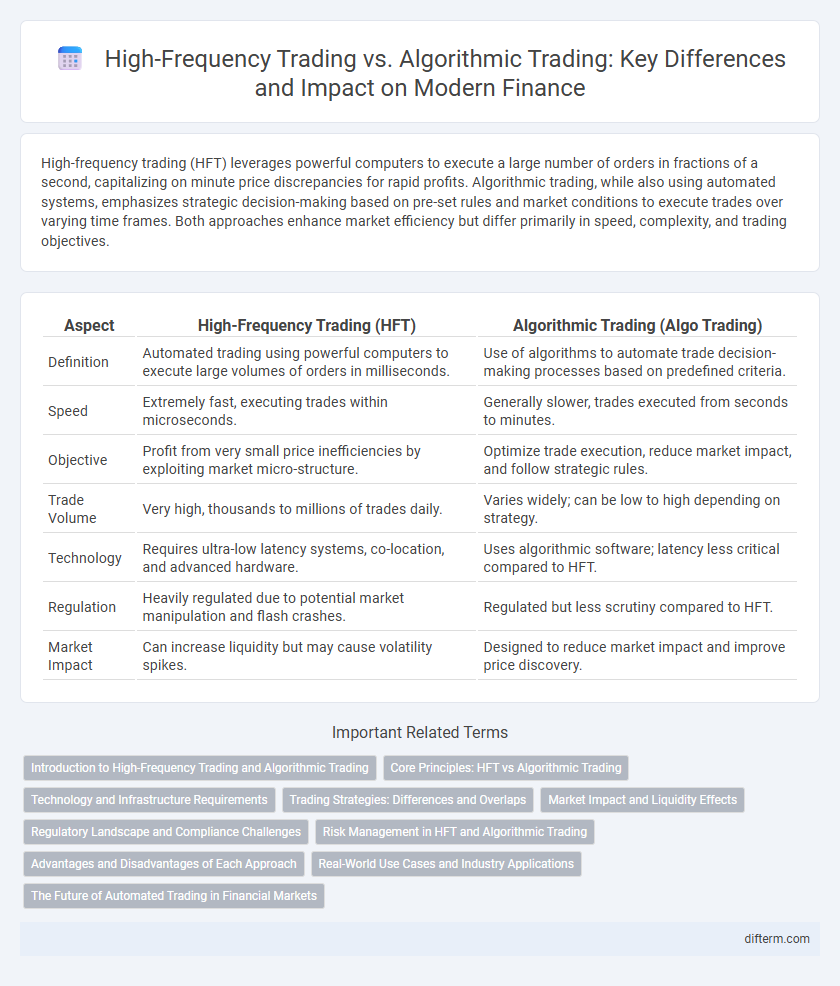

High-frequency trading (HFT) leverages powerful computers to execute a large number of orders in fractions of a second, capitalizing on minute price discrepancies for rapid profits. Algorithmic trading, while also using automated systems, emphasizes strategic decision-making based on pre-set rules and market conditions to execute trades over varying time frames. Both approaches enhance market efficiency but differ primarily in speed, complexity, and trading objectives.

Table of Comparison

| Aspect | High-Frequency Trading (HFT) | Algorithmic Trading (Algo Trading) |

|---|---|---|

| Definition | Automated trading using powerful computers to execute large volumes of orders in milliseconds. | Use of algorithms to automate trade decision-making processes based on predefined criteria. |

| Speed | Extremely fast, executing trades within microseconds. | Generally slower, trades executed from seconds to minutes. |

| Objective | Profit from very small price inefficiencies by exploiting market micro-structure. | Optimize trade execution, reduce market impact, and follow strategic rules. |

| Trade Volume | Very high, thousands to millions of trades daily. | Varies widely; can be low to high depending on strategy. |

| Technology | Requires ultra-low latency systems, co-location, and advanced hardware. | Uses algorithmic software; latency less critical compared to HFT. |

| Regulation | Heavily regulated due to potential market manipulation and flash crashes. | Regulated but less scrutiny compared to HFT. |

| Market Impact | Can increase liquidity but may cause volatility spikes. | Designed to reduce market impact and improve price discovery. |

Introduction to High-Frequency Trading and Algorithmic Trading

High-Frequency Trading (HFT) utilizes powerful computers to execute a large number of orders at extremely fast speeds, often measured in microseconds, capitalizing on small price discrepancies across markets. Algorithmic Trading employs pre-programmed instructions and mathematical models to automatically execute trades based on a set of defined criteria, improving efficiency and minimizing human intervention. Both strategies rely on sophisticated software and data analytics to enhance decision-making in financial markets.

Core Principles: HFT vs Algorithmic Trading

High-Frequency Trading (HFT) relies on ultra-low latency and high-speed data processing to execute thousands of trades within milliseconds, capitalizing on minute price discrepancies. Algorithmic Trading employs complex mathematical models and predetermined instructions to execute trades systematically, focusing on strategy optimization rather than speed alone. Core principles of HFT emphasize speed, infrastructure, and market microstructure, while Algorithmic Trading prioritizes strategy design, risk management, and execution efficiency.

Technology and Infrastructure Requirements

High-frequency trading (HFT) demands ultra-low latency technology, including co-location services, high-speed data feeds, and powerful FPGA or ASIC hardware to execute thousands of trades per second. Algorithmic trading requires advanced software algorithms and robust computing infrastructure but typically operates on less stringent latency constraints, emphasizing strategy optimization over raw speed. Both trading types rely on secure, scalable cloud platforms and real-time market data integration to maintain competitive advantages in modern financial markets.

Trading Strategies: Differences and Overlaps

High-frequency trading (HFT) and algorithmic trading both employ computer algorithms to execute trades, but HFT focuses on extremely rapid order execution at millisecond speeds, leveraging market microstructure and order book dynamics. Algorithmic trading encompasses a broader range of strategies, including statistical arbitrage, trend following, and mean reversion, often operating on longer time frames with complex decision-making processes. Overlaps occur as both strategies use quantitative models and real-time data analysis, yet HFT prioritizes speed and short holding periods, whereas algorithmic trading emphasizes strategic trade planning and execution.

Market Impact and Liquidity Effects

High-frequency trading (HFT) significantly influences market impact by executing large volumes of orders at extremely fast speeds, enhancing liquidity through tighter bid-ask spreads but sometimes amplifying short-term volatility. Algorithmic trading, while also improving liquidity, tends to have a more moderate market impact by executing strategically timed orders to minimize price disruption. Both trading methods alter market dynamics, yet HFT often leads to transient liquidity spikes, whereas algorithmic trading supports more stable and sustainable liquidity provision.

Regulatory Landscape and Compliance Challenges

Regulatory landscape for High-Frequency Trading (HFT) and Algorithmic Trading involves stringent oversight from agencies such as the SEC and CFTC, emphasizing market fairness and transparency. Compliance challenges include real-time monitoring, adherence to order cancellation protocols, and risk controls to prevent market manipulation or flash crashes. Firms must implement robust audit trails and maintain detailed documentation to meet regulatory requirements and avoid penalties.

Risk Management in HFT and Algorithmic Trading

Risk management in high-frequency trading (HFT) involves real-time monitoring of market conditions and automated execution to minimize exposure to rapid price fluctuations and liquidity risks. Algorithmic trading employs pre-defined risk parameters, such as stop-loss limits and position sizing rules, to control drawdowns and volatility over longer time horizons. Advanced risk management systems in both HFT and algorithmic trading integrate machine learning models to predict market anomalies and adjust strategies dynamically.

Advantages and Disadvantages of Each Approach

High-frequency trading (HFT) offers the advantage of extremely rapid execution, enabling traders to exploit minute price discrepancies and increase liquidity in financial markets, but it requires significant technological infrastructure and faces regulatory scrutiny due to potential market manipulation risks. Algorithmic trading allows for systematic, rule-based decision-making that reduces human error and emotional bias while accommodating complex strategies across various asset classes; however, it may suffer from model overfitting and lacks the speed advantage critical in ultra-short-term opportunities. Both approaches improve efficiency and market access, yet traders must weigh the balance between speed, complexity, cost, and regulatory compliance when choosing the optimal method.

Real-World Use Cases and Industry Applications

High-frequency trading (HFT) leverages ultra-low latency systems to execute thousands of trades per second, optimizing market-making strategies and arbitrage opportunities in equities and futures markets. Algorithmic trading encompasses a broader range of systematic strategies, including trend-following, statistical arbitrage, and portfolio rebalancing, widely adopted in asset management and hedge funds. In real-world applications, HFT drives liquidity and tightens bid-ask spreads on electronic exchanges, while algorithmic trading enhances execution efficiency and risk management across diverse financial instruments.

The Future of Automated Trading in Financial Markets

High-frequency trading (HFT) and algorithmic trading continue to transform financial markets through increased speed and enhanced data analytics. Advances in artificial intelligence and machine learning are driving the evolution of predictive models, enabling more sophisticated decision-making algorithms. Regulatory developments and market infrastructure improvements will shape the scalability and transparency of automated trading strategies in the coming years.

High-Frequency Trading vs Algorithmic Trading Infographic

difterm.com

difterm.com