Angel investors provide early-stage funding from their personal finances, often supporting startups during the initial phases with smaller investment amounts. Venture capitalists manage pooled funds from institutions and high-net-worth individuals, investing larger sums into companies with higher growth potential and a more developed business model. Understanding the differences in investment scale, risk tolerance, and involvement is crucial for entrepreneurs seeking strategic financial partnerships.

Table of Comparison

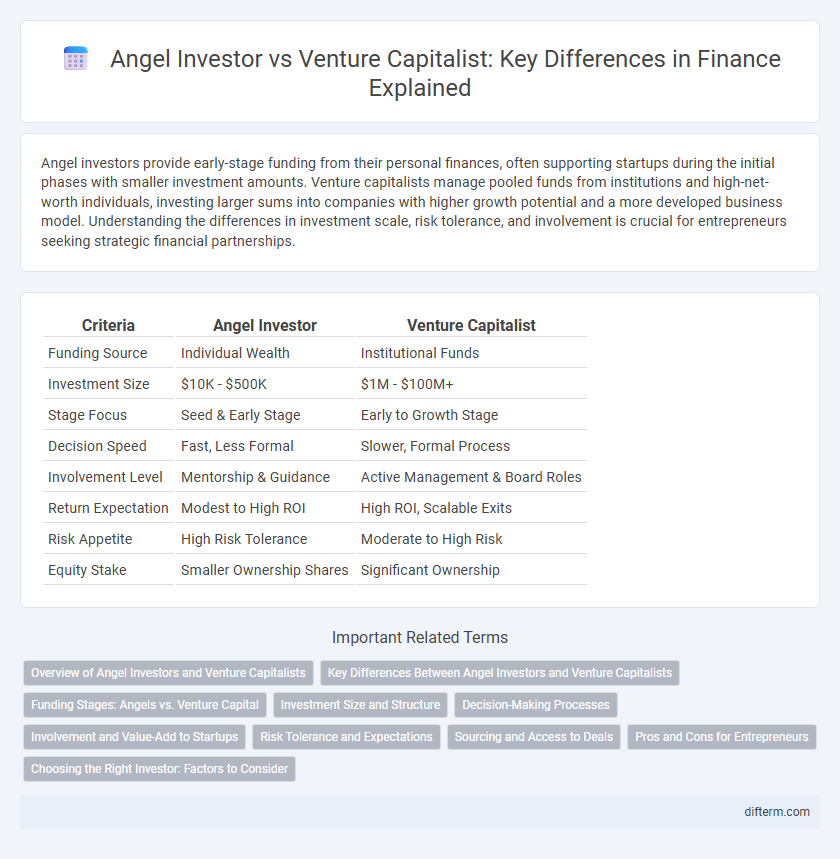

| Criteria | Angel Investor | Venture Capitalist |

|---|---|---|

| Funding Source | Individual Wealth | Institutional Funds |

| Investment Size | $10K - $500K | $1M - $100M+ |

| Stage Focus | Seed & Early Stage | Early to Growth Stage |

| Decision Speed | Fast, Less Formal | Slower, Formal Process |

| Involvement Level | Mentorship & Guidance | Active Management & Board Roles |

| Return Expectation | Modest to High ROI | High ROI, Scalable Exits |

| Risk Appetite | High Risk Tolerance | Moderate to High Risk |

| Equity Stake | Smaller Ownership Shares | Significant Ownership |

Overview of Angel Investors and Venture Capitalists

Angel investors are high-net-worth individuals who provide early-stage funding to startups, often contributing not only capital but also mentorship and industry connections. Venture capitalists, representing professional investment firms, manage pooled funds from multiple investors to invest in scalable startups with high growth potential during later funding rounds. Both play crucial roles in startup ecosystems by supplying essential capital but differ in funding scale, investment stage, and involvement level.

Key Differences Between Angel Investors and Venture Capitalists

Angel investors typically fund startups in early stages with personal capital, often investing amounts ranging from $25,000 to $100,000, while venture capitalists manage pooled funds from institutional investors and invest larger sums exceeding $1 million in later-stage startups. Angel investors usually take a more hands-on mentoring role, offering guidance and industry connections, whereas venture capitalists focus on scaling the business rapidly to achieve significant returns within a 5-10 year exit horizon. Ownership stakes differ as well; angels generally acquire smaller equity percentages compared to venture capitalists who aim for substantial control to influence strategic decisions.

Funding Stages: Angels vs. Venture Capital

Angel investors typically fund early-stage startups during seed or pre-seed rounds, providing smaller amounts of capital to help entrepreneurs develop their initial ideas. Venture capitalists invest in later funding stages, such as Series A and beyond, offering substantial capital to scale operations and accelerate growth. The funding amounts from venture capital firms generally range from millions to hundreds of millions, while angel investments usually span from tens of thousands to a few hundred thousand dollars.

Investment Size and Structure

Angel investors typically invest smaller amounts, ranging from $10,000 to $500,000, often providing equity or convertible debt in early-stage startups. Venture capitalists manage larger funds, investing millions in exchange for significant equity stakes, structured through multiple funding rounds and detailed term sheets. Investment structures from venture capitalists usually include preferred shares with protective provisions, while angel investments tend to be simpler and more flexible.

Decision-Making Processes

Angel investors typically make decisions quickly based on personal intuition, industry experience, and the entrepreneur's potential, often relying on informal evaluations and smaller investment amounts. Venture capitalists employ a more rigorous, structured decision-making process involving detailed due diligence, market analysis, and input from professional committees to mitigate risk and ensure scalable returns. The contrasting approaches reflect the scale of investments, with angel investors favoring agility and venture capitalists prioritizing thorough risk assessment.

Involvement and Value-Add to Startups

Angel investors typically provide early-stage funding along with mentorship and strategic advice, leveraging their experience to guide startups through initial growth phases. Venture capitalists offer larger capital investments and bring structured resources, extensive networks, and operational expertise to scale businesses rapidly. Both investors contribute value beyond capital, but venture capitalists are more involved in board-level decisions and long-term growth strategies.

Risk Tolerance and Expectations

Angel investors typically exhibit higher risk tolerance as they invest personal funds in early-stage startups with unproven business models, expecting substantial equity stakes and potential high returns over a longer time horizon. Venture capitalists manage pooled funds from limited partners, apply rigorous due diligence processes, and demand scalable business models with clear exit strategies, showing moderate risk tolerance but expecting faster growth and defined timelines for returns. Both seek equity but differ in risk appetite and expectations, with angels favoring innovative startups and VCs prioritizing structured growth and market traction.

Sourcing and Access to Deals

Angel investors typically source deals through personal networks, industry events, and startup pitch competitions, leveraging their individual connections for early-stage investment opportunities. Venture capitalists have structured deal sourcing mechanisms including dedicated scouting teams, partnerships with incubators, and access to proprietary market data, enabling them to evaluate a higher volume of startups systematically. Access to deals for venture capitalists is often enhanced by their brand reputation and established relationships with entrepreneurs, accelerators, and syndicates, providing exclusive entry to high-potential ventures.

Pros and Cons for Entrepreneurs

Angel investors provide early-stage funding with more flexible terms, allowing entrepreneurs to retain greater control but typically offer smaller capital amounts. Venture capitalists bring larger investments and valuable industry connections, accelerating growth potential while demanding equity stakes and strategic influence that may dilute founders' control. Entrepreneurs must weigh the trade-offs between personalized support and financial scale when choosing between angel investors and venture capitalists.

Choosing the Right Investor: Factors to Consider

Angel investors typically provide early-stage funding with smaller amounts, often offering personalized mentorship and greater flexibility in deal terms. Venture capitalists usually invest larger sums during growth stages, expecting faster scalability and higher returns, while conducting thorough due diligence and demanding significant equity stakes. Choosing the right investor requires assessing the startup's capital needs, growth potential, desired level of control, and alignment with investor expertise and network.

Angel investor vs venture capitalist Infographic

difterm.com

difterm.com