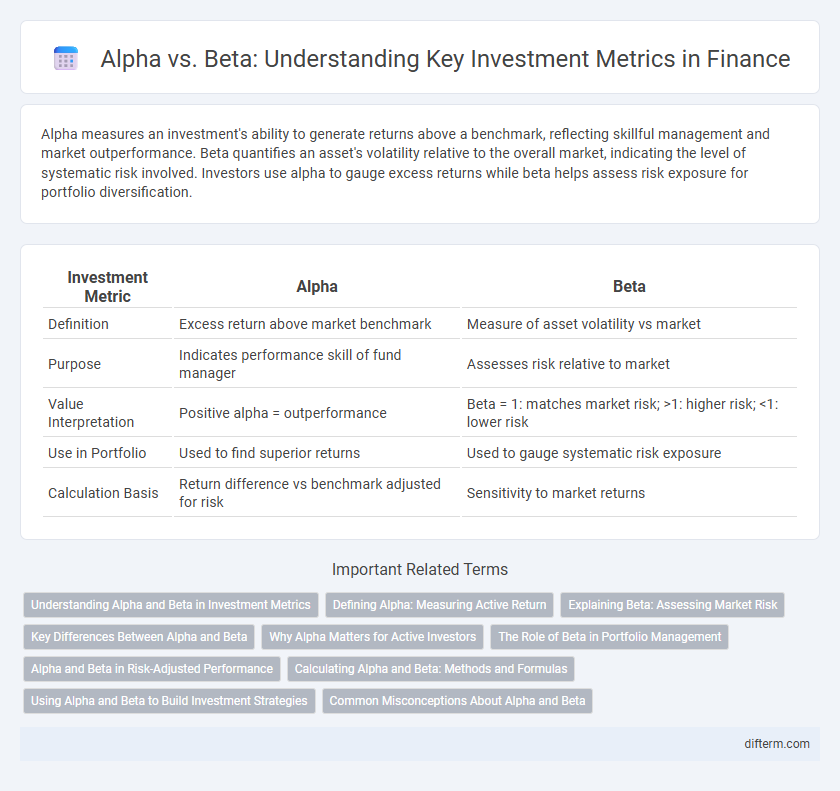

Alpha measures an investment's ability to generate returns above a benchmark, reflecting skillful management and market outperformance. Beta quantifies an asset's volatility relative to the overall market, indicating the level of systematic risk involved. Investors use alpha to gauge excess returns while beta helps assess risk exposure for portfolio diversification.

Table of Comparison

| Investment Metric | Alpha | Beta |

|---|---|---|

| Definition | Excess return above market benchmark | Measure of asset volatility vs market |

| Purpose | Indicates performance skill of fund manager | Assesses risk relative to market |

| Value Interpretation | Positive alpha = outperformance | Beta = 1: matches market risk; >1: higher risk; <1: lower risk |

| Use in Portfolio | Used to find superior returns | Used to gauge systematic risk exposure |

| Calculation Basis | Return difference vs benchmark adjusted for risk | Sensitivity to market returns |

Understanding Alpha and Beta in Investment Metrics

Alpha represents the excess return of an investment relative to its benchmark index, indicating the manager's ability to generate value beyond market movements. Beta measures the sensitivity of an investment's returns to overall market fluctuations, with a beta greater than 1 indicating higher volatility than the market. Understanding alpha and beta helps investors assess risk-adjusted performance and make informed portfolio allocation decisions.

Defining Alpha: Measuring Active Return

Alpha represents the active return on an investment relative to a market benchmark, quantifying the value a portfolio manager adds through skillful security selection or timing. It is calculated as the difference between the portfolio's actual return and the expected return based on Beta and market performance. A positive Alpha indicates outperformance beyond market movements, signaling effective active management in generating excess returns.

Explaining Beta: Assessing Market Risk

Beta measures an investment's sensitivity to overall market movements, indicating its systematic risk relative to a benchmark index like the S&P 500. A beta greater than 1 signals higher volatility than the market, while a beta less than 1 indicates lower volatility. Investors use beta to gauge how much an asset's returns may fluctuate with market shifts, shaping portfolio risk management strategies.

Key Differences Between Alpha and Beta

Alpha measures an investment's excess return relative to a benchmark index, indicating the value added by the portfolio manager's skill. Beta assesses the volatility or systematic risk of an investment compared to the overall market, reflecting sensitivity to market movements. The key difference lies in Alpha quantifying outperformance and skill, while Beta quantifies market-related risk exposure.

Why Alpha Matters for Active Investors

Alpha measures an investment's excess return relative to a benchmark index, indicating the value added by active portfolio management. Investors prioritize alpha to assess the skill of fund managers in generating returns above market expectations despite risks. Consistently positive alpha signals effective stock selection and timing strategies that outperform beta-driven market returns.

The Role of Beta in Portfolio Management

Beta measures an asset's sensitivity to market movements and helps investors evaluate systematic risk within a portfolio. Portfolio managers use beta to construct diversified portfolios aligned with their risk tolerance and market outlook. By analyzing beta, investors can balance potential returns against exposure to market volatility, enhancing strategic asset allocation.

Alpha and Beta in Risk-Adjusted Performance

Alpha measures an investment's excess return relative to a benchmark, indicating the manager's ability to generate risk-adjusted performance beyond market movements. Beta quantifies the sensitivity of an asset's returns to market fluctuations, reflecting systematic risk exposure rather than skill. High Alpha signifies superior risk-adjusted returns, while Beta helps assess the risk level correlated to market volatility.

Calculating Alpha and Beta: Methods and Formulas

Alpha measures an investment's performance relative to a benchmark, calculated using the formula Alpha = Actual Return - [Risk-Free Rate + Beta x (Market Return - Risk-Free Rate)]. Beta quantifies an asset's sensitivity to market movements, derived through regression analysis of the asset's returns against market returns, expressed as Beta = Covariance(Asset, Market) / Variance(Market). Accurate calculation of Alpha and Beta enables investors to assess risk-adjusted returns and market risk exposure effectively.

Using Alpha and Beta to Build Investment Strategies

Alpha measures an investment's performance relative to a benchmark, indicating excess returns generated by active management. Beta quantifies an asset's volatility compared to the overall market, guiding risk assessment in portfolio construction. Combining Alpha and Beta enables investors to optimize strategies by balancing risk-adjusted returns and market exposure.

Common Misconceptions About Alpha and Beta

Alpha and Beta are commonly misunderstood investment metrics, where Alpha measures an investment's excess return relative to a benchmark, and Beta gauges its sensitivity to market movements or systematic risk. Many investors mistakenly believe a high Beta always means higher returns, whereas it primarily indicates volatility compared to the market. Another frequent misconception is that a positive Alpha guarantees outperformance in all market conditions, ignoring that Alpha is context-specific and depends on various factors including the chosen benchmark and time frame.

Alpha vs Beta (investment metrics) Infographic

difterm.com

difterm.com