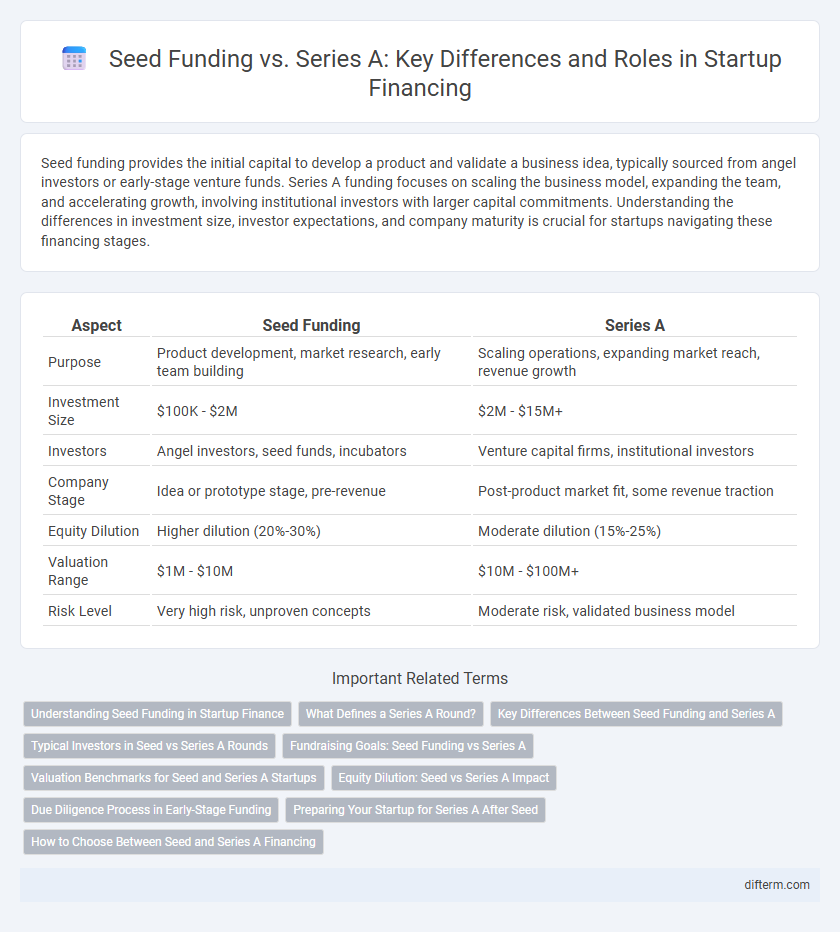

Seed funding provides the initial capital to develop a product and validate a business idea, typically sourced from angel investors or early-stage venture funds. Series A funding focuses on scaling the business model, expanding the team, and accelerating growth, involving institutional investors with larger capital commitments. Understanding the differences in investment size, investor expectations, and company maturity is crucial for startups navigating these financing stages.

Table of Comparison

| Aspect | Seed Funding | Series A |

|---|---|---|

| Purpose | Product development, market research, early team building | Scaling operations, expanding market reach, revenue growth |

| Investment Size | $100K - $2M | $2M - $15M+ |

| Investors | Angel investors, seed funds, incubators | Venture capital firms, institutional investors |

| Company Stage | Idea or prototype stage, pre-revenue | Post-product market fit, some revenue traction |

| Equity Dilution | Higher dilution (20%-30%) | Moderate dilution (15%-25%) |

| Valuation Range | $1M - $10M | $10M - $100M+ |

| Risk Level | Very high risk, unproven concepts | Moderate risk, validated business model |

Understanding Seed Funding in Startup Finance

Seed funding in startup finance refers to the initial capital raised to support early-stage product development and market research before a company has generated significant revenue. Typically ranging from $100,000 to $2 million, seed funding comes from angel investors, seed venture capital firms, or crowdfunding platforms. This financing phase is crucial for validating the business idea, building a prototype, and preparing for Series A funding, where larger investments drive growth and scaling.

What Defines a Series A Round?

A Series A round is defined by its goal to scale a startup's operations beyond initial product development, typically raising between $2 million and $15 million from venture capital investors. Unlike seed funding, which focuses on validating the business idea and market fit, Series A emphasizes optimizing the business model and expanding customer acquisition. Key metrics such as revenue growth, user retention, and market potential are crucial factors that attract Series A investment.

Key Differences Between Seed Funding and Series A

Seed funding typically involves smaller capital injections aimed at product development and market research, often sourced from angel investors or early-stage venture funds. Series A rounds attract larger investments focused on scaling operations, refining the business model, and expanding the customer base, usually led by venture capital firms. The valuation in Series A funding is generally higher, reflecting progress and reduced risk compared to seed funding.

Typical Investors in Seed vs Series A Rounds

Seed funding typically attracts angel investors, early-stage venture capital firms, and startup incubators that focus on high-risk, high-reward opportunities with minimal traction. Series A rounds involve more established venture capital firms and institutional investors who prioritize startups demonstrating product-market fit and scalable business models. The shift in investor profile from Seed to Series A reflects increasing expectations for financial performance and growth potential.

Fundraising Goals: Seed Funding vs Series A

Seed funding primarily focuses on validating the business idea and developing a minimum viable product, typically ranging from $500K to $2M to cover initial operational costs and early market research. Series A rounds aim to scale the business model, secure larger market share, and generate sustainable revenue streams, often raising between $2M and $15M from venture capital firms. Fundraising goals shift from proving concept viability in seed funding to optimizing growth metrics and user acquisition during Series A.

Valuation Benchmarks for Seed and Series A Startups

Seed funding valuations for startups typically range between $3 million and $8 million, reflecting early-stage risk and product development phases. Series A funding sees valuations increase substantially, often between $10 million and $30 million, driven by demonstrated market fit, user traction, and revenue growth. Key valuation benchmarks depend on industry trends, startup location, and revenue metrics, with tech startups in Silicon Valley frequently commanding higher multipliers.

Equity Dilution: Seed vs Series A Impact

Seed funding typically results in higher equity dilution for founders, as initial investors often receive significant ownership for early-stage risk. Series A rounds usually involve larger capital infusions at higher valuations, reducing dilution percentage compared to seed funding. Understanding the equity dilution impact at each stage helps founders strategically balance ownership retention and growth capital.

Due Diligence Process in Early-Stage Funding

The due diligence process in seed funding primarily emphasizes validating the founding team, market potential, and the initial product concept, with limited financial data available. In contrast, Series A due diligence requires a deeper analysis of business models, revenue streams, customer acquisition metrics, and financial projections to assess scalability and growth potential. Investors in Series A rounds focus intensely on operational risks, legal compliance, and competitive landscape to ensure sustainable market traction.

Preparing Your Startup for Series A After Seed

After securing seed funding, focus on refining your product-market fit and demonstrating consistent revenue growth to attract Series A investors. Develop a scalable business model, strengthen your management team, and provide detailed financial projections showcasing a clear path to profitability. Comprehensive due diligence preparation and robust performance metrics increase the likelihood of securing substantial Series A capital to accelerate expansion.

How to Choose Between Seed and Series A Financing

Choosing between seed funding and Series A financing depends on your startup's development stage, market validation, and growth potential. Seed funding is ideal for early-stage companies needing capital to develop prototypes and achieve product-market fit, while Series A targets startups with proven traction seeking to scale operations and expand market reach. Evaluate your current milestones, investor expectations, and long-term business goals to determine the most strategic financing option.

Seed Funding vs Series A Infographic

difterm.com

difterm.com