Full-service brokers provide personalized investment advice, portfolio management, and a wide range of financial services, catering to clients seeking comprehensive support. Discount brokers offer lower fees by focusing on trade execution with minimal advisory services, making them suitable for cost-conscious investors who prefer self-directed trading. Choosing between the two depends on the investor's need for guidance versus cost efficiency and independence.

Table of Comparison

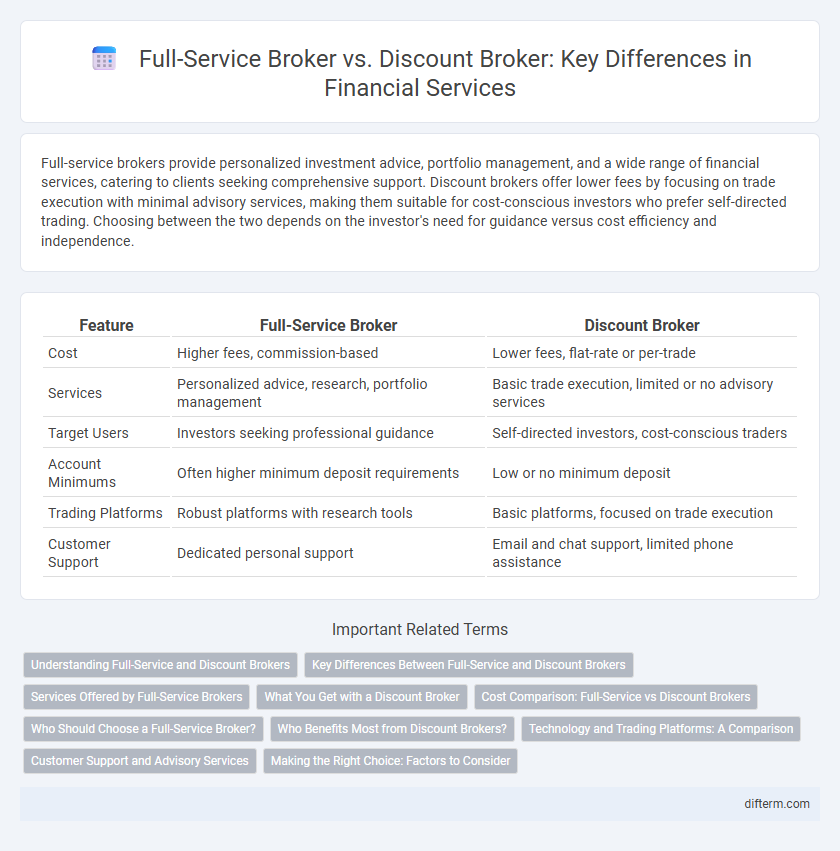

| Feature | Full-Service Broker | Discount Broker |

|---|---|---|

| Cost | Higher fees, commission-based | Lower fees, flat-rate or per-trade |

| Services | Personalized advice, research, portfolio management | Basic trade execution, limited or no advisory services |

| Target Users | Investors seeking professional guidance | Self-directed investors, cost-conscious traders |

| Account Minimums | Often higher minimum deposit requirements | Low or no minimum deposit |

| Trading Platforms | Robust platforms with research tools | Basic platforms, focused on trade execution |

| Customer Support | Dedicated personal support | Email and chat support, limited phone assistance |

Understanding Full-Service and Discount Brokers

Full-service brokers provide comprehensive investment services including personalized financial advice, portfolio management, and retirement planning, catering to clients who seek expert guidance and tailored strategies. Discount brokers offer a cost-effective alternative by executing trades with minimal fees, appealing to self-directed investors who prioritize low commissions over advisory support. Understanding the differences between these broker types is crucial for aligning investment approaches with individual financial goals and service preferences.

Key Differences Between Full-Service and Discount Brokers

Full-service brokers provide personalized investment advice, portfolio management, and comprehensive research tools, typically charging higher fees or commissions. Discount brokers offer lower-cost trading platforms with minimal advisory services, catering to self-directed investors looking to minimize expenses. The choice between the two depends on the investor's need for guidance and willingness to pay for additional services versus a cost-effective, do-it-yourself approach.

Services Offered by Full-Service Brokers

Full-service brokers offer comprehensive financial services including personalized investment advice, portfolio management, retirement planning, and tax strategies, catering to clients who seek tailored support. They provide in-depth market research, access to a wide range of investment products, and financial planning tools that discount brokers typically do not offer. These brokers also assist with complex transactions such as estate planning and margin lending, delivering a holistic approach to wealth management.

What You Get with a Discount Broker

A discount broker offers lower commission fees by providing fewer personalized services compared to full-service brokers, making them ideal for cost-conscious investors primarily managing their trades independently. Typical features include access to online trading platforms, real-time market data, and essential research tools, but without tailored investment advice or portfolio management. Investors benefit from greater control and reduced costs while sacrificing the comprehensive support and financial planning services offered by full-service brokers.

Cost Comparison: Full-Service vs Discount Brokers

Full-service brokers charge higher fees, often including commissions, advisory fees, and account maintenance charges, reflecting their comprehensive services such as personalized investment advice and portfolio management. Discount brokers offer significantly lower costs by limiting services to basic trade execution, with many platforms providing commission-free trades and minimal account fees. Investors aiming to minimize expenses typically prefer discount brokers, while those seeking tailored financial guidance may justify the premium costs associated with full-service brokerage.

Who Should Choose a Full-Service Broker?

Investors seeking personalized investment advice, comprehensive financial planning, and access to a wide range of services including retirement, estate, and tax planning should choose a full-service broker. High-net-worth individuals or those unfamiliar with market complexities benefit from expert guidance and tailored portfolio management offered by full-service brokers. Traders who prioritize convenience and professional support over lower fees often prefer full-service brokers for their broad expertise and resources.

Who Benefits Most from Discount Brokers?

Discount brokers primarily benefit cost-conscious investors seeking to minimize trading fees without sacrificing access to essential market tools and research. These platforms cater to self-directed traders who prefer to make independent investment decisions rather than rely on personalized advice. Discount brokers offer a streamlined, low-cost alternative to full-service brokers, appealing especially to experienced investors and those managing smaller portfolios.

Technology and Trading Platforms: A Comparison

Full-service brokers offer advanced, proprietary trading platforms equipped with robust research tools, real-time data analytics, and integrated financial advisory services tailored for comprehensive portfolio management. Discount brokers provide streamlined, user-friendly platforms optimized for cost-effective, self-directed trading, often featuring lower latency and intuitive mobile accessibility focused on high-frequency trades and order execution speed. Technology in full-service platforms prioritizes depth and customization, whereas discount brokers emphasize efficiency and low-cost scalability.

Customer Support and Advisory Services

Full-service brokers provide comprehensive customer support and personalized advisory services, including financial planning, retirement advice, and portfolio management, tailored to individual investor needs. Discount brokers offer limited customer support, primarily focusing on trade execution with minimal or no advisory services, catering to self-directed investors seeking low-cost transactions. The choice between the two depends on an investor's requirement for personalized guidance versus cost efficiency.

Making the Right Choice: Factors to Consider

Evaluate trading frequency, budget constraints, and desired advisory support when choosing between a full-service broker and a discount broker. Full-service brokers offer comprehensive investment advice, research reports, and personalized portfolio management, typically charging higher fees. Discount brokers provide cost-effective, self-directed trading platforms with lower commissions but limited advisory services, making them suitable for experienced investors seeking greater control over their investments.

Full-service broker vs Discount broker Infographic

difterm.com

difterm.com