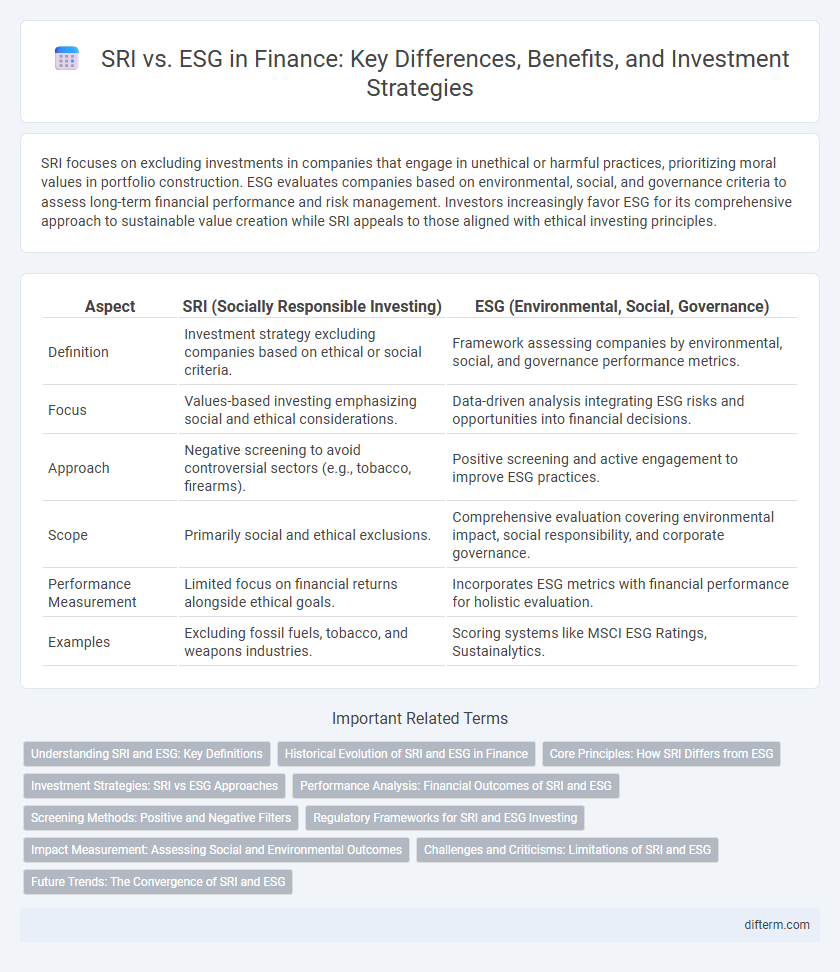

SRI focuses on excluding investments in companies that engage in unethical or harmful practices, prioritizing moral values in portfolio construction. ESG evaluates companies based on environmental, social, and governance criteria to assess long-term financial performance and risk management. Investors increasingly favor ESG for its comprehensive approach to sustainable value creation while SRI appeals to those aligned with ethical investing principles.

Table of Comparison

| Aspect | SRI (Socially Responsible Investing) | ESG (Environmental, Social, Governance) |

|---|---|---|

| Definition | Investment strategy excluding companies based on ethical or social criteria. | Framework assessing companies by environmental, social, and governance performance metrics. |

| Focus | Values-based investing emphasizing social and ethical considerations. | Data-driven analysis integrating ESG risks and opportunities into financial decisions. |

| Approach | Negative screening to avoid controversial sectors (e.g., tobacco, firearms). | Positive screening and active engagement to improve ESG practices. |

| Scope | Primarily social and ethical exclusions. | Comprehensive evaluation covering environmental impact, social responsibility, and corporate governance. |

| Performance Measurement | Limited focus on financial returns alongside ethical goals. | Incorporates ESG metrics with financial performance for holistic evaluation. |

| Examples | Excluding fossil fuels, tobacco, and weapons industries. | Scoring systems like MSCI ESG Ratings, Sustainalytics. |

Understanding SRI and ESG: Key Definitions

SRI (Socially Responsible Investing) focuses on excluding investments that conflict with specific ethical values, such as tobacco or fossil fuels, by applying negative screening criteria. ESG (Environmental, Social, and Governance) investing evaluates companies based on quantified performance metrics related to sustainability, social impact, and governance practices to identify long-term value and risk factors. While SRI is values-driven and exclusionary, ESG is data-driven and integrates non-financial factors into investment analysis for comprehensive risk-return assessment.

Historical Evolution of SRI and ESG in Finance

Socially Responsible Investing (SRI) originated in the 1960s as investors sought to exclude companies involved in controversial industries, emphasizing ethical considerations. Environmental, Social, and Governance (ESG) criteria emerged in the early 2000s, expanding the focus to integrate non-financial performance indicators into financial analysis for sustainability and long-term value. The evolution from SRI to ESG reflects a shift from exclusionary strategies to comprehensive frameworks that assess corporate behaviors impacting financial risk and opportunity.

Core Principles: How SRI Differs from ESG

Socially Responsible Investing (SRI) primarily centers on excluding investments that conflict with ethical or moral values, emphasizing negative screening based on specific social or environmental criteria. Environmental, Social, and Governance (ESG) investing integrates these factors into financial analysis to identify opportunities and risks that may impact long-term performance, focusing on positive screening and materiality. SRI's core principle is value-driven exclusion, whereas ESG adopts a data-driven, risk-return framework to guide investment decisions.

Investment Strategies: SRI vs ESG Approaches

SRI (Socially Responsible Investing) prioritizes excluding investments based on ethical criteria, targeting companies that align with specific social or environmental values. ESG (Environmental, Social, and Governance) investing integrates comprehensive non-financial factors into financial analysis to evaluate a company's long-term sustainability and risk. While SRI tends to filter out certain sectors entirely, ESG strategies use data-driven assessments to optimize portfolio performance alongside positive social impact.

Performance Analysis: Financial Outcomes of SRI and ESG

SRI (Socially Responsible Investing) and ESG (Environmental, Social, and Governance) strategies demonstrate varying financial outcomes, with ESG often showing stronger performance due to its integrated approach in assessing company risks and opportunities. Studies indicate ESG-focused portfolios generally achieve competitive returns and lower volatility, while SRI, emphasizing exclusion criteria, may limit diversification and slightly impact risk-adjusted returns. Performance analyses reveal that ESG investments tend to align better with long-term financial value creation by incorporating sustainability factors into systematic decision-making processes.

Screening Methods: Positive and Negative Filters

In sustainable finance, SRI (Socially Responsible Investing) primarily employs negative screening by excluding companies involved in harmful activities such as tobacco, fossil fuels, or weapons manufacturing. ESG (Environmental, Social, and Governance) investing incorporates both positive and negative filters, assessing firms based on their environmental impact, social responsibility, and governance practices to identify sustainable and ethical opportunities. Positive screening in ESG targets companies with strong carbon reduction initiatives, diversity policies, and transparent governance, whereas SRI's negative screening focuses on avoiding objectionable industries altogether.

Regulatory Frameworks for SRI and ESG Investing

SRI (Socially Responsible Investing) and ESG (Environmental, Social, and Governance) investing are shaped by evolving regulatory frameworks that emphasize transparency, accountability, and standardized reporting. The European Union's Sustainable Finance Disclosure Regulation (SFDR) mandates clear ESG disclosures to prevent greenwashing, while the U.S. Securities and Exchange Commission (SEC) is strengthening climate-related disclosure requirements for public companies. These regulations drive asset managers to integrate robust ESG analysis and socially responsible criteria into investment decisions, aligning capital flows with sustainability goals.

Impact Measurement: Assessing Social and Environmental Outcomes

Impact measurement in Socially Responsible Investing (SRI) focuses primarily on screening investments to avoid harm by excluding companies with poor social or environmental records. Environmental, Social, and Governance (ESG) investing emphasizes quantifiable metrics and performance data, integrating positive social and environmental outcomes into financial analysis. ESG frameworks utilize standardized reporting tools like SASB and GRI to assess impact, enabling investors to track tangible changes in sustainability and corporate responsibility effectively.

Challenges and Criticisms: Limitations of SRI and ESG

SRI (Socially Responsible Investing) faces challenges due to its often narrow focus on ethical values, which can limit portfolio diversification and financial returns. ESG (Environmental, Social, Governance) criteria are criticized for inconsistent standards, subjective metrics, and greenwashing risks that undermine investor confidence. Both approaches struggle with data transparency and the difficulty of measuring long-term impact on sustainability and corporate behavior.

Future Trends: The Convergence of SRI and ESG

SRI (Socially Responsible Investing) and ESG (Environmental, Social, and Governance) are increasingly converging as investors seek comprehensive frameworks that incorporate ethical values with measurable performance metrics. Future trends highlight the integration of SRI's value-based screening with ESG's data-driven analysis to drive sustainable investment decisions and corporate accountability. This convergence is expected to enhance transparency, risk management, and long-term value creation within the global financial markets.

SRI vs ESG Infographic

difterm.com

difterm.com