No-load funds do not charge a commission or sales fee when investors buy or sell shares, making them cost-effective options for cost-conscious investors. Load funds, on the other hand, impose upfront or back-end sales charges that compensate brokers but reduce the investor's overall return. Understanding these fee structures is crucial for investors aiming to maximize their portfolio's growth potential while managing expenses.

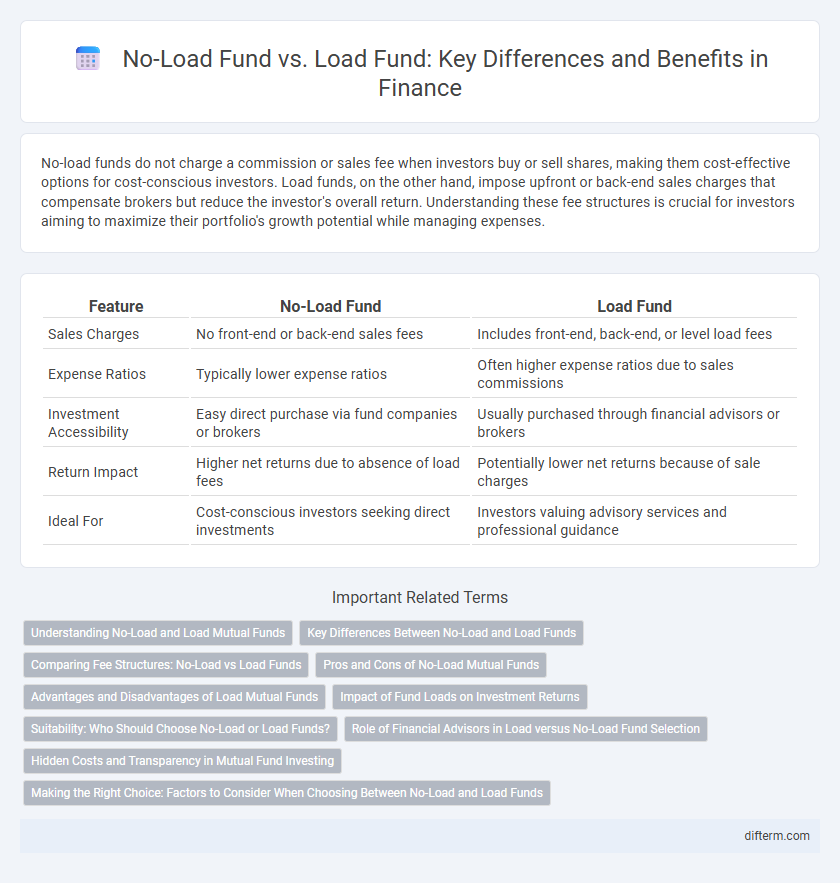

Table of Comparison

| Feature | No-Load Fund | Load Fund |

|---|---|---|

| Sales Charges | No front-end or back-end sales fees | Includes front-end, back-end, or level load fees |

| Expense Ratios | Typically lower expense ratios | Often higher expense ratios due to sales commissions |

| Investment Accessibility | Easy direct purchase via fund companies or brokers | Usually purchased through financial advisors or brokers |

| Return Impact | Higher net returns due to absence of load fees | Potentially lower net returns because of sale charges |

| Ideal For | Cost-conscious investors seeking direct investments | Investors valuing advisory services and professional guidance |

Understanding No-Load and Load Mutual Funds

No-load mutual funds do not charge an upfront sales commission, allowing investors to allocate 100% of their investment capital toward shares, making them cost-effective for long-term growth. Load mutual funds impose a sales charge or commission, either at purchase (front-end load) or sale (back-end load), which can reduce overall returns despite potential access to professional advisory services. Understanding the fee structure and impact on net returns is crucial for investors when selecting between no-load and load funds to align with their financial goals and investment horizon.

Key Differences Between No-Load and Load Funds

No-load funds do not charge any commission or sales fees, allowing investors to buy and sell shares without incurring additional costs, whereas load funds impose upfront (front-end) or deferred (back-end) sales charges. Expense ratios in no-load funds are generally lower, making them cost-effective for long-term investors, while load funds often include fees that compensate brokers for their services. Investment strategies and fund performance can be similar, but the key difference lies in the presence or absence of sales charges affecting overall returns.

Comparing Fee Structures: No-Load vs Load Funds

No-load funds charge no sales commissions or upfront fees, allowing investors to buy and sell shares without incurring additional costs, which can lead to higher net returns over time. Load funds impose sales charges, either upfront (front-end load) or upon sale (back-end load), reducing the initial investment amount or the ultimate proceeds and potentially impacting overall investment growth. Evaluating fee structures, including management fees and potential sales loads, is critical for investors seeking cost-efficient fund options with minimal drag on investment performance.

Pros and Cons of No-Load Mutual Funds

No-load mutual funds eliminate sales commissions, allowing investors to allocate 100% of their investment directly into the fund, which often results in lower overall costs compared to load funds. These funds offer greater transparency and accessibility, making them ideal for cost-conscious investors seeking long-term growth without the burden of upfront fees. However, the absence of load fees may also mean fewer resources for fund management and marketing, potentially affecting fund quality and investor support.

Advantages and Disadvantages of Load Mutual Funds

Load mutual funds charge a sales commission, either upfront (front-end load) or upon redemption (back-end load), which can reduce the initial investment amount and overall returns. These funds often provide access to professional financial advice and fund managers who may offer tailored investment guidance and support. However, the fees associated with load funds can erode long-term growth potential, making them less cost-effective compared to no-load funds that do not charge sales commissions.

Impact of Fund Loads on Investment Returns

Investment returns in load funds are often reduced by sales charges that can range from 1% to 5.75%, directly decreasing the initial amount invested and compounding effects over time. No-load funds eliminate these upfront or back-end fees, allowing investors to allocate 100% of their capital to asset growth and potentially achieve higher net returns. The presence of fund loads impacts compounding benefits, making no-load funds generally more cost-efficient for long-term investors seeking maximum return on investment.

Suitability: Who Should Choose No-Load or Load Funds?

No-load funds are ideal for cost-conscious investors seeking to maximize investment returns without incurring sales charges, making them suitable for long-term investors with limited trading activity. Load funds, which charge front-end or back-end fees, may be appropriate for individuals requiring professional financial advice and personalized asset management to justify the fees. Assessing investment goals, risk tolerance, and the need for advisory services is crucial when choosing between no-load and load funds for optimal portfolio alignment.

Role of Financial Advisors in Load versus No-Load Fund Selection

Financial advisors play a crucial role in load fund selection by providing personalized investment strategies and explaining the implications of front-end or back-end sales charges. In contrast, no-load funds eliminate advisor commissions but may require investors to rely on their own research or fiduciary services. Understanding the advisor's fee structure and value addition is essential for investors choosing between load and no-load mutual funds.

Hidden Costs and Transparency in Mutual Fund Investing

No-load funds generally offer greater transparency by charging no sales commissions, ensuring investors avoid hidden fees that can erode returns, while load funds often include upfront or backend sales charges that obscure total investment costs. The absence of load fees in no-load funds allows clearer assessment of actual fund performance and expense ratios, crucial for investor decision-making. Understanding the hidden costs and transparency differences between load and no-load funds is essential for optimizing mutual fund investment strategies and maximizing net returns.

Making the Right Choice: Factors to Consider When Choosing Between No-Load and Load Funds

Choosing between no-load and load funds depends on factors such as investment goals, cost sensitivity, and the value of advisory services. No-load funds eliminate upfront sales charges, maximizing the initial investment amount, while load funds may offer personalized advice but incur higher fees that can impact long-term returns. Evaluating expense ratios, fund performance history, and the investor's preference for professional guidance is crucial in making an informed decision.

No-load fund vs Load fund Infographic

difterm.com

difterm.com