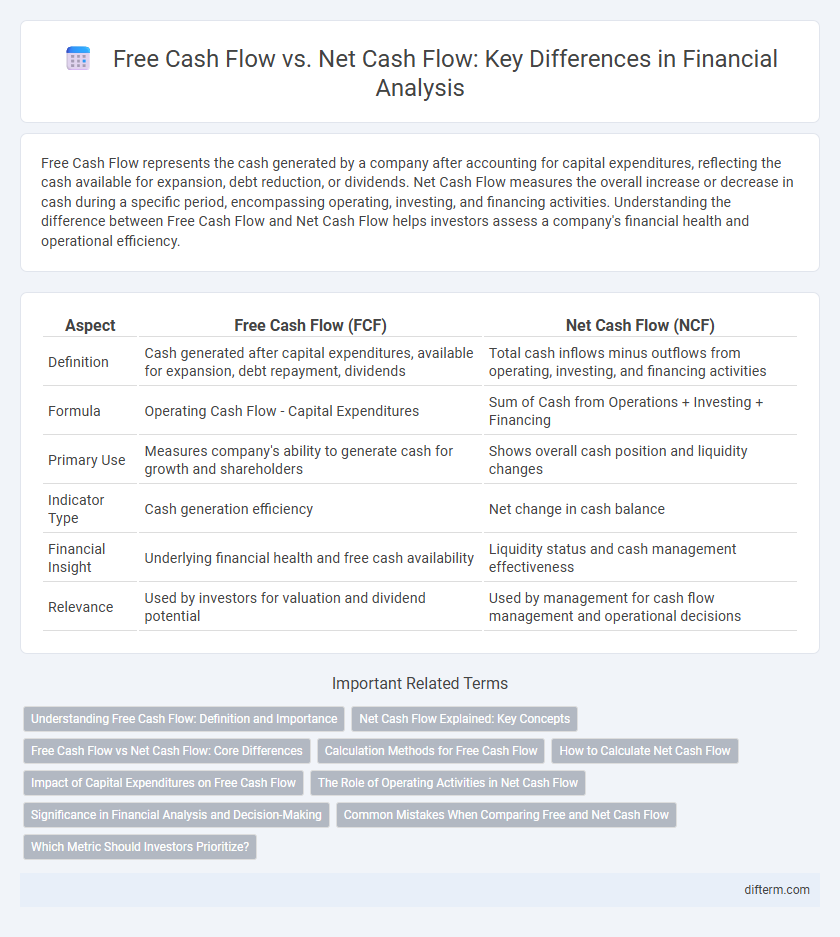

Free Cash Flow represents the cash generated by a company after accounting for capital expenditures, reflecting the cash available for expansion, debt reduction, or dividends. Net Cash Flow measures the overall increase or decrease in cash during a specific period, encompassing operating, investing, and financing activities. Understanding the difference between Free Cash Flow and Net Cash Flow helps investors assess a company's financial health and operational efficiency.

Table of Comparison

| Aspect | Free Cash Flow (FCF) | Net Cash Flow (NCF) |

|---|---|---|

| Definition | Cash generated after capital expenditures, available for expansion, debt repayment, dividends | Total cash inflows minus outflows from operating, investing, and financing activities |

| Formula | Operating Cash Flow - Capital Expenditures | Sum of Cash from Operations + Investing + Financing |

| Primary Use | Measures company's ability to generate cash for growth and shareholders | Shows overall cash position and liquidity changes |

| Indicator Type | Cash generation efficiency | Net change in cash balance |

| Financial Insight | Underlying financial health and free cash availability | Liquidity status and cash management effectiveness |

| Relevance | Used by investors for valuation and dividend potential | Used by management for cash flow management and operational decisions |

Understanding Free Cash Flow: Definition and Importance

Free Cash Flow (FCF) represents the cash generated by a company after accounting for capital expenditures required to maintain or expand its asset base, reflecting the firm's ability to generate surplus cash for investors and debt repayment. Unlike Net Cash Flow, which measures the total cash inflow and outflow from all activities including operating, investing, and financing, FCF specifically highlights operational efficiency and financial health by isolating cash available from core business operations. Understanding Free Cash Flow is crucial for investors and analysts to assess a company's true profitability and capacity to fund growth without relying on external financing.

Net Cash Flow Explained: Key Concepts

Net Cash Flow represents the total amount of cash generated or lost during a specific period, reflecting all cash inflows and outflows from operating, investing, and financing activities. It provides a comprehensive view of a company's liquidity and financial health, indicating the actual cash available for business operations or debt repayment. Unlike Free Cash Flow, which focuses primarily on cash generated after capital expenditures, Net Cash Flow encompasses the full spectrum of cash movements, making it critical for cash flow analysis and financial decision-making.

Free Cash Flow vs Net Cash Flow: Core Differences

Free Cash Flow (FCF) represents the cash a company generates after accounting for capital expenditures required to maintain or expand its asset base, highlighting operational efficiency and financial flexibility. Net Cash Flow (NCF) encompasses all cash inflows and outflows from operating, investing, and financing activities, providing a comprehensive overview of a company's liquidity position. The core difference lies in FCF's focus on cash available for discretionary use versus NCF's reflection of total cash movement across all business activities.

Calculation Methods for Free Cash Flow

Free Cash Flow (FCF) is calculated by subtracting capital expenditures from operating cash flow, highlighting the cash generated after maintaining or expanding asset base. The formula FCF = Operating Cash Flow - Capital Expenditures enables investors to assess a company's financial health and ability to generate surplus cash. Unlike Net Cash Flow, which includes all cash inflows and outflows across financing and investing activities, Free Cash Flow specifically focuses on operational efficiency and reinvestment capacity.

How to Calculate Net Cash Flow

Net cash flow is calculated by subtracting total cash outflows from total cash inflows within a specific period, encompassing operating, investing, and financing activities. It provides a comprehensive measure of a company's liquidity position by accounting for all sources and uses of cash. Unlike free cash flow, which focuses primarily on operating cash minus capital expenditures, net cash flow captures the overall cash movement including debt issuance, dividend payments, and asset sales.

Impact of Capital Expenditures on Free Cash Flow

Free Cash Flow (FCF) is significantly impacted by capital expenditures (CapEx) as it is calculated by subtracting CapEx from operating cash flow, reflecting the cash available for expansion or dividends. High CapEx reduces FCF, indicating heavy investment in fixed assets, which can limit liquidity despite positive net cash flow. In contrast, Net Cash Flow reflects overall cash movement without isolating capital investments, making FCF a more precise measure of financial flexibility and sustainability.

The Role of Operating Activities in Net Cash Flow

Operating activities are crucial in determining net cash flow as they reflect the core business operations' cash generation, including receipts from customers and payments to suppliers and employees. Free cash flow, derived after deducting capital expenditures from operating cash flow, emphasizes the cash available for expansion or debt repayment. Net cash flow incorporates cash from operating, investing, and financing activities, providing a comprehensive view of a company's liquidity and financial health.

Significance in Financial Analysis and Decision-Making

Free Cash Flow (FCF) represents the cash generated by a company after accounting for capital expenditures, highlighting the firm's ability to generate surplus cash to reinvest, reduce debt, or distribute to shareholders. Net Cash Flow reflects the total cash inflows and outflows from operating, investing, and financing activities, providing a comprehensive view of liquidity and financial health. Analyzing FCF is crucial for assessing a company's operational efficiency and long-term viability, while Net Cash Flow informs short-term cash management and financing decisions.

Common Mistakes When Comparing Free and Net Cash Flow

Confusing free cash flow with net cash flow often leads to inaccurate financial analysis because free cash flow excludes capital expenditures, while net cash flow includes all cash inflows and outflows. Analysts frequently overlook the impact of financing activities on net cash flow, causing misinterpretation of a company's liquidity and operational efficiency. Failing to adjust for non-recurring items in net cash flow can further distort comparisons, resulting in flawed investment decisions.

Which Metric Should Investors Prioritize?

Free Cash Flow (FCF) provides investors with a clearer picture of a company's financial health by measuring cash generated after capital expenditures, essential for assessing growth potential and dividend sustainability. Net Cash Flow reflects the overall cash movement, including operating, investing, and financing activities, but it can be influenced by non-recurring events, making it less reliable for evaluating ongoing profitability. Investors should prioritize Free Cash Flow to gauge true operational efficiency and long-term value creation.

Free Cash Flow vs Net Cash Flow Infographic

difterm.com

difterm.com