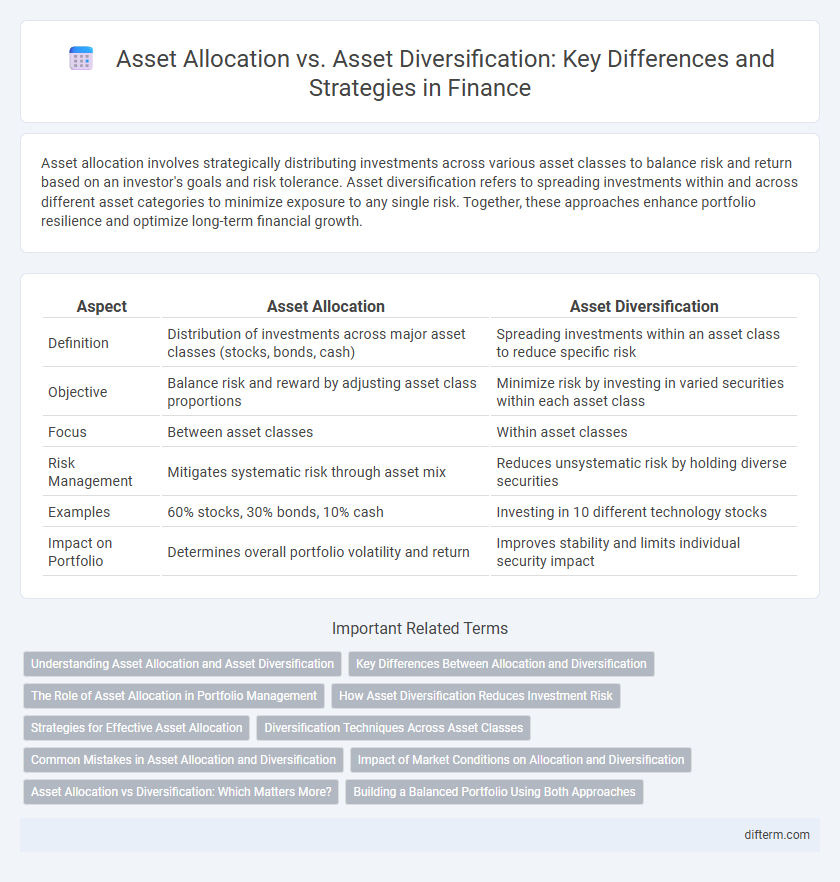

Asset allocation involves strategically distributing investments across various asset classes to balance risk and return based on an investor's goals and risk tolerance. Asset diversification refers to spreading investments within and across different asset categories to minimize exposure to any single risk. Together, these approaches enhance portfolio resilience and optimize long-term financial growth.

Table of Comparison

| Aspect | Asset Allocation | Asset Diversification |

|---|---|---|

| Definition | Distribution of investments across major asset classes (stocks, bonds, cash) | Spreading investments within an asset class to reduce specific risk |

| Objective | Balance risk and reward by adjusting asset class proportions | Minimize risk by investing in varied securities within each asset class |

| Focus | Between asset classes | Within asset classes |

| Risk Management | Mitigates systematic risk through asset mix | Reduces unsystematic risk by holding diverse securities |

| Examples | 60% stocks, 30% bonds, 10% cash | Investing in 10 different technology stocks |

| Impact on Portfolio | Determines overall portfolio volatility and return | Improves stability and limits individual security impact |

Understanding Asset Allocation and Asset Diversification

Asset allocation involves strategically distributing investments across various asset classes such as stocks, bonds, and cash to balance risk and reward based on an investor's goals and risk tolerance. Asset diversification, on the other hand, focuses on spreading investments within each asset class to reduce exposure to any single investment or risk factor. Understanding the distinction helps optimize a portfolio's performance by managing risk through both broad asset class distribution and specific asset variety.

Key Differences Between Allocation and Diversification

Asset allocation involves distributing investments across major asset classes such as stocks, bonds, and cash to balance risk and reward according to an investor's goals and risk tolerance. Asset diversification refers to spreading investments within each asset class across various sectors, industries, or geographic regions to reduce specific risks. The key difference lies in asset allocation addressing broader investment categories, while diversification targets risk reduction within those categories to enhance portfolio stability.

The Role of Asset Allocation in Portfolio Management

Asset allocation plays a critical role in portfolio management by strategically distributing investments across asset classes such as equities, bonds, and cash to balance risk and return. It aims to optimize portfolio performance by aligning asset distribution with an investor's risk tolerance, financial goals, and investment horizon. Effective asset allocation reduces portfolio volatility and enhances long-term growth potential by systematically managing exposure to market fluctuations.

How Asset Diversification Reduces Investment Risk

Asset diversification reduces investment risk by spreading capital across various asset classes such as stocks, bonds, real estate, and commodities, minimizing exposure to any single market downturn. Unlike asset allocation, which sets target proportions for different assets, diversification ensures that poor performance in one investment is offset by gains in others, enhancing portfolio stability. This risk mitigation strategy improves the likelihood of achieving consistent returns and preserves capital in volatile financial markets.

Strategies for Effective Asset Allocation

Effective asset allocation strategies balance risk and return by distributing investments across major asset classes such as equities, fixed income, and cash based on an investor's risk tolerance, time horizon, and financial goals. Tactical adjustments within asset allocation allow for capitalizing on market opportunities by overweighting or underweighting specific sectors or asset classes without compromising the overall risk profile. Combining strategic asset allocation with periodic rebalancing enhances portfolio resilience and aligns investments with evolving market conditions and personal financial objectives.

Diversification Techniques Across Asset Classes

Effective asset diversification techniques span multiple asset classes such as equities, fixed income, real estate, and commodities to mitigate risk and enhance portfolio stability. Employing strategies like geographic diversification, sector rotation, and varying investment vehicles within asset classes optimizes returns while reducing volatility. Utilizing a blend of correlation analysis and risk assessment tools ensures the diversification approach aligns with an investor's financial goals and risk tolerance.

Common Mistakes in Asset Allocation and Diversification

Common mistakes in asset allocation involve overconcentration in a few asset classes, neglecting risk tolerance and investment goals, which can lead to significant portfolio volatility and losses. In asset diversification, investors often mistakenly believe that simply increasing the number of holdings guarantees reduced risk, ignoring the correlation between assets that can undermine diversification benefits. Failure to regularly rebalance the portfolio to maintain target allocations exacerbates these errors, reducing overall investment performance.

Impact of Market Conditions on Allocation and Diversification

Asset allocation adjusts portfolio weights among asset classes to manage risk and optimize returns in response to shifting market conditions, such as interest rate changes or economic cycles. Asset diversification spreads investments across various sectors and instruments, reducing unsystematic risk but may not fully protect against systemic market downturns. Market volatility and geopolitical events can significantly impact allocation strategy efficacy, necessitating ongoing portfolio review and rebalancing to maintain alignment with investment goals.

Asset Allocation vs Diversification: Which Matters More?

Asset allocation determines the overall distribution of investments across major asset classes such as stocks, bonds, and cash, directly impacting portfolio risk and return profiles. Asset diversification involves spreading investments within each asset class to reduce specific risks associated with individual securities. Research shows asset allocation drives more than 90% of portfolio performance variability, making it a more critical factor than diversification in long-term wealth management.

Building a Balanced Portfolio Using Both Approaches

Building a balanced portfolio involves integrating asset allocation and asset diversification to optimize risk and return. Asset allocation focuses on distributing investments across major asset classes such as stocks, bonds, and real estate, while asset diversification spreads investments within each asset class to reduce specific risk. Combining these strategies enhances portfolio stability, capital preservation, and long-term growth potential.

Asset Allocation vs Asset Diversification Infographic

difterm.com

difterm.com