ROI measures the overall return on an investment as a percentage of the original cost, providing a straightforward snapshot of profitability. IRR calculates the discount rate that makes the net present value of all cash flows from an investment equal to zero, offering a dynamic perspective on efficiency and time value of money. Comparing ROI and IRR helps investors assess both the magnitude and timing of returns for more informed financial decisions.

Table of Comparison

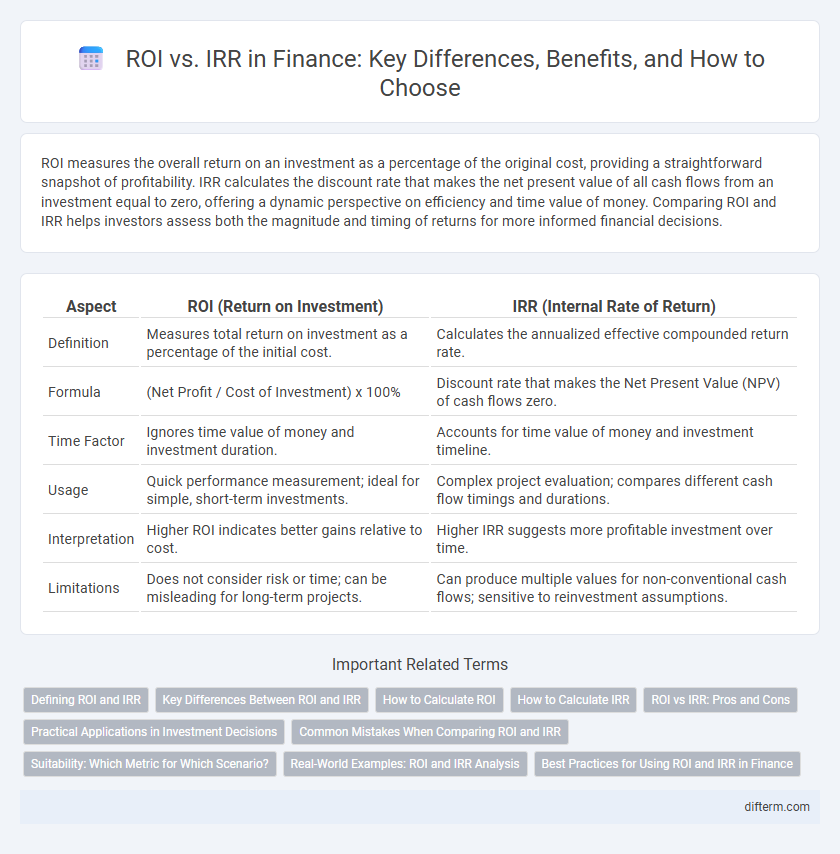

| Aspect | ROI (Return on Investment) | IRR (Internal Rate of Return) |

|---|---|---|

| Definition | Measures total return on investment as a percentage of the initial cost. | Calculates the annualized effective compounded return rate. |

| Formula | (Net Profit / Cost of Investment) x 100% | Discount rate that makes the Net Present Value (NPV) of cash flows zero. |

| Time Factor | Ignores time value of money and investment duration. | Accounts for time value of money and investment timeline. |

| Usage | Quick performance measurement; ideal for simple, short-term investments. | Complex project evaluation; compares different cash flow timings and durations. |

| Interpretation | Higher ROI indicates better gains relative to cost. | Higher IRR suggests more profitable investment over time. |

| Limitations | Does not consider risk or time; can be misleading for long-term projects. | Can produce multiple values for non-conventional cash flows; sensitive to reinvestment assumptions. |

Defining ROI and IRR

Return on Investment (ROI) measures the percentage gain or loss generated on an investment relative to its initial cost, providing a straightforward metric for profitability assessment. Internal Rate of Return (IRR) represents the discount rate that equates the net present value (NPV) of all cash flows from an investment to zero, offering insight into the investment's annualized effective yield. Both ROI and IRR are essential financial metrics, but IRR accounts for the time value of money while ROI does not.

Key Differences Between ROI and IRR

ROI (Return on Investment) measures the overall profitability of an investment as a percentage of the initial cost, providing a simple snapshot of returns. IRR (Internal Rate of Return) calculates the discount rate that makes the net present value (NPV) of cash flows from an investment equal to zero, accounting for the time value of money. While ROI focuses on total returns without considering timing, IRR emphasizes the efficiency of cash flow timing and is more suitable for comparing projects with different durations.

How to Calculate ROI

To calculate ROI (Return on Investment), subtract the initial investment cost from the final investment value, then divide the result by the initial investment cost. The formula is ROI = (Net Profit / Investment Cost) x 100, expressed as a percentage to measure profitability. This straightforward calculation helps investors assess the efficiency of their investments compared to alternative opportunities.

How to Calculate IRR

Calculating the Internal Rate of Return (IRR) involves finding the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero. This requires solving the equation \(\text{NPV} = \sum \frac{C_t}{(1 + IRR)^t} = 0\), where \(C_t\) represents cash flows at time \(t\). Financial calculators, spreadsheet functions like Excel's IRR formula, or iterative numerical methods such as the Newton-Raphson algorithm are commonly used to determine the IRR precisely.

ROI vs IRR: Pros and Cons

Return on Investment (ROI) provides a straightforward percentage measure of investment profitability, making it easy to compare across different projects but lacks sensitivity to the time value of money. Internal Rate of Return (IRR) accounts for the timing of cash flows and offers a more comprehensive view of an investment's profitability over time, yet it can be misleading for non-conventional cash flows or multiple IRRs. ROI is preferred for quick evaluations and simplicity, while IRR is better suited for complex projects requiring detailed cash flow analysis.

Practical Applications in Investment Decisions

ROI measures the percentage gain or loss relative to the initial investment, providing a straightforward metric for evaluating the overall profitability of a project. IRR calculates the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero, offering insight into the investment's potential growth rate over time. Investors often use ROI for quick profitability assessments and IRR for comparing the efficiency of competing projects with varying cash flow patterns and time horizons.

Common Mistakes When Comparing ROI and IRR

Comparing ROI and IRR often leads to common mistakes such as ignoring the time value of money, where ROI fails to account for the timing of cash flows while IRR incorporates it. Misinterpreting ROI as a rate of return over multiple periods without annualizing can cause misleading conclusions, whereas IRR represents an annualized return rate. Failing to consider project scale and duration differences can skew comparisons, since ROI measures total profitability and IRR evaluates efficiency relative to invested capital over time.

Suitability: Which Metric for Which Scenario?

ROI provides a straightforward percentage indicating total return relative to the initial investment, making it suitable for quick comparisons in short-term projects or when evaluating overall profitability. IRR calculates the discount rate that makes the net present value of cash flows zero, offering a dynamic measure ideal for assessing long-term investments with multiple cash flows and reinvestment assumptions. Choosing between ROI and IRR depends on project complexity, cash flow timing, and investment duration, where IRR is more informative for multi-period decision-making, and ROI works well for single-period, simple evaluations.

Real-World Examples: ROI and IRR Analysis

ROI measures the percentage gain or loss relative to the initial investment, offering a straightforward metric for evaluating profitability. IRR calculates the discount rate that makes the net present value of cash flows from an investment zero, reflecting the project's annualized effective return. In real-world applications, investors use ROI to quickly compare different investments, while IRR provides deeper insights into projects with varying cash flow timings, such as infrastructure development or startup funding scenarios.

Best Practices for Using ROI and IRR in Finance

ROI provides a straightforward measure of investment profitability by comparing net gains to initial costs, making it ideal for quick performance assessments and benchmarking. IRR offers a more comprehensive evaluation by accounting for the time value of money and cash flow timings, essential for long-term project analysis and capital budgeting. Best practices involve using ROI for simple, short-term comparisons while relying on IRR for complex, multi-period investments to ensure accurate financial decision-making.

ROI vs IRR Infographic

difterm.com

difterm.com