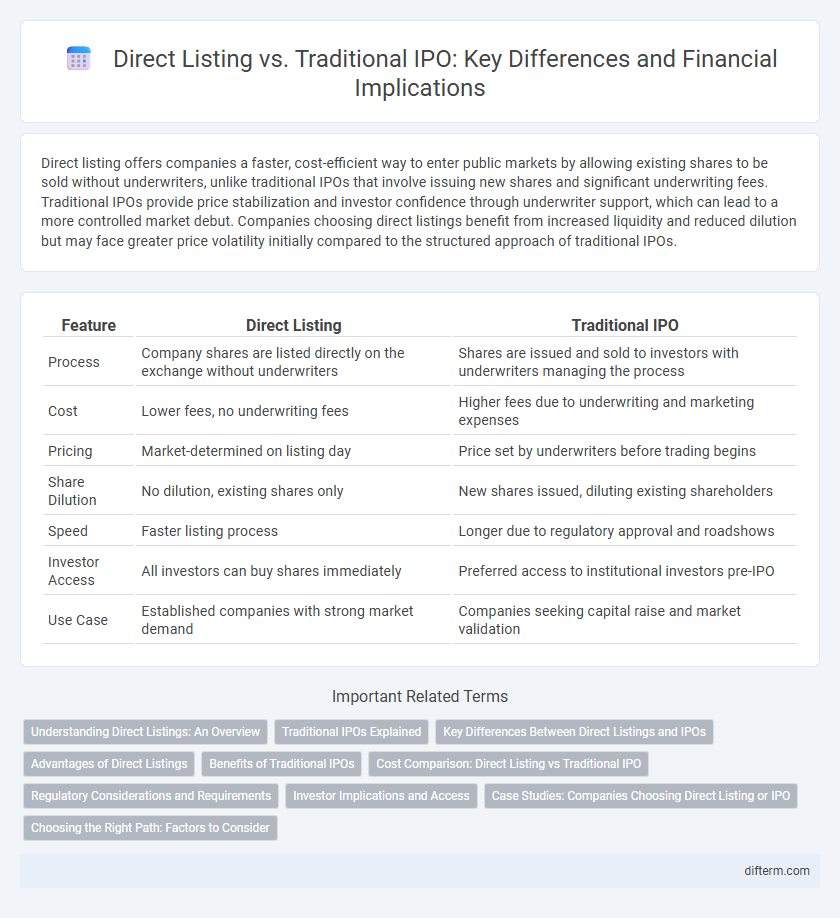

Direct listing offers companies a faster, cost-efficient way to enter public markets by allowing existing shares to be sold without underwriters, unlike traditional IPOs that involve issuing new shares and significant underwriting fees. Traditional IPOs provide price stabilization and investor confidence through underwriter support, which can lead to a more controlled market debut. Companies choosing direct listings benefit from increased liquidity and reduced dilution but may face greater price volatility initially compared to the structured approach of traditional IPOs.

Table of Comparison

| Feature | Direct Listing | Traditional IPO |

|---|---|---|

| Process | Company shares are listed directly on the exchange without underwriters | Shares are issued and sold to investors with underwriters managing the process |

| Cost | Lower fees, no underwriting fees | Higher fees due to underwriting and marketing expenses |

| Pricing | Market-determined on listing day | Price set by underwriters before trading begins |

| Share Dilution | No dilution, existing shares only | New shares issued, diluting existing shareholders |

| Speed | Faster listing process | Longer due to regulatory approval and roadshows |

| Investor Access | All investors can buy shares immediately | Preferred access to institutional investors pre-IPO |

| Use Case | Established companies with strong market demand | Companies seeking capital raise and market validation |

Understanding Direct Listings: An Overview

Direct listings provide companies with an alternative to traditional IPOs by enabling existing shareholders to sell shares directly to the public without issuing new stock or raising capital. This method eliminates underwriting fees and can offer greater price transparency, as the market determines the share price from the outset. Unlike traditional IPOs, direct listings do not involve lock-up periods, allowing immediate liquidity for insiders and investors.

Traditional IPOs Explained

Traditional IPOs involve underwriters who assess company value, set an offering price, and facilitate the sale of shares to institutional and retail investors. Companies benefit from price stabilization and increased market visibility, while underwriters provide risk mitigation through guaranteed capital raise. Regulatory compliance and extensive disclosures are mandatory, ensuring transparency and investor confidence during the public offering process.

Key Differences Between Direct Listings and IPOs

Direct listings enable companies to sell existing shares directly to the public without issuing new shares, avoiding underwriting fees and dilution of ownership. Traditional IPOs involve issuing new shares with underwriters who help set the price, create demand, and stabilize the stock post-launch. Direct listings often result in a more market-driven price discovery, whereas IPOs provide more price certainty through book-building processes.

Advantages of Direct Listings

Direct listings eliminate underwriting fees, allowing companies to save substantial costs compared to traditional IPOs. They offer immediate liquidity by enabling existing shareholders to sell shares directly to the public without lock-up periods. This approach promotes price discovery through market-driven mechanisms, potentially leading to a more accurate valuation.

Benefits of Traditional IPOs

Traditional IPOs offer extensive capital raising opportunities by attracting a broad base of institutional investors through underwriters, ensuring price stability and greater market confidence. The rigorous regulatory scrutiny and roadshow process enhance transparency and credibility, fostering investor trust and long-term shareholder value. Underwriters also provide price support and aftermarket stabilization, reducing volatility and facilitating smoother market entry compared to direct listings.

Cost Comparison: Direct Listing vs Traditional IPO

Direct listings typically incur lower costs compared to traditional IPOs by eliminating underwriting fees, which can range from 5% to 7% of the transaction value. Traditional IPOs also involve higher expenses related to roadshows, marketing, and regulatory compliance, which increase the overall capital outlay. Companies opting for direct listings save significantly on these fees, making it a more cost-effective method for going public.

Regulatory Considerations and Requirements

Direct listings require companies to comply with SEC regulations without underwriters, focusing on transparent disclosure and investor protection. Traditional IPOs demand adherence to extensive SEC filings, including registration statements and roadshows, often involving underwriters to ensure regulatory compliance. Both methods mandate SEC approval, but direct listings emphasize ongoing compliance and fair access to shares rather than pricing guarantees.

Investor Implications and Access

Direct listings provide investors immediate access to shares without underwriter restrictions, enabling transparent price discovery but offering no new shares or capital raise. Traditional IPOs allocate shares through underwriters, often creating initial pricing premiums but limiting retail investor participation and causing potential lock-up periods. Investors in direct listings face higher volatility but benefit from open market dynamics, while IPO investors gain from underwriter support yet encounter potential allocation constraints and post-offering stabilization.

Case Studies: Companies Choosing Direct Listing or IPO

Spotify and Slack pioneered direct listings in 2018 and 2019, bypassing traditional underwriters to save on fees and allow existing shareholders to sell shares immediately. In contrast, companies like Airbnb and Uber opted for traditional IPOs, leveraging underwriters for price stabilization and broader investor outreach during their market debuts. The choice between direct listings and IPOs often hinges on company size, investor base, and capital-raising objectives, as demonstrated by these high-profile case studies.

Choosing the Right Path: Factors to Consider

Evaluating factors such as market volatility, capital needs, and company maturity is critical when choosing between a direct listing and a traditional IPO. Direct listings often benefit established companies by minimizing underwriting fees and allowing for immediate liquidity, while traditional IPOs provide structured price discovery and capital raising through underwriters. Analyzing investor demand, regulatory requirements, and long-term growth strategies ensures alignment with financial goals and market conditions.

Direct listing vs Traditional IPO Infographic

difterm.com

difterm.com