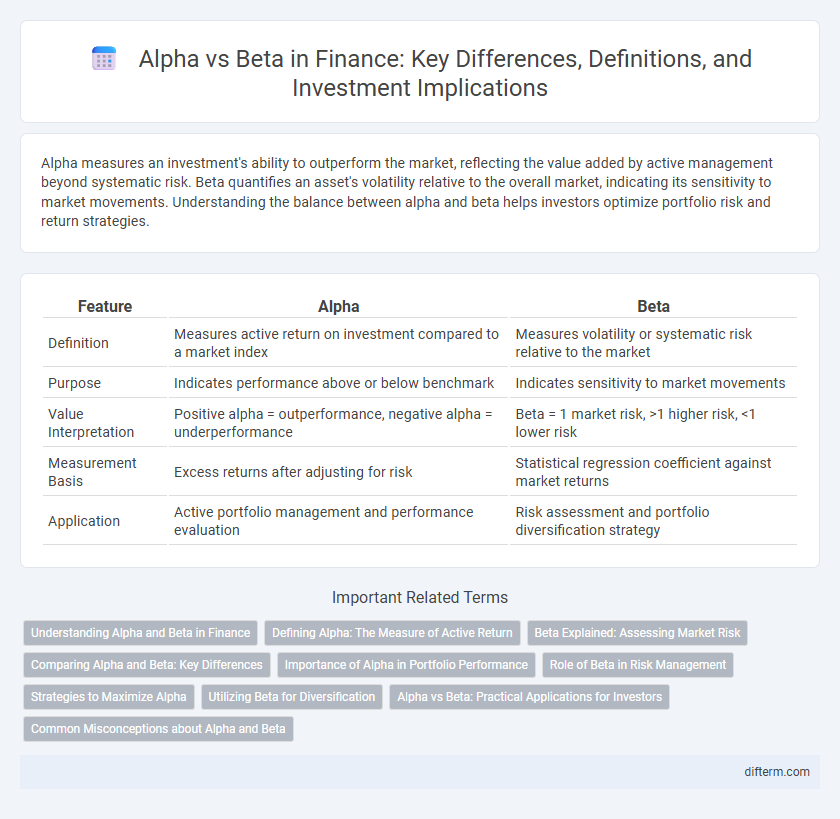

Alpha measures an investment's ability to outperform the market, reflecting the value added by active management beyond systematic risk. Beta quantifies an asset's volatility relative to the overall market, indicating its sensitivity to market movements. Understanding the balance between alpha and beta helps investors optimize portfolio risk and return strategies.

Table of Comparison

| Feature | Alpha | Beta |

|---|---|---|

| Definition | Measures active return on investment compared to a market index | Measures volatility or systematic risk relative to the market |

| Purpose | Indicates performance above or below benchmark | Indicates sensitivity to market movements |

| Value Interpretation | Positive alpha = outperformance, negative alpha = underperformance | Beta = 1 market risk, >1 higher risk, <1 lower risk |

| Measurement Basis | Excess returns after adjusting for risk | Statistical regression coefficient against market returns |

| Application | Active portfolio management and performance evaluation | Risk assessment and portfolio diversification strategy |

Understanding Alpha and Beta in Finance

Alpha measures an investment's excess return relative to a benchmark index, indicating the value a portfolio manager adds beyond market movements. Beta quantifies an asset's volatility in comparison to the overall market, showing its sensitivity to market fluctuations. Understanding alpha and beta helps investors assess risk-adjusted performance and make informed portfolio decisions.

Defining Alpha: The Measure of Active Return

Alpha represents the active return on an investment compared to a market index or benchmark, indicating the value a portfolio manager adds through skill rather than market movement. It quantifies the difference between actual returns and expected returns based on the investment's beta, isolating the effect of active management decisions. A positive alpha signifies outperformance, while a negative alpha indicates underperformance relative to the benchmark.

Beta Explained: Assessing Market Risk

Beta measures an investment's sensitivity to market movements, indicating its systematic risk relative to the overall market. A beta greater than 1 signals higher volatility than the market, while a beta less than 1 indicates lower volatility. Investors use beta to assess portfolio risk and to balance exposure between aggressive and conservative assets.

Comparing Alpha and Beta: Key Differences

Alpha measures the excess return of an investment relative to a benchmark index, indicating the value a portfolio manager adds through active management. Beta quantifies the volatility or systematic risk of an investment compared to the overall market, revealing its sensitivity to market movements. Understanding Alpha and Beta helps investors evaluate both risk-adjusted performance and market risk exposure when constructing diversified portfolios.

Importance of Alpha in Portfolio Performance

Alpha measures a portfolio's ability to generate returns above its expected benchmark performance, directly indicating the added value of an investment strategy. A positive alpha signifies skilled management and a potential for higher risk-adjusted returns, making it a critical metric for investors seeking outperforming assets. Beta measures market risk exposure but does not capture the manager's unique skill, underscoring alpha's importance in evaluating true portfolio success.

Role of Beta in Risk Management

Beta measures a financial asset's sensitivity to market movements, serving as a key indicator of systematic risk in portfolio management. A higher beta indicates greater volatility relative to the market, informing risk-adjusted return strategies and asset allocation decisions. Portfolio managers use beta to balance exposure, optimize diversification, and implement hedging techniques for effective risk management.

Strategies to Maximize Alpha

Maximizing alpha in investment portfolios requires employing strategies such as active management, sector rotation, and market timing to exploit inefficiencies and generate returns above the benchmark beta. Utilizing quantitative models and alternative data sources enhances stock selection precision, while hedging techniques mitigate systematic risk, preserving alpha gains. Integrating factor investing and leveraging advanced risk controls further refines portfolio performance, optimizing alpha generation relative to market exposure.

Utilizing Beta for Diversification

Beta measures a stock's volatility relative to the overall market, making it a crucial metric for portfolio diversification strategies. Investors utilize low-beta assets to reduce risk exposure while maintaining potential returns, balancing high-beta holdings that drive growth. Effective diversification leverages varied beta coefficients to optimize risk-adjusted performance and enhance capital allocation.

Alpha vs Beta: Practical Applications for Investors

Alpha quantifies an investment's ability to outperform the market benchmark, reflecting skillful asset selection and active management. Beta measures an asset's sensitivity to market movements, indicating its systematic risk relative to the overall market. Investors use alpha to identify superior returns beyond market trends, while beta guides portfolio diversification and risk management strategies.

Common Misconceptions about Alpha and Beta

Alpha and Beta are often misunderstood as measures solely of investment returns and risk, but Alpha represents excess return relative to a benchmark, while Beta indicates the sensitivity of an asset's returns to market movements. A common misconception is that a high Beta always means higher risk and higher returns, ignoring that Beta only measures systematic risk related to market fluctuations. Many investors mistakenly equate a positive Alpha with guaranteed outperformance, overlooking that Alpha is a relative measure dependent on the chosen benchmark and timeframe.

Alpha vs Beta Infographic

difterm.com

difterm.com