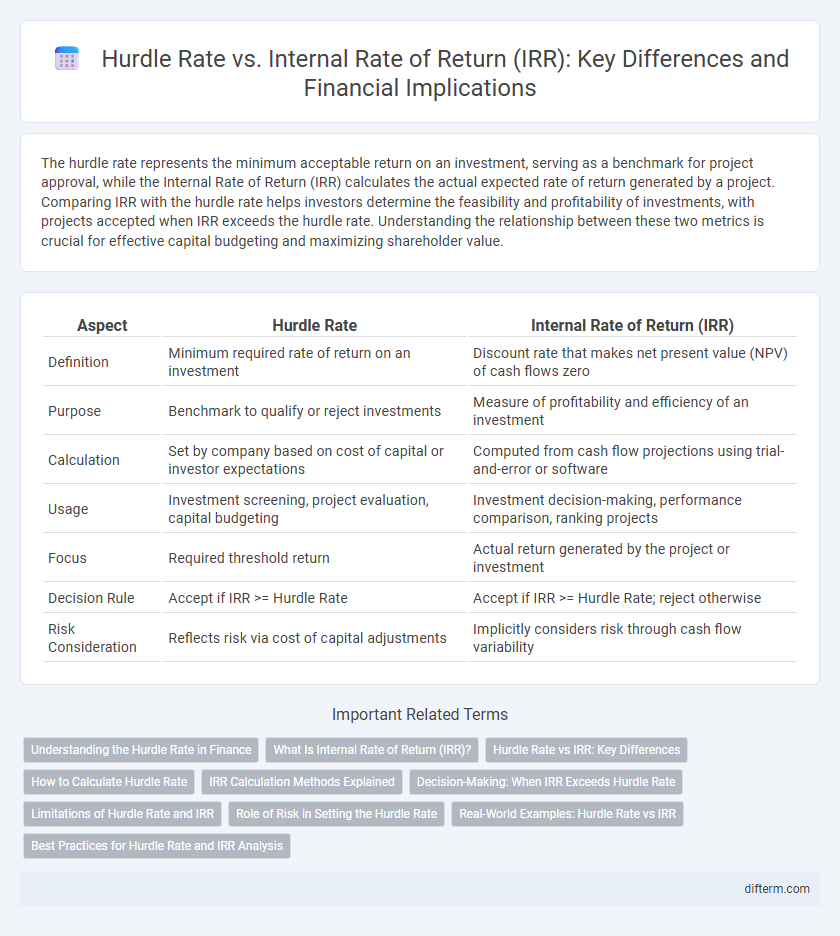

The hurdle rate represents the minimum acceptable return on an investment, serving as a benchmark for project approval, while the Internal Rate of Return (IRR) calculates the actual expected rate of return generated by a project. Comparing IRR with the hurdle rate helps investors determine the feasibility and profitability of investments, with projects accepted when IRR exceeds the hurdle rate. Understanding the relationship between these two metrics is crucial for effective capital budgeting and maximizing shareholder value.

Table of Comparison

| Aspect | Hurdle Rate | Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Minimum required rate of return on an investment | Discount rate that makes net present value (NPV) of cash flows zero |

| Purpose | Benchmark to qualify or reject investments | Measure of profitability and efficiency of an investment |

| Calculation | Set by company based on cost of capital or investor expectations | Computed from cash flow projections using trial-and-error or software |

| Usage | Investment screening, project evaluation, capital budgeting | Investment decision-making, performance comparison, ranking projects |

| Focus | Required threshold return | Actual return generated by the project or investment |

| Decision Rule | Accept if IRR >= Hurdle Rate | Accept if IRR >= Hurdle Rate; reject otherwise |

| Risk Consideration | Reflects risk via cost of capital adjustments | Implicitly considers risk through cash flow variability |

Understanding the Hurdle Rate in Finance

The hurdle rate in finance represents the minimum acceptable rate of return on an investment, serving as a benchmark to evaluate project viability and ensure value creation. It typically reflects the company's cost of capital, adjusted for risk factors associated with the investment. Comparing the internal rate of return (IRR) to the hurdle rate determines whether a project meets the required financial threshold to justify funding.

What Is Internal Rate of Return (IRR)?

Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero, serving as a key metric for evaluating project profitability. IRR represents the expected annualized rate of return, helping investors determine whether a project meets or exceeds the required Hurdle Rate. Comparing IRR to the Hurdle Rate assists in assessing the feasibility of investments by indicating potential value creation or financial risk.

Hurdle Rate vs IRR: Key Differences

Hurdle Rate represents the minimum acceptable rate of return set by investors or management to approve a project, serving as a benchmark for investment decisions. Internal Rate of Return (IRR) calculates the actual expected return of a project based on its cash flows, indicating profitability potential. The key difference lies in Hurdle Rate being a threshold for investment approval, while IRR measures the project's intrinsic return, determining if it meets or exceeds the Hurdle Rate.

How to Calculate Hurdle Rate

The hurdle rate is calculated by determining the minimum acceptable rate of return based on the company's cost of capital, market risk premium, and project-specific risk factors. It often involves using the Weighted Average Cost of Capital (WACC) as a baseline, adjusted for additional risk premiums related to the investment's complexity or sector volatility. Precise calculation requires incorporating the risk-free rate, equity risk premium, beta coefficient, and debt cost weighted by capital structure to ensure an accurate threshold for investment appraisal.

IRR Calculation Methods Explained

The Internal Rate of Return (IRR) calculation involves finding the discount rate that sets the net present value (NPV) of all cash flows from an investment to zero, typically using iterative numerical methods such as the Newton-Raphson or secant method due to the equation's non-linearity. Financial analysts often apply software tools and spreadsheet functions like Excel's IRR or XIRR to accurately compute IRR for irregular cash flow timings. Understanding the IRR calculation process is crucial for comparing investment performance against the hurdle rate, ensuring that projects meet or exceed required return thresholds.

Decision-Making: When IRR Exceeds Hurdle Rate

When the Internal Rate of Return (IRR) exceeds the hurdle rate, it signals that a project is expected to generate returns higher than the minimum required by investors or management, justifying investment approval. This decision criterion prioritizes projects that enhance firm value by exceeding cost of capital benchmarks, ensuring optimal allocation of capital resources. Comparing IRR against hurdle rate streamlines capital budgeting decisions by filtering out projects that do not meet profitability thresholds.

Limitations of Hurdle Rate and IRR

Hurdle rate limitations include its static nature, which fails to account for changing market conditions and risk profiles over time, potentially leading to suboptimal investment decisions. IRR can be misleading when projects have non-conventional cash flows or multiple sign changes, resulting in multiple IRRs or no real solution. Both metrics ignore scale and timing nuances, with IRR sometimes favoring smaller projects with higher percentage returns over larger, more profitable ventures.

Role of Risk in Setting the Hurdle Rate

The hurdle rate incorporates the risk premium to account for the uncertainty and potential volatility associated with a specific investment, ensuring that only projects exceeding this threshold justify the risk taken. Internal Rate of Return (IRR) measures the expected profitability of a project without directly adjusting for risk, making the hurdle rate a critical benchmark to gauge acceptable risk levels. Adjusting the hurdle rate to reflect market conditions and project-specific risks ensures more accurate investment decisions and capital allocation.

Real-World Examples: Hurdle Rate vs IRR

A real estate investment project with a hurdle rate of 8% requires the internal rate of return (IRR) to exceed this threshold to be considered viable, ensuring risk-adjusted returns are met. For example, if the IRR on a commercial property acquisition is 10%, it surpasses the hurdle rate, indicating profitability above the minimum acceptable return. In contrast, a renewable energy project with an IRR of 6% against a hurdle rate of 7% may signal insufficient returns, prompting reevaluation or rejection.

Best Practices for Hurdle Rate and IRR Analysis

Best practices for hurdle rate and IRR analysis include setting the hurdle rate based on company-specific risk factors and market conditions to ensure realistic project evaluation benchmarks. Incorporating sensitivity analysis around IRR calculations helps account for uncertainties in cash flow projections and improves investment decision accuracy. Regularly updating hurdle rates and comparing them against IRR ensures alignment with evolving capital costs and strategic financial goals.

Hurdle Rate vs Internal Rate of Return (IRR) Infographic

difterm.com

difterm.com