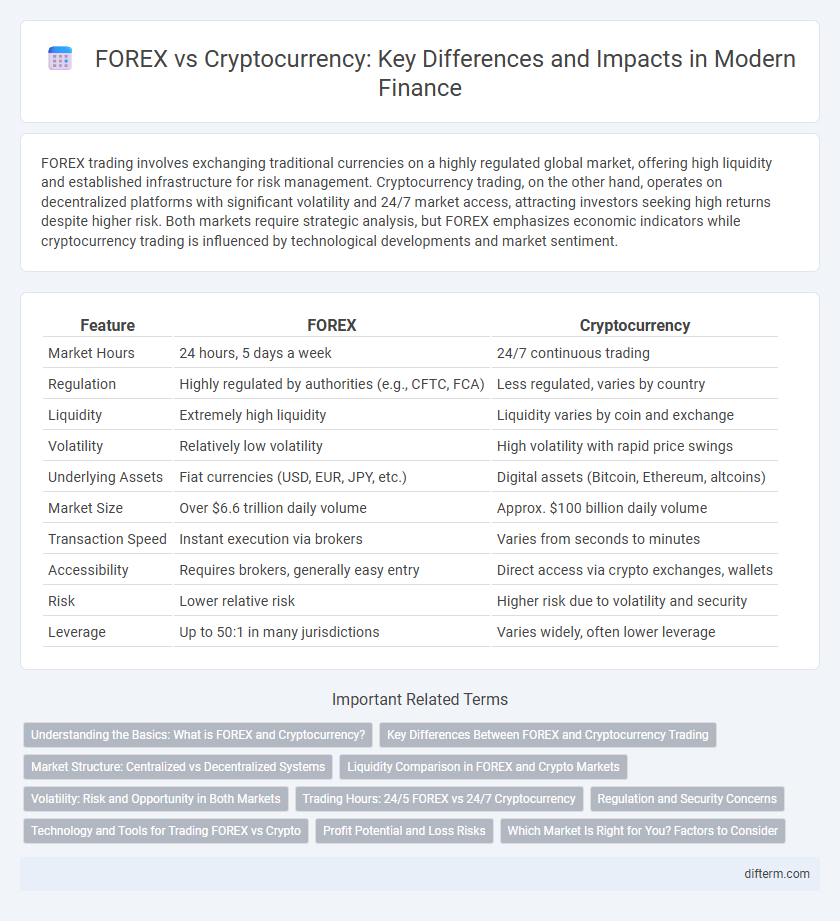

FOREX trading involves exchanging traditional currencies on a highly regulated global market, offering high liquidity and established infrastructure for risk management. Cryptocurrency trading, on the other hand, operates on decentralized platforms with significant volatility and 24/7 market access, attracting investors seeking high returns despite higher risk. Both markets require strategic analysis, but FOREX emphasizes economic indicators while cryptocurrency trading is influenced by technological developments and market sentiment.

Table of Comparison

| Feature | FOREX | Cryptocurrency |

|---|---|---|

| Market Hours | 24 hours, 5 days a week | 24/7 continuous trading |

| Regulation | Highly regulated by authorities (e.g., CFTC, FCA) | Less regulated, varies by country |

| Liquidity | Extremely high liquidity | Liquidity varies by coin and exchange |

| Volatility | Relatively low volatility | High volatility with rapid price swings |

| Underlying Assets | Fiat currencies (USD, EUR, JPY, etc.) | Digital assets (Bitcoin, Ethereum, altcoins) |

| Market Size | Over $6.6 trillion daily volume | Approx. $100 billion daily volume |

| Transaction Speed | Instant execution via brokers | Varies from seconds to minutes |

| Accessibility | Requires brokers, generally easy entry | Direct access via crypto exchanges, wallets |

| Risk | Lower relative risk | Higher risk due to volatility and security |

| Leverage | Up to 50:1 in many jurisdictions | Varies widely, often lower leverage |

Understanding the Basics: What is FOREX and Cryptocurrency?

FOREX, or foreign exchange market, is the global platform for trading national currencies, characterized by high liquidity and regulated financial institutions. Cryptocurrency operates on decentralized blockchain technology, enabling secure digital asset exchanges without intermediaries. Understanding the fundamental differences in market structure, volatility, and regulatory frameworks is crucial for investors navigating FOREX and cryptocurrency trading.

Key Differences Between FOREX and Cryptocurrency Trading

FOREX trading involves the exchange of traditional fiat currencies, regulated by centralized financial institutions and characterized by high liquidity and lower volatility. Cryptocurrency trading operates in a decentralized environment with digital assets like Bitcoin and Ethereum, often subject to rapid price fluctuations and lower market regulation. Key differences include market hours--FOREX markets typically operate 24/5 while cryptocurrency markets run 24/7--and the underlying technology, with cryptocurrencies utilizing blockchain for transparency and security.

Market Structure: Centralized vs Decentralized Systems

Forex operates within a centralized market structure dominated by banks, brokers, and regulatory authorities, ensuring liquidity and transparency through established financial institutions. In contrast, cryptocurrency markets function on decentralized blockchain technology, enabling peer-to-peer trading without intermediaries, which increases market accessibility but introduces higher volatility and regulatory uncertainty. Understanding these structural differences highlights the varying risk profiles, liquidity levels, and regulatory frameworks intrinsic to each trading environment.

Liquidity Comparison in FOREX and Crypto Markets

FOREX markets exhibit significantly higher liquidity, with daily trading volumes surpassing $6 trillion, ensuring tighter spreads and swift execution. Cryptocurrency markets, while growing, offer considerably lower liquidity, often resulting in higher volatility and larger bid-ask spreads. Institutional investors favor FOREX for its depth and stability, whereas crypto liquidity varies widely across different tokens and exchanges.

Volatility: Risk and Opportunity in Both Markets

FOREX markets typically experience lower volatility compared to cryptocurrencies, offering more predictable price movements and reduced risk exposure. Cryptocurrency markets can exhibit price swings exceeding 10% within minutes due to lower liquidity and speculative trading, presenting high-risk but potentially high-reward opportunities. Traders in both domains must employ robust risk management strategies to capitalize on volatility while protecting capital.

Trading Hours: 24/5 FOREX vs 24/7 Cryptocurrency

FOREX trading operates 24 hours a day, five days a week, closing on weekends, which limits market accessibility during those periods. Cryptocurrency markets remain open 24 hours a day, seven days a week, providing continuous trading opportunities without interruption. This constant availability in cryptocurrency trading enhances liquidity and allows investors to respond instantly to market events at any time.

Regulation and Security Concerns

Regulation in FOREX markets is typically stringent, with oversight by established financial authorities such as the U.S. Commodity Futures Trading Commission (CFTC) and the Financial Conduct Authority (FCA) in the UK, ensuring trader protection and market integrity. Cryptocurrency markets, however, face fragmented regulatory frameworks globally, leading to higher exposure to fraud, hacking, and market manipulation risks due to inconsistent compliance standards. Security concerns in FOREX are minimal compared to cryptocurrencies, where decentralized exchanges and wallets are vulnerable to cyberattacks and require advanced cryptographic safeguards for asset protection.

Technology and Tools for Trading FOREX vs Crypto

Forex trading relies heavily on advanced platforms like MetaTrader 4 and 5, which offer automated trading, real-time charts, and technical indicators optimized for currency pairs. Cryptocurrency trading utilizes decentralized exchanges, blockchain analytics tools, and smart contract-enabled platforms to enhance transparency and security in digital asset transactions. Both markets employ algorithmic trading and AI-driven bots, but crypto tools uniquely integrate wallet management and cross-chain functionality for diversified portfolio management.

Profit Potential and Loss Risks

FOREX trading offers high liquidity and relatively stable market conditions, allowing for predictable profit potential with lower volatility compared to cryptocurrencies. Cryptocurrency markets exhibit extreme price volatility, creating opportunities for rapid, high profits but also escalating loss risks due to sudden market swings and lower regulatory oversight. Effective risk management strategies are crucial in both markets to maximize returns and minimize potential financial losses.

Which Market Is Right for You? Factors to Consider

Choosing between FOREX and cryptocurrency markets depends on factors such as volatility tolerance, trading hours, and regulatory environment. FOREX offers high liquidity and operates 24/5 with regulated brokers, making it suitable for risk-averse traders seeking stable currency pairs. Cryptocurrency markets provide 24/7 trading with potentially higher returns but come with increased price volatility and less regulatory oversight, appealing to risk-tolerant investors seeking diversification.

FOREX vs Cryptocurrency Infographic

difterm.com

difterm.com