Binance Smart Chain offers faster transaction times and lower fees compared to Ethereum, making it a cost-effective choice for DeFi applications and NFT projects. Ethereum maintains a larger ecosystem with more developers and a wider range of decentralized applications, ensuring robust security and network reliability. Users must weigh the trade-offs between Binance Smart Chain's efficiency and Ethereum's extensive infrastructure when selecting a blockchain platform for financial projects.

Table of Comparison

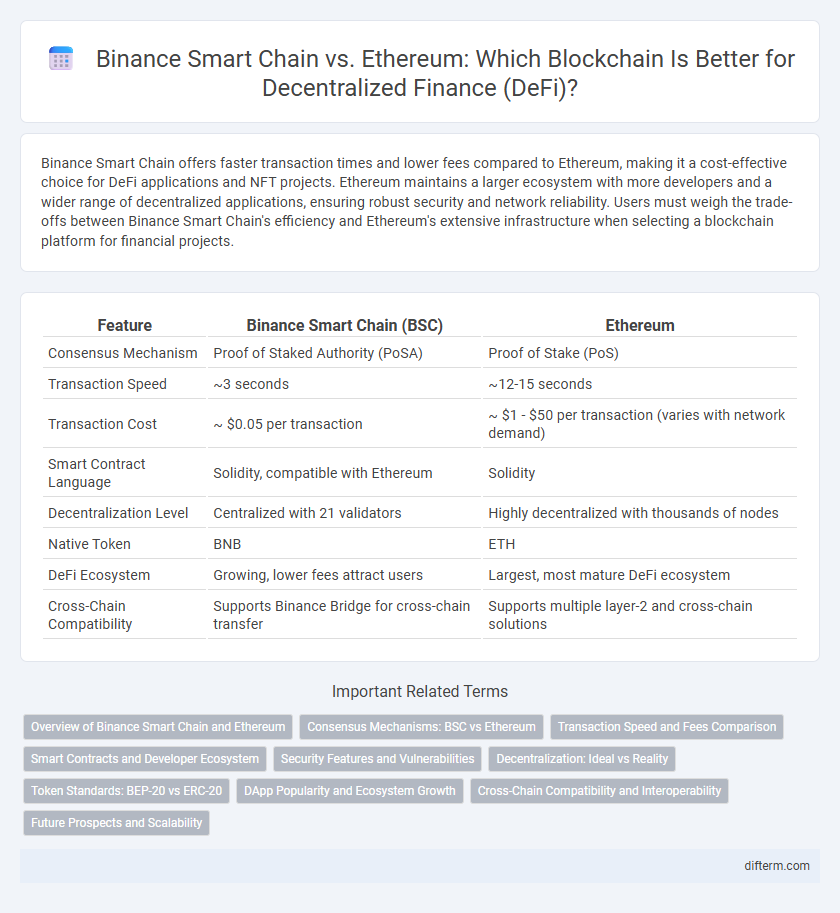

| Feature | Binance Smart Chain (BSC) | Ethereum |

|---|---|---|

| Consensus Mechanism | Proof of Staked Authority (PoSA) | Proof of Stake (PoS) |

| Transaction Speed | ~3 seconds | ~12-15 seconds |

| Transaction Cost | ~ $0.05 per transaction | ~ $1 - $50 per transaction (varies with network demand) |

| Smart Contract Language | Solidity, compatible with Ethereum | Solidity |

| Decentralization Level | Centralized with 21 validators | Highly decentralized with thousands of nodes |

| Native Token | BNB | ETH |

| DeFi Ecosystem | Growing, lower fees attract users | Largest, most mature DeFi ecosystem |

| Cross-Chain Compatibility | Supports Binance Bridge for cross-chain transfer | Supports multiple layer-2 and cross-chain solutions |

Overview of Binance Smart Chain and Ethereum

Binance Smart Chain (BSC) is a high-performance blockchain platform known for its low transaction fees and fast block times, making it popular for decentralized finance (DeFi) applications and cross-chain compatibility with Binance Chain. Ethereum, the pioneer in smart contracts and decentralized applications (dApps), boasts a robust network with widespread developer support and a vast ecosystem but faces challenges like higher gas fees and slower transaction speeds. Both platforms utilize proof-of-stake consensus mechanisms, with BSC using a delegated proof-of-stake (DPoS) model and Ethereum transitioning to Ethereum 2.0 to enhance scalability and energy efficiency.

Consensus Mechanisms: BSC vs Ethereum

Binance Smart Chain (BSC) employs a Proof of Staked Authority (PoSA) consensus mechanism, combining delegated proof-of-stake with authority-based validation to achieve faster block times and lower transaction fees. In contrast, Ethereum utilizes a Proof of Stake (PoS) consensus, following its transition from Proof of Work, which enhances security and decentralization but results in comparatively slower transactions and higher costs. The choice of consensus mechanisms significantly impacts network scalability, security, and gas fees for decentralized finance (DeFi) applications on both platforms.

Transaction Speed and Fees Comparison

Binance Smart Chain processes transactions in approximately 3 seconds with average fees around $0.05, significantly outperforming Ethereum's 15-second block time and average transaction cost exceeding $10 during peak demand. Ethereum's network congestion leads to higher gas fees, making Binance Smart Chain a more cost-effective solution for decentralized finance applications. Lower latency and minimal transaction expenses on Binance Smart Chain enhance scalability and user accessibility compared to Ethereum's current infrastructure.

Smart Contracts and Developer Ecosystem

Binance Smart Chain (BSC) offers faster transaction speeds and lower fees compared to Ethereum, making it attractive for deploying smart contracts in decentralized finance (DeFi) applications. Ethereum's mature developer ecosystem features extensive toolsets, robust security audits, and a wide array of decentralized applications (dApps), driving innovation and network effects. BSC's compatibility with Ethereum Virtual Machine (EVM) allows seamless migration of Ethereum-based smart contracts, fostering rapid development across both platforms.

Security Features and Vulnerabilities

Binance Smart Chain (BSC) utilizes a consensus mechanism based on Delegated Proof of Stake (DPoS), offering faster transaction speeds but potentially exposing it to centralization risks and Validator-related attacks compared to Ethereum's Proof of Work (PoW) and soon Proof of Stake (PoS) models, which prioritize decentralization and security. Ethereum's mature ecosystem benefits from extensive security audits, formal verification of smart contracts, and a robust developer community that continually addresses vulnerabilities, whereas BSC's rapid growth has led to fewer audits and higher susceptibility to exploits and flash loan attacks. Both blockchains implement smart contract security best practices, yet Ethereum's longer track record and rigorous update processes provide stronger protection against emerging threats.

Decentralization: Ideal vs Reality

Binance Smart Chain offers faster transaction speeds and lower fees compared to Ethereum, but it achieves this at the expense of true decentralization due to its limited number of validators primarily controlled by Binance. Ethereum remains the benchmark for decentralized finance (DeFi) with thousands of nodes distributed globally, ensuring censorship resistance and network security. However, Ethereum's higher gas fees and slower transaction times create trade-offs between ideal decentralization and practical usability in blockchain networks.

Token Standards: BEP-20 vs ERC-20

BEP-20 and ERC-20 are the primary token standards on Binance Smart Chain (BSC) and Ethereum respectively, facilitating the creation and management of fungible tokens. BEP-20 tokens benefit from lower transaction fees and faster block times on BSC, making them cost-efficient and scalable for decentralized applications compared to Ethereum's ERC-20 tokens. Ethereum's ERC-20 standard remains the most widely adopted with robust developer tools and broad compatibility across wallets and exchanges, supporting a vast decentralized finance ecosystem.

DApp Popularity and Ecosystem Growth

Binance Smart Chain (BSC) has rapidly gained popularity among decentralized applications (DApps) due to its lower transaction fees and faster block times compared to Ethereum, attracting a surge of DeFi projects and NFT platforms. Ethereum maintains a dominant position with the largest and most mature ecosystem, boasting thousands of DApps and extensive developer support, which fuels continuous innovation and network security. BSC's compatibility with Ethereum's Virtual Machine (EVM) fosters seamless cross-chain development, contributing to accelerated ecosystem growth and diversified DeFi adoption.

Cross-Chain Compatibility and Interoperability

Binance Smart Chain (BSC) offers robust cross-chain compatibility through its native Binance Bridge, enabling seamless asset transfers between BSC and Ethereum, enhancing liquidity and user accessibility. Ethereum's emerging Layer 2 solutions and interoperability protocols, such as Polkadot and Cosmos, provide scalable cross-chain interoperability but often involve more complex integration processes. BSC's low transaction fees and faster block times present distinct advantages for developers seeking efficient multi-chain DeFi applications with interoperable smart contracts.

Future Prospects and Scalability

Binance Smart Chain leverages a dual-chain architecture and Proof of Staked Authority consensus to achieve higher transaction throughput compared to Ethereum's current Proof of Work system, positioning it for enhanced scalability in decentralized finance applications. Ethereum's upcoming Ethereum 2.0 upgrade, featuring Proof of Stake and shard chains, promises significant improvements in scalability and energy efficiency, aiming to support a broader range of decentralized applications and institutional adoption. Both blockchains are evolving to accommodate increasing demand, but Ethereum's robust developer ecosystem and transition to scalable infrastructure underscore its long-term dominance in smart contract deployment and DeFi innovation.

Binance Smart Chain vs Ethereum Infographic

difterm.com

difterm.com