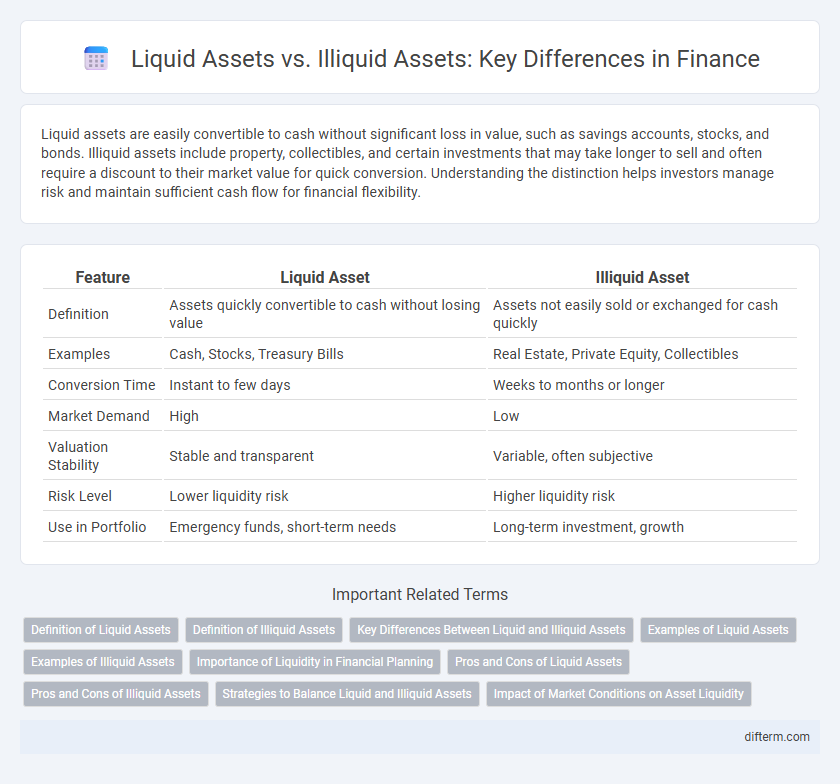

Liquid assets are easily convertible to cash without significant loss in value, such as savings accounts, stocks, and bonds. Illiquid assets include property, collectibles, and certain investments that may take longer to sell and often require a discount to their market value for quick conversion. Understanding the distinction helps investors manage risk and maintain sufficient cash flow for financial flexibility.

Table of Comparison

| Feature | Liquid Asset | Illiquid Asset |

|---|---|---|

| Definition | Assets quickly convertible to cash without losing value | Assets not easily sold or exchanged for cash quickly |

| Examples | Cash, Stocks, Treasury Bills | Real Estate, Private Equity, Collectibles |

| Conversion Time | Instant to few days | Weeks to months or longer |

| Market Demand | High | Low |

| Valuation Stability | Stable and transparent | Variable, often subjective |

| Risk Level | Lower liquidity risk | Higher liquidity risk |

| Use in Portfolio | Emergency funds, short-term needs | Long-term investment, growth |

Definition of Liquid Assets

Liquid assets are financial resources that can be quickly converted into cash without significantly affecting their market value. These assets include cash, money market instruments, and highly marketable securities such as Treasury bills. The ease of conversion and minimal transaction costs differentiate liquid assets from illiquid assets, which require more time and effort to sell.

Definition of Illiquid Assets

Illiquid assets are financial or physical assets that cannot be quickly converted into cash without a significant loss in value. Examples include real estate, private equity, and collectibles, which often require longer time frames to sell at market value. These assets typically lack a ready market, making them less flexible for meeting immediate financial needs compared to liquid assets like stocks or cash.

Key Differences Between Liquid and Illiquid Assets

Liquid assets, such as cash and marketable securities, can be quickly converted into cash without significant loss of value, providing immediate access to funds for financial obligations. Illiquid assets, including real estate and private equity, require longer timeframes to sell and often involve higher transaction costs, limiting their use for urgent liquidity needs. The key differences lie in conversion speed, marketability, and price stability, affecting portfolio flexibility and risk management.

Examples of Liquid Assets

Cash and checking account balances represent the most common examples of liquid assets due to their immediate availability for transactions. Marketable securities such as Treasury bills, stocks, and bonds can also be classified as liquid assets because they can be quickly converted into cash with minimal loss of value. Money market funds and highly liquid mutual funds provide additional examples, as they offer quick access to funds while maintaining investment returns.

Examples of Illiquid Assets

Illiquid assets include real estate properties, private equity investments, and collectibles such as art or antiques, which often require extended periods to convert into cash. These assets lack active markets, making their valuation and sale processes complex and time-consuming. Investors holding illiquid assets face challenges in accessing quick funds compared to liquid assets like stocks or cash equivalents.

Importance of Liquidity in Financial Planning

Liquidity plays a crucial role in financial planning by ensuring quick access to cash through liquid assets like cash, marketable securities, and checking accounts, which can cover emergencies or investment opportunities. Illiquid assets, such as real estate, private equity, or collectibles, often require substantial time and cost to convert into cash, potentially hindering financial flexibility. Prioritizing liquid assets enhances risk management and cash flow stability, enabling more effective budgeting and timely financial decision-making.

Pros and Cons of Liquid Assets

Liquid assets offer high accessibility and quick conversion to cash, facilitating immediate financial flexibility and meeting urgent liabilities. However, they typically yield lower returns compared to illiquid assets, which may limit long-term growth potential in a diversified portfolio. The ease of trading liquid assets reduces market risk but exposes investors to potential losses during market volatility.

Pros and Cons of Illiquid Assets

Illiquid assets, such as real estate and private equity, offer potential for higher returns and portfolio diversification but pose challenges due to difficulty in converting them to cash quickly without significant loss of value. These assets often require long holding periods and can be less transparent, increasing risk and limiting flexibility for urgent financial needs. Despite these drawbacks, illiquid assets can enhance long-term growth and stability when balanced with liquid holdings.

Strategies to Balance Liquid and Illiquid Assets

Balancing liquid and illiquid assets requires maintaining an optimal mix that supports both immediate cash flow needs and long-term growth objectives. Employing portfolio diversification techniques and setting clear liquidity ratios ensure sufficient access to cash while capitalizing on higher returns from illiquid investments such as real estate or private equity. Strategic rebalancing and continuous monitoring of market conditions help adjust the allocation to match changing financial goals and risk tolerance.

Impact of Market Conditions on Asset Liquidity

Market fluctuations significantly affect the liquidity of assets, with liquid assets such as cash and treasury bills maintaining stability and quick convertibility even during economic downturns. Illiquid assets, including real estate and private equity, experience prolonged selling periods and potential value erosion when market conditions deteriorate. Understanding these dynamics helps investors balance portfolios by aligning asset liquidity with risk tolerance and market volatility.

Liquid Asset vs Illiquid Asset Infographic

difterm.com

difterm.com