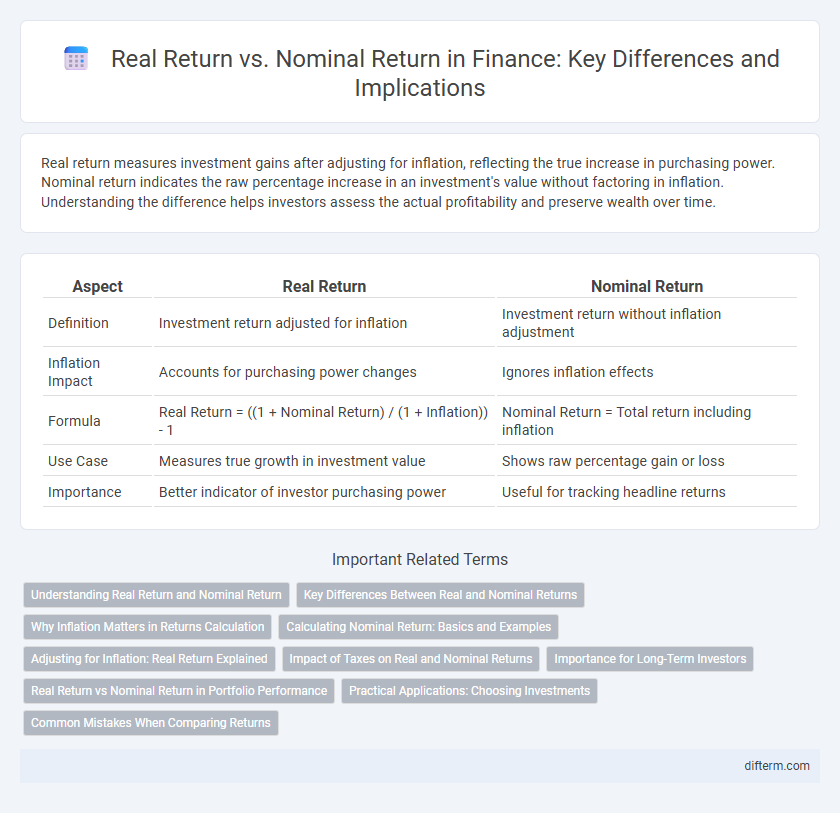

Real return measures investment gains after adjusting for inflation, reflecting the true increase in purchasing power. Nominal return indicates the raw percentage increase in an investment's value without factoring in inflation. Understanding the difference helps investors assess the actual profitability and preserve wealth over time.

Table of Comparison

| Aspect | Real Return | Nominal Return |

|---|---|---|

| Definition | Investment return adjusted for inflation | Investment return without inflation adjustment |

| Inflation Impact | Accounts for purchasing power changes | Ignores inflation effects |

| Formula | Real Return = ((1 + Nominal Return) / (1 + Inflation)) - 1 | Nominal Return = Total return including inflation |

| Use Case | Measures true growth in investment value | Shows raw percentage gain or loss |

| Importance | Better indicator of investor purchasing power | Useful for tracking headline returns |

Understanding Real Return and Nominal Return

Real return measures the profitability of an investment after adjusting for inflation, reflecting the true increase in purchasing power. Nominal return represents the raw percentage gain without accounting for inflation, often overstating actual financial growth. Investors focus on real return to evaluate the effective performance of assets over time in terms of value retention and growth.

Key Differences Between Real and Nominal Returns

Nominal return measures the total percentage gain or loss on an investment without adjusting for inflation, reflecting the raw financial outcome. Real return accounts for inflation, providing a more accurate measure of an investment's purchasing power growth by subtracting the inflation rate from the nominal return. Understanding the key difference helps investors compare investment performance across different time periods and economic conditions more effectively.

Why Inflation Matters in Returns Calculation

Real return measures investment gains after adjusting for inflation, reflecting true purchasing power growth, while nominal return shows raw percentage increase without inflation consideration. Inflation reduces the actual value of money over time, causing nominal returns to potentially overstate investment performance if not accounted for. Accurately calculating real return is crucial for investors to understand true wealth accumulation and make informed financial decisions.

Calculating Nominal Return: Basics and Examples

Nominal return represents the percentage increase in an investment's value without adjusting for inflation, calculated using the formula: (Ending Value - Beginning Value) / Beginning Value x 100. For example, if an investment grows from $1,000 to $1,100 over one year, the nominal return is (($1,100 - $1,000) / $1,000) x 100 = 10%. Investors use nominal returns to assess the superficial growth of assets before accounting for purchasing power changes.

Adjusting for Inflation: Real Return Explained

Real return measures the actual purchasing power gained from an investment after adjusting for inflation, reflecting the true increase in value over time. Nominal return represents the raw percentage increase in investment value without considering the erosion caused by rising prices. Adjusting for inflation is crucial in finance to understand how much an investment truly grows in terms of real wealth, enabling more accurate comparisons and informed decision-making.

Impact of Taxes on Real and Nominal Returns

Taxes significantly diminish both real and nominal returns, but their impact on real returns is more pronounced as inflation-adjusted gains shrink after taxation. Nominal returns reflect total earnings before inflation adjustment, making tax effects appear larger when inflation is high. Understanding the tax burden on investments helps investors accurately assess the net real return, ensuring better financial planning and investment decisions.

Importance for Long-Term Investors

Real return adjusts nominal return for inflation, providing a true measure of purchasing power growth essential for long-term investors. Focusing on real returns helps investors evaluate investment performance accurately over extended periods, preserving wealth against inflation erosion. Understanding the difference between real and nominal returns is crucial for strategic asset allocation and achieving sustainable financial goals.

Real Return vs Nominal Return in Portfolio Performance

Real return measures the actual purchasing power gained from an investment by adjusting nominal returns for inflation, offering a more accurate gauge of portfolio performance. Nominal return reflects the raw percentage increase in investment value without considering inflation, which can overstate true gains during periods of rising prices. Comparing real return to nominal return enables investors to assess the effective growth of their portfolio and make informed decisions based on inflation-adjusted wealth accumulation.

Practical Applications: Choosing Investments

Real return reflects the inflation-adjusted profit from an investment, providing a clearer measure of purchasing power growth compared to nominal return, which represents the raw percentage increase without inflation consideration. Investors prioritize real return when selecting assets such as Treasury Inflation-Protected Securities (TIPS) or real estate to protect against inflation risk and ensure genuine wealth accumulation. Understanding the distinction guides portfolio allocation, balancing nominal gains with inflation-adjusted performance for long-term financial planning.

Common Mistakes When Comparing Returns

Investors often mistakenly compare nominal returns without adjusting for inflation, leading to an overestimation of actual gains. Ignoring the impact of purchasing power erosion distorts the real value of investments over time. Accurate assessment requires isolating real returns by factoring inflation rates and other economic variables affecting investment performance.

Real Return vs Nominal Return Infographic

difterm.com

difterm.com