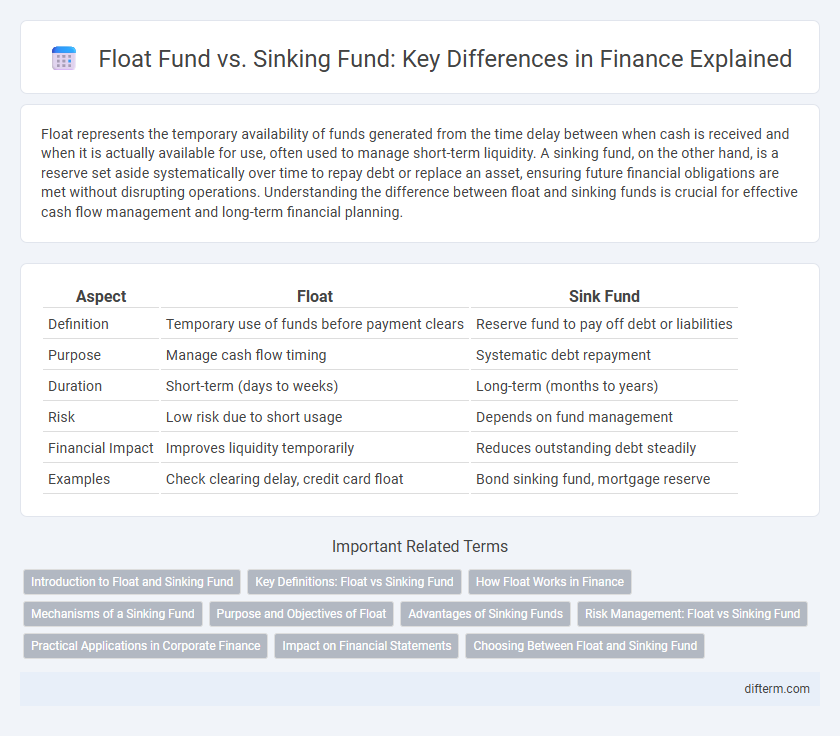

Float represents the temporary availability of funds generated from the time delay between when cash is received and when it is actually available for use, often used to manage short-term liquidity. A sinking fund, on the other hand, is a reserve set aside systematically over time to repay debt or replace an asset, ensuring future financial obligations are met without disrupting operations. Understanding the difference between float and sinking funds is crucial for effective cash flow management and long-term financial planning.

Table of Comparison

| Aspect | Float | Sink Fund |

|---|---|---|

| Definition | Temporary use of funds before payment clears | Reserve fund to pay off debt or liabilities |

| Purpose | Manage cash flow timing | Systematic debt repayment |

| Duration | Short-term (days to weeks) | Long-term (months to years) |

| Risk | Low risk due to short usage | Depends on fund management |

| Financial Impact | Improves liquidity temporarily | Reduces outstanding debt steadily |

| Examples | Check clearing delay, credit card float | Bond sinking fund, mortgage reserve |

Introduction to Float and Sinking Fund

Float refers to the time difference between when a payment is initiated and when the funds are actually available for use, impacting cash flow management and short-term liquidity for businesses. A sinking fund is a reserve set aside over time to repay debt or replace capital assets, ensuring financial stability and systematic debt reduction. Understanding the role of float helps optimize cash position, while sinking funds provide long-term fiscal discipline and risk mitigation.

Key Definitions: Float vs Sinking Fund

Float refers to the amount of money represented by checks or payments that have been issued but not yet cleared, temporarily increasing available cash balance for a business or individual. A sinking fund is a dedicated reserve of money set aside regularly by an organization to repay debt or replace a large asset in the future, ensuring financial stability and planned expense coverage. Understanding the distinction between float and sinking fund is crucial for effective cash flow management and strategic financial planning in corporate finance.

How Float Works in Finance

Float in finance refers to the period between the issuance of a payment and the actual clearance of funds, allowing businesses to utilize the available capital temporarily. This temporary cash availability can enhance liquidity management by enabling companies to invest or cover short-term expenses before the funds are officially deducted from their accounts. Businesses monitor float closely to optimize cash flow, reducing the need for external financing and improving operational efficiency.

Mechanisms of a Sinking Fund

A sinking fund operates by setting aside specific amounts of money regularly to repay debt or replace assets, reducing default risk and improving creditworthiness. This fund accumulates over time through scheduled contributions, aligning with a predetermined repayment timeline to ensure sufficient reserves for future liabilities. Unlike float, which utilizes temporary cash availability, sinking funds provide structured, disciplined savings to meet long-term financial obligations.

Purpose and Objectives of Float

Float in finance represents the temporary availability of funds due to timing differences between outgoing payments and incoming receipts, aiming to optimize cash management and liquidity. The primary purpose of float is to maximize the use of available capital by delaying disbursements or accelerating collections without jeopardizing payment obligations. This strategy helps businesses maintain operational efficiency and reduce the need for external borrowing by effectively managing working capital flow.

Advantages of Sinking Funds

Sinking funds provide a structured savings approach that ensures the availability of capital to meet future debt repayments or large expenses, reducing the risk of default. Unlike float, which relies on temporary excess balances, sinking funds accumulate funds systematically, enhancing financial discipline and creditworthiness. This method offers predictable cash flow management and strengthens investor confidence by demonstrating a proactive repayment strategy.

Risk Management: Float vs Sinking Fund

Float and sinking funds serve distinct functions in risk management by controlling liquidity and debt repayment strategies. Float allows firms to optimize cash flow timing, reducing short-term liquidity risk by using available funds before expenses are due. A sinking fund mitigates default risk through systematic accumulation of reserves to meet future debt obligations, ensuring long-term financial stability.

Practical Applications in Corporate Finance

Float in corporate finance refers to the temporary availability of funds due to timing differences between cash inflows and outflows, enabling companies to optimize short-term liquidity management and improve working capital efficiency. Sink funds are reserved accounts set aside systematically to repay debt or replace assets, ensuring long-term financial stability and risk mitigation. Practical applications involve using float to enhance cash flow forecasting and daily operations, while sink funds support structured debt repayment schedules and capital budgeting strategies.

Impact on Financial Statements

Float represents the temporary availability of cash before obligations are paid, positively affecting liquidity and cash flow on the balance sheet and cash flow statement. Sink funds, designated reserves for future debt repayment or asset replacement, appear as restricted cash or liabilities, impacting long-term financial stability and reducing free cash flow. Proper management of float improves working capital metrics, while sink funds ensure debt servicing capacity, influencing financial ratios and investor confidence.

Choosing Between Float and Sinking Fund

Choosing between float and sinking fund involves analyzing liquidity management and debt repayment strategies. Float provides temporary access to funds through delays in cash outflows, enhancing short-term working capital, while sinking funds allocate regular payments to repay debt over time, reducing default risk and interest costs. Companies aiming for flexible cash flow control may prefer float, whereas those seeking structured debt reduction and investor confidence typically opt for sinking funds.

Float vs Sink Fund Infographic

difterm.com

difterm.com