EBITDA measures a company's operating performance by excluding interest, taxes, depreciation, and amortization, providing a clear view of core profitability. Net Income, on the other hand, reflects the total profit after all expenses, including non-operating costs and taxes, offering a comprehensive overview of financial health. Comparing EBITDA and Net Income helps investors assess operational efficiency versus overall profitability and cash flow sustainability.

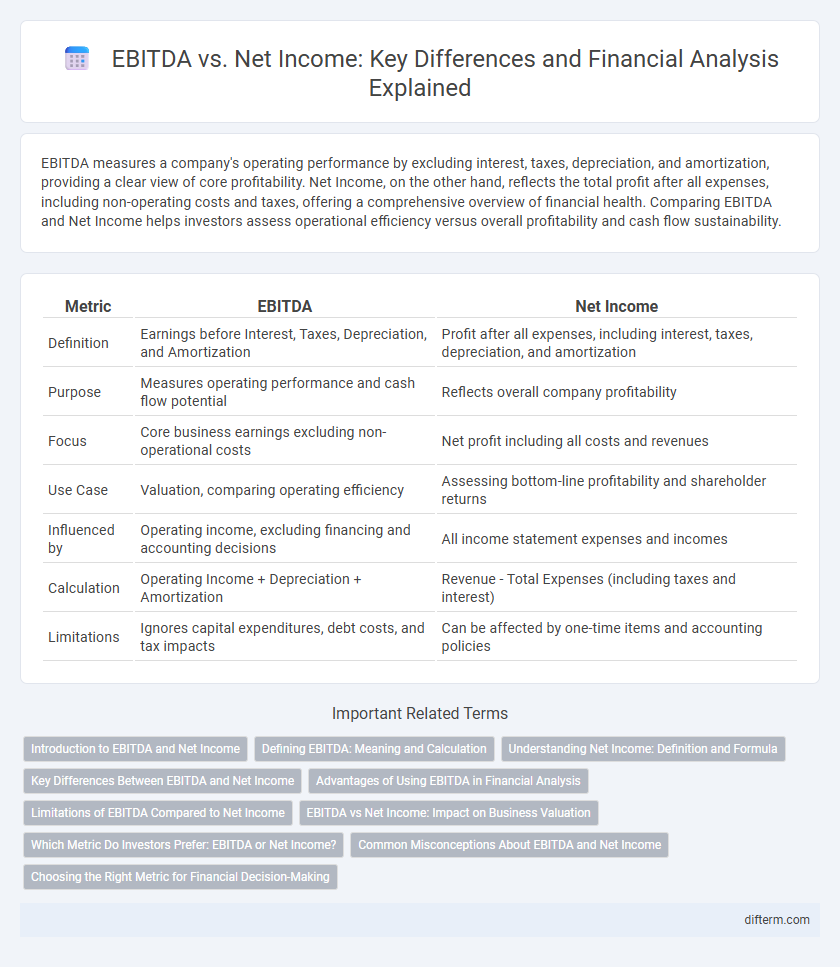

Table of Comparison

| Metric | EBITDA | Net Income |

|---|---|---|

| Definition | Earnings before Interest, Taxes, Depreciation, and Amortization | Profit after all expenses, including interest, taxes, depreciation, and amortization |

| Purpose | Measures operating performance and cash flow potential | Reflects overall company profitability |

| Focus | Core business earnings excluding non-operational costs | Net profit including all costs and revenues |

| Use Case | Valuation, comparing operating efficiency | Assessing bottom-line profitability and shareholder returns |

| Influenced by | Operating income, excluding financing and accounting decisions | All income statement expenses and incomes |

| Calculation | Operating Income + Depreciation + Amortization | Revenue - Total Expenses (including taxes and interest) |

| Limitations | Ignores capital expenditures, debt costs, and tax impacts | Can be affected by one-time items and accounting policies |

Introduction to EBITDA and Net Income

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-operational expenses, offering a clearer view of core profitability. Net Income represents the total profit after all expenses, taxes, and costs have been deducted, reflecting the actual profitability available to shareholders. Comparing EBITDA and Net Income helps investors assess operational efficiency versus overall financial health.

Defining EBITDA: Meaning and Calculation

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-operating expenses and non-cash charges. It is calculated by adding back interest, taxes, depreciation, and amortization to net income, providing a clearer view of core business performance. This metric is widely used for comparing profitability across companies by isolating earnings from financing and accounting decisions.

Understanding Net Income: Definition and Formula

Net income, also known as net profit or earnings, represents the total profitability of a company after all expenses, taxes, and costs have been deducted from total revenue. The formula for calculating net income is: Net Income = Total Revenue - Total Expenses (including operating costs, interest, and taxes). This metric provides a comprehensive view of a company's financial performance and is crucial for assessing its overall profitability and shareholder value.

Key Differences Between EBITDA and Net Income

EBITDA measures a company's operational profitability by excluding expenses like interest, taxes, depreciation, and amortization, providing insight into core business performance. Net Income reflects the company's total profit after all expenses, including non-operational costs and tax liabilities, giving a comprehensive view of financial health. Key differences include EBITDA's focus on cash flow potential and operational efficiency, while Net Income accounts for financing and tax impacts, essential for assessing overall profitability.

Advantages of Using EBITDA in Financial Analysis

EBITDA provides a clearer picture of a company's operational performance by excluding non-operating expenses such as interest, taxes, depreciation, and amortization, allowing analysts to focus on core profitability. It facilitates easier comparison between companies in different industries or with varying capital structures by removing the effects of financing and accounting decisions. Investors and lenders prefer EBITDA for assessing cash flow potential and operational efficiency, which are critical for valuation and creditworthiness analysis.

Limitations of EBITDA Compared to Net Income

EBITDA excludes depreciation, amortization, interest, and taxes, which can lead to an overestimation of a company's profitability by ignoring essential expenses that impact cash flow and financial health. Unlike net income, EBITDA does not account for capital expenditures or changes in working capital, limiting its effectiveness for assessing long-term sustainability. The absence of tax and interest considerations in EBITDA can also distort comparisons between companies with different financing structures and tax environments.

EBITDA vs Net Income: Impact on Business Valuation

EBITDA provides a clearer picture of operational profitability by excluding non-operating expenses, taxes, depreciation, and amortization, making it a preferred metric for business valuation in industries with significant capital expenditures. Net income accounts for all expenses and reflects the company's actual profit, offering insight into overall financial health but potentially obscuring operational performance. Investors often prioritize EBITDA to assess cash flow potential and compare companies within sectors, while net income influences valuation through earnings quality and sustainability analysis.

Which Metric Do Investors Prefer: EBITDA or Net Income?

Investors often prefer EBITDA over Net Income for evaluating a company's operational performance because EBITDA highlights earnings before interest, taxes, depreciation, and amortization, providing a clearer view of cash flow and operational efficiency. However, Net Income remains crucial as it accounts for all expenses, taxes, and non-operating costs, offering a comprehensive picture of profitability and bottom-line results. The choice between EBITDA and Net Income depends on the investor's focus, with EBITDA favored for assessing core business health and Net Income for understanding overall financial performance.

Common Misconceptions About EBITDA and Net Income

EBITDA often gets mistaken for a direct indicator of profitability, but it excludes critical expenses such as interest, taxes, depreciation, and amortization that impact net income. Many investors overlook that net income provides a more comprehensive measure of a company's financial performance by accounting for all revenues and expenses. Understanding the distinction between EBITDA as a cash flow proxy and net income as bottom-line profit is essential for accurate financial analysis and valuation.

Choosing the Right Metric for Financial Decision-Making

EBITDA provides a clear picture of operating performance by excluding non-cash expenses like depreciation and amortization, making it ideal for assessing core profitability and cash flow potential. Net income accounts for all expenses, taxes, and interest, offering a comprehensive view of a company's overall profitability and financial health. Selecting the right metric depends on whether the decision prioritizes operational efficiency or the complete bottom-line impact, crucial for investors, creditors, and management.

EBITDA vs Net Income Infographic

difterm.com

difterm.com