Market cap represents the total value of a company's outstanding shares, reflecting equity valuation in the stock market. Enterprise value provides a comprehensive measure by including market cap, debt, minority interest, and subtracting cash, offering a clearer picture of a company's total worth. Investors use enterprise value to assess takeover costs, while market cap indicates the size and market perception of the company's equity.

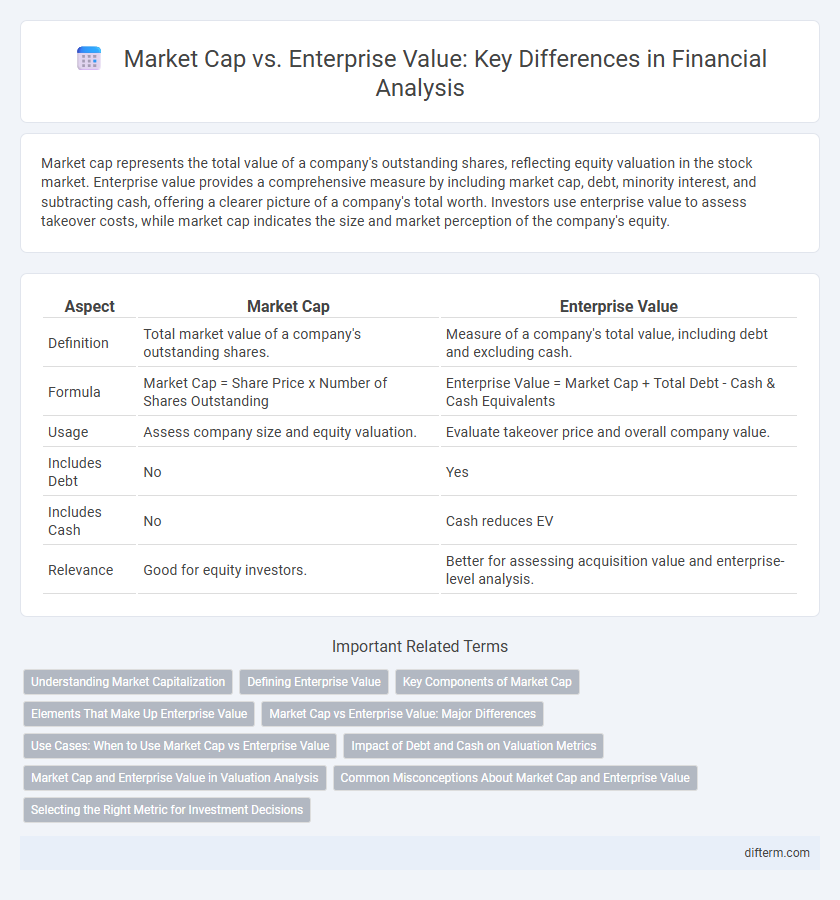

Table of Comparison

| Aspect | Market Cap | Enterprise Value |

|---|---|---|

| Definition | Total market value of a company's outstanding shares. | Measure of a company's total value, including debt and excluding cash. |

| Formula | Market Cap = Share Price x Number of Shares Outstanding | Enterprise Value = Market Cap + Total Debt - Cash & Cash Equivalents |

| Usage | Assess company size and equity valuation. | Evaluate takeover price and overall company value. |

| Includes Debt | No | Yes |

| Includes Cash | No | Cash reduces EV |

| Relevance | Good for equity investors. | Better for assessing acquisition value and enterprise-level analysis. |

Understanding Market Capitalization

Market capitalization represents the total value of a company's outstanding shares of stock, calculated by multiplying the current share price by the total number of shares outstanding. It serves as a primary indicator of a company's size and investor perception in the stock market. Unlike enterprise value, market cap does not account for debt or cash, making it a narrower measure of a company's overall value.

Defining Enterprise Value

Enterprise Value (EV) represents the total value of a company, encompassing market capitalization, debt, minority interest, and preferred shares, minus cash and cash equivalents. It provides a comprehensive measure of a firm's financial worth, reflecting the cost to acquire the entire business, including its debts. Unlike market cap, which only accounts for equity value, EV offers a clearer picture of a company's true valuation, particularly for mergers and acquisitions analysis.

Key Components of Market Cap

Market cap, or market capitalization, represents the total value of a company's outstanding shares and is calculated by multiplying the current share price by the number of outstanding shares. Key components of market cap include common shares, preferred shares, and market price per share, reflecting investor sentiment and equity valuation. Market cap provides a snapshot of company size and investor perception but excludes debt and cash, unlike enterprise value, which offers a more comprehensive valuation.

Elements That Make Up Enterprise Value

Enterprise value (EV) includes market capitalization, total debt, preferred equity, and minority interest, minus cash and cash equivalents, providing a comprehensive valuation of a company. Unlike market cap, which only considers outstanding shares multiplied by the stock price, EV accounts for the company's entire capital structure. This metric offers investors a clearer picture of a company's total value and acquisition cost by incorporating debt and liquidity elements.

Market Cap vs Enterprise Value: Major Differences

Market capitalization (Market Cap) represents the total value of a company's outstanding shares, calculated by multiplying the stock price by the number of shares outstanding, reflecting investor sentiment and equity value. Enterprise Value (EV) provides a comprehensive measure of a company's total value by including market cap, debt, minority interest, preferred shares, and subtracting cash and cash equivalents, offering a clearer picture for acquisition considerations. Unlike market cap, Enterprise Value accounts for a company's capital structure and debt obligations, making EV a more accurate metric for assessing a firm's overall valuation and financial health.

Use Cases: When to Use Market Cap vs Enterprise Value

Market cap is best used for comparing the equity value of companies and assessing shareholder wealth, especially in contexts like stock price valuation and market sentiment analysis. Enterprise value provides a comprehensive measure of a company's total value, making it more suitable for mergers and acquisitions, takeover scenarios, or evaluating capital structure efficiency. Investors and analysts rely on market cap for equity-focused insights and on enterprise value to gauge a firm's true economic worth including debt and cash positions.

Impact of Debt and Cash on Valuation Metrics

Market capitalization reflects a company's equity value by multiplying its share price by the total outstanding shares, while enterprise value (EV) provides a comprehensive valuation by including debt and subtracting cash and cash equivalents. High debt levels increase EV, indicating greater financial obligations and risk, whereas substantial cash reserves lower EV, offering a cushion against liabilities. Investors use EV to assess the true takeover cost and operational value, considering both the capital structure and liquidity position.

Market Cap and Enterprise Value in Valuation Analysis

Market Cap represents the total market value of a company's outstanding shares, calculated by multiplying the current share price by the total number of shares, serving as a primary indicator of company size in valuation analysis. Enterprise Value (EV) offers a comprehensive measure by including Market Cap plus total debt, minority interest, and preferred shares, minus cash and cash equivalents, reflecting the true cost to acquire a company. Comparing Market Cap and Enterprise Value is essential in valuation analysis to assess equity value versus total firm value, providing investors with a clearer picture of a company's financial health and acquisition cost.

Common Misconceptions About Market Cap and Enterprise Value

Market cap is frequently confused as a comprehensive measure of a company's value, but it only reflects the equity value based on current stock price and shares outstanding. Enterprise value provides a more complete picture by including debt, preferred shares, and subtracting cash, giving investors insight into the total valuation of a company. Misinterpreting market cap alone can lead to underestimating financial obligations and overvaluing a company's actual worth in mergers and acquisitions.

Selecting the Right Metric for Investment Decisions

Market capitalization measures a company's equity value based on share price and outstanding shares, providing a straightforward snapshot of market perception. Enterprise value offers a comprehensive valuation by including debt, cash, and minority interest, essential for assessing total company worth in acquisition scenarios. Investors should prioritize enterprise value when evaluating takeover targets or capital structure impact, while market cap suits quick comparisons of public companies' relative size.

Market cap vs Enterprise value Infographic

difterm.com

difterm.com