Leveraged ETFs aim to amplify the daily returns of an underlying index, offering investors the potential for higher gains but with increased risk and volatility. Inverse ETFs, on the other hand, are designed to move opposite to the index's daily performance, providing a tool for hedging or profiting from market declines. Both types require careful monitoring due to their complex structure and potential for significant losses over extended periods.

Table of Comparison

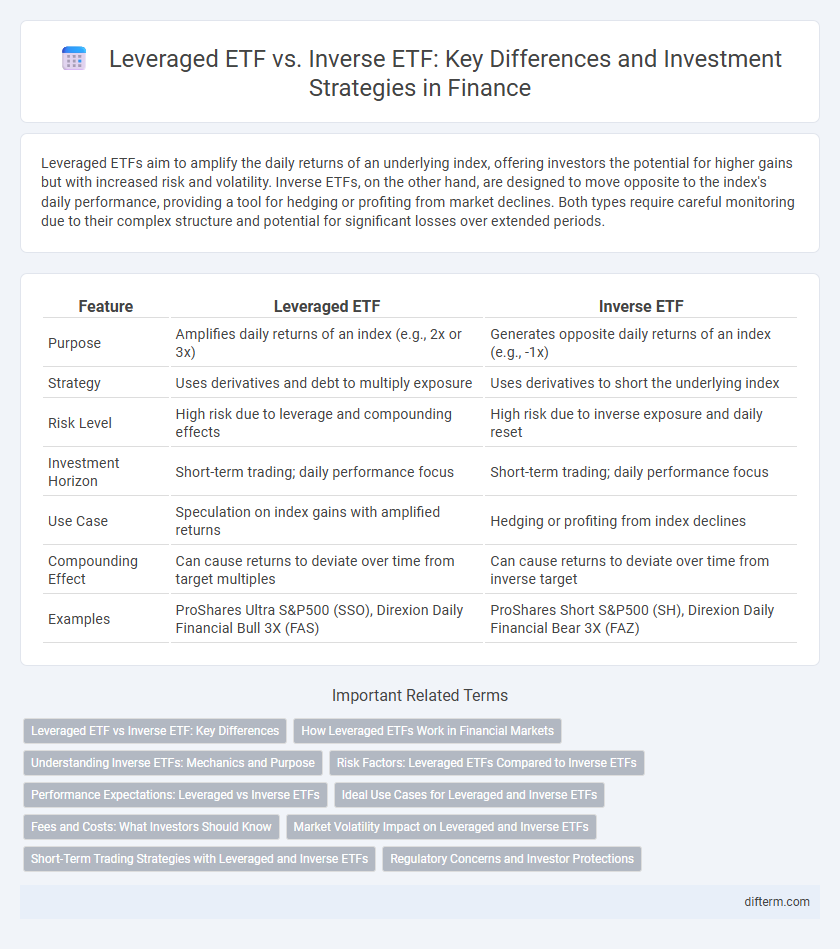

| Feature | Leveraged ETF | Inverse ETF |

|---|---|---|

| Purpose | Amplifies daily returns of an index (e.g., 2x or 3x) | Generates opposite daily returns of an index (e.g., -1x) |

| Strategy | Uses derivatives and debt to multiply exposure | Uses derivatives to short the underlying index |

| Risk Level | High risk due to leverage and compounding effects | High risk due to inverse exposure and daily reset |

| Investment Horizon | Short-term trading; daily performance focus | Short-term trading; daily performance focus |

| Use Case | Speculation on index gains with amplified returns | Hedging or profiting from index declines |

| Compounding Effect | Can cause returns to deviate over time from target multiples | Can cause returns to deviate over time from inverse target |

| Examples | ProShares Ultra S&P500 (SSO), Direxion Daily Financial Bull 3X (FAS) | ProShares Short S&P500 (SH), Direxion Daily Financial Bear 3X (FAZ) |

Leveraged ETF vs Inverse ETF: Key Differences

Leveraged ETFs aim to amplify the daily returns of an underlying index by using financial derivatives and debt, typically targeting multiples such as 2x or 3x, whereas Inverse ETFs seek to deliver the opposite daily performance of the index, often used for hedging or profiting from declines. Leveraged ETFs tend to incur higher volatility and require careful monitoring due to daily reset mechanisms that can erode returns over time, while Inverse ETFs provide a straightforward inverse correlation without leveraged magnification of gains or losses. Key differences include their strategic purposes, risk profiles, and compounding effects in volatile markets, making them suitable for distinct investor objectives.

How Leveraged ETFs Work in Financial Markets

Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index, typically targeting a multiple of daily performance such as 2x or 3x. These funds rebalance daily to maintain their leverage ratio, which can lead to significant gains or losses in volatile markets due to compounding effects. Investors use leveraged ETFs for short-term trading or hedging strategies, but they carry higher risks compared to traditional ETFs because of their sensitivity to market fluctuations.

Understanding Inverse ETFs: Mechanics and Purpose

Inverse ETFs use derivative contracts such as swaps and futures to deliver the opposite daily return of a specific index, enabling investors to profit from market downturns without short selling. These funds reset their leverage daily, which can lead to compounding effects that affect returns over longer holding periods. Understanding the mechanics of inverse ETFs is crucial for managing risks associated with volatility decay and ensuring alignment with short-term trading strategies.

Risk Factors: Leveraged ETFs Compared to Inverse ETFs

Leveraged ETFs amplify returns by using debt and derivatives to multiply exposure, which significantly increases volatility and risk of substantial losses during market swings. Inverse ETFs aim to deliver opposite performance of an index or asset, but their daily reset feature causes compounding risk, especially in volatile markets, leading to potential divergence from expected inverse returns over time. Both leveraged and inverse ETFs carry heightened risks due to complexity, increased sensitivity to market movements, and potential for rapid value erosion, requiring careful risk management by investors.

Performance Expectations: Leveraged vs Inverse ETFs

Leveraged ETFs aim to amplify the daily returns of an underlying index by a multiple, such as 2x or 3x, often resulting in higher volatility and potential for significant gains in trending markets. Inverse ETFs seek to deliver the opposite daily performance of the index, providing a hedge against market downturns but typically underperforming in sideways or bullish trends. Both ETF types are designed for short-term trading, with performance erosion risks due to daily rebalancing and compounding effects over longer holding periods.

Ideal Use Cases for Leveraged and Inverse ETFs

Leveraged ETFs are ideal for traders seeking amplified exposure to short-term market movements, capitalizing on bullish trends by targeting multiples of daily index returns. Inverse ETFs serve best for hedging portfolios against downturns or profiting from declining markets by providing inverse exposure to benchmark indices. Both leveraged and inverse ETFs suit sophisticated investors employing tactical asset allocation or active trading strategies in volatile market conditions.

Fees and Costs: What Investors Should Know

Leveraged ETFs typically incur higher fees due to their complex portfolio management and daily rebalancing requirements, often charging expense ratios between 0.95% and 1.50%. Inverse ETFs also carry elevated costs compared to traditional ETFs, with expense ratios usually ranging from 0.75% to 1.20%, reflecting the expenses related to short-selling and derivatives usage. Investors should carefully evaluate these fees alongside potential tracking errors to fully understand the impact on overall returns.

Market Volatility Impact on Leveraged and Inverse ETFs

Market volatility significantly affects leveraged and inverse ETFs by amplifying their daily returns, leading to increased potential gains or losses compared to traditional ETFs. Leveraged ETFs use derivatives and debt to multiply the performance of an underlying index, while inverse ETFs aim to deliver the opposite return, both experiencing greater performance decay in highly volatile markets due to compounding effects. Investors must carefully monitor market volatility when trading these ETFs, as sharp price fluctuations can erode value faster than long-term index movements suggest.

Short-Term Trading Strategies with Leveraged and Inverse ETFs

Leveraged ETFs amplify daily price movements of underlying indices using financial derivatives, making them ideal for short-term trading strategies that capitalize on volatility. Inverse ETFs provide opposite returns to the underlying assets, enabling traders to profit from market declines without directly shorting stocks. Combining leveraged and inverse ETFs requires careful risk management due to compounding effects and daily resets that can erode returns in prolonged trends.

Regulatory Concerns and Investor Protections

Regulatory concerns surrounding leveraged ETFs and inverse ETFs primarily involve their complexity and heightened risk, prompting the SEC to enforce strict disclosure requirements and suitability standards for investors. These funds use derivatives to amplify or invert daily market returns, increasing the potential for rapid losses and volatility, which raises investor protection issues. The SEC and FINRA emphasize transparency and demand that brokers ensure investors understand the risks before trading these products.

Leveraged ETF vs Inverse ETF Infographic

difterm.com

difterm.com