taxable income. Analyzing cash flow impacts, tax implications, and alignment with industry standards will guide businesses to the most advantageous accounting method.

FIFO vs LIFO Infographic

difterm.com

difterm.com