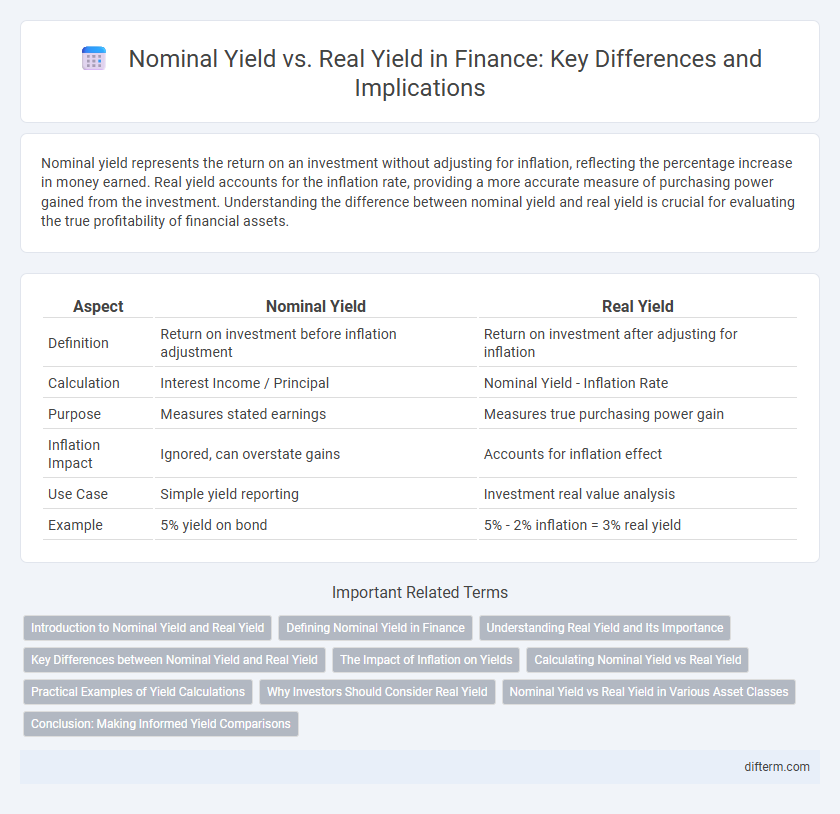

Nominal yield represents the return on an investment without adjusting for inflation, reflecting the percentage increase in money earned. Real yield accounts for the inflation rate, providing a more accurate measure of purchasing power gained from the investment. Understanding the difference between nominal yield and real yield is crucial for evaluating the true profitability of financial assets.

Table of Comparison

| Aspect | Nominal Yield | Real Yield |

|---|---|---|

| Definition | Return on investment before inflation adjustment | Return on investment after adjusting for inflation |

| Calculation | Interest Income / Principal | Nominal Yield - Inflation Rate |

| Purpose | Measures stated earnings | Measures true purchasing power gain |

| Inflation Impact | Ignored, can overstate gains | Accounts for inflation effect |

| Use Case | Simple yield reporting | Investment real value analysis |

| Example | 5% yield on bond | 5% - 2% inflation = 3% real yield |

Introduction to Nominal Yield and Real Yield

Nominal yield represents the return on an investment without adjusting for inflation, reflecting the percentage interest or dividends earned annually. Real yield adjusts the nominal yield by accounting for inflation, providing a more accurate measure of purchasing power and actual investment growth. Understanding the difference between nominal and real yield is essential for evaluating the true profitability of fixed-income securities and other financial assets.

Defining Nominal Yield in Finance

Nominal yield in finance refers to the interest rate or return on an investment without adjusting for inflation or other factors. It represents the percentage of income generated by an investment relative to its face value over a specific period. Investors use nominal yield to gauge the initial profitability of bonds or fixed-income securities before considering the erosion of purchasing power caused by inflation.

Understanding Real Yield and Its Importance

Real yield reflects the true return on investment by adjusting nominal yield for inflation, providing a more accurate measure of purchasing power gains. Investors prioritize real yield to assess the genuine growth of their capital and maintain wealth over time. Understanding real yield is crucial for making informed decisions in bond markets and inflation-sensitive financial instruments.

Key Differences between Nominal Yield and Real Yield

Nominal yield represents the percentage return on an investment without adjusting for inflation, reflecting the stated interest or dividend rate. Real yield accounts for inflation by subtracting the inflation rate from the nominal yield, providing a more accurate measure of an investment's purchasing power. The key difference lies in real yield's ability to reveal true economic gain, while nominal yield may overstate returns during periods of high inflation.

The Impact of Inflation on Yields

Nominal yield represents the stated interest rate on an investment, while real yield adjusts for inflation, reflecting the true purchasing power of returns. Inflation erodes nominal yields by reducing the value of future cash flows, causing real yields to often fall below nominal rates during periods of rising inflation. Investors focus on real yield to assess the actual profitability of fixed-income securities after accounting for inflationary pressures.

Calculating Nominal Yield vs Real Yield

Nominal yield calculates the return on an investment without adjusting for inflation, typically expressed as the annual interest rate divided by the current bond price. Real yield accounts for inflation by subtracting the inflation rate from the nominal yield, providing a clearer measure of purchasing power gains. Investors use these calculations to assess true investment performance and make informed decisions in varying economic conditions.

Practical Examples of Yield Calculations

Nominal yield represents the return on an investment without adjusting for inflation, calculated simply by dividing the annual interest payment by the bond's face value. Real yield takes inflation into account, providing a more accurate measure of purchasing power by subtracting the inflation rate from the nominal yield. For example, if a bond has a nominal yield of 6% and inflation is 2%, the real yield is approximately 4%, reflecting the true increase in value for investors.

Why Investors Should Consider Real Yield

Investors should consider real yield because it reflects the true purchasing power of returns after accounting for inflation, providing a more accurate measure of investment profitability. Nominal yield can be misleading as it shows only the raw return without adjusting for inflation, potentially overstating gains. Real yield offers a clearer perspective on actual wealth growth and helps investors make better-informed decisions in varying economic conditions.

Nominal Yield vs Real Yield in Various Asset Classes

Nominal yield represents the return on an investment without adjusting for inflation, while real yield accounts for the inflation rate, providing a more accurate measure of purchasing power gains. In fixed income securities like government bonds, nominal yields are often higher but can be significantly eroded by inflation, whereas Treasury Inflation-Protected Securities (TIPS) offer real yields that maintain value against inflation. Equities typically exhibit higher nominal yields through dividends but their real yield varies depending on inflation and market performance, making real yield a critical metric for comparing the true returns across asset classes such as bonds, stocks, and real estate.

Conclusion: Making Informed Yield Comparisons

Nominal yield represents the stated interest rate on an investment without adjusting for inflation, while real yield accounts for inflation's impact on purchasing power, providing a clearer measure of true investment returns. Comparing nominal yields alone can mislead investors, especially during periods of high inflation when real yield may be negative despite attractive nominal rates. Making informed yield comparisons requires analyzing real yields to evaluate the effective growth potential and safeguard against inflation eroding investment gains.

Nominal Yield vs Real Yield Infographic

difterm.com

difterm.com