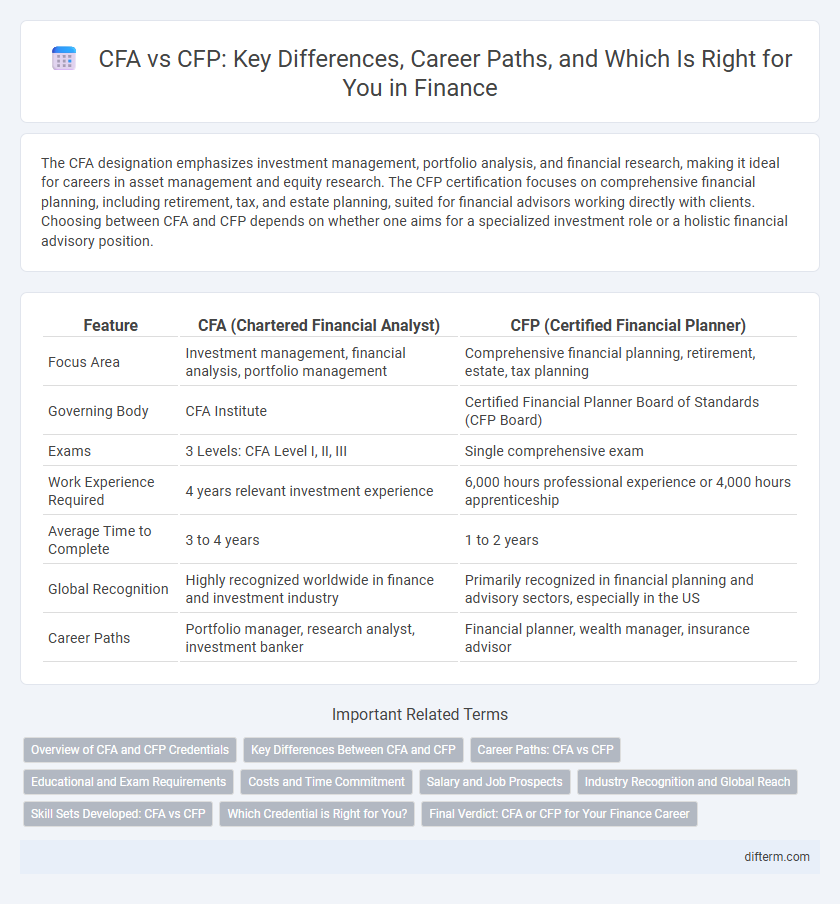

The CFA designation emphasizes investment management, portfolio analysis, and financial research, making it ideal for careers in asset management and equity research. The CFP certification focuses on comprehensive financial planning, including retirement, tax, and estate planning, suited for financial advisors working directly with clients. Choosing between CFA and CFP depends on whether one aims for a specialized investment role or a holistic financial advisory position.

Table of Comparison

| Feature | CFA (Chartered Financial Analyst) | CFP (Certified Financial Planner) |

|---|---|---|

| Focus Area | Investment management, financial analysis, portfolio management | Comprehensive financial planning, retirement, estate, tax planning |

| Governing Body | CFA Institute | Certified Financial Planner Board of Standards (CFP Board) |

| Exams | 3 Levels: CFA Level I, II, III | Single comprehensive exam |

| Work Experience Required | 4 years relevant investment experience | 6,000 hours professional experience or 4,000 hours apprenticeship |

| Average Time to Complete | 3 to 4 years | 1 to 2 years |

| Global Recognition | Highly recognized worldwide in finance and investment industry | Primarily recognized in financial planning and advisory sectors, especially in the US |

| Career Paths | Portfolio manager, research analyst, investment banker | Financial planner, wealth manager, insurance advisor |

Overview of CFA and CFP Credentials

The CFA (Chartered Financial Analyst) credential is globally recognized for expertise in investment management, portfolio analysis, and financial research, typically pursued by professionals aiming for roles in asset management, equity research, and investment banking. The CFP (Certified Financial Planner) designation emphasizes comprehensive financial planning, including retirement, estate, tax, and insurance planning, ideal for advisors focused on personal financial management and client-centered wealth strategies. Both certifications require rigorous exams and adherence to ethical standards, with the CFA demanding a strong foundation in quantitative analysis, while the CFP highlights holistic financial advisory skills.

Key Differences Between CFA and CFP

The CFA (Chartered Financial Analyst) designation emphasizes investment management, portfolio analysis, and financial research, targeting professionals in asset management and equity research. The CFP (Certified Financial Planner) credential focuses on personal financial planning, including retirement, estate, tax, and insurance planning, catering to advisors working directly with individuals and families. CFA programs require passing three rigorous exams and demonstrate expertise in investment theory and ethics, whereas CFP certification involves completing coursework, passing a comprehensive exam, and meeting experience requirements centered on holistic financial advice.

Career Paths: CFA vs CFP

The CFA designation primarily targets investment management, portfolio analysis, and financial research roles within asset management firms, hedge funds, and banks. CFP certification directs professionals toward personal financial planning, wealth management, retirement planning, and insurance advisory positions, often working with individual clients or families. Career paths diverge as CFA holders typically engage in corporate finance and institutional investing, while CFPs specialize in holistic financial planning and client-focused advisory services.

Educational and Exam Requirements

The Chartered Financial Analyst (CFA) designation requires candidates to hold a bachelor's degree or equivalent and pass three rigorous levels of exams covering investment management, ethics, and financial analysis. The Certified Financial Planner (CFP) certification mandates a bachelor's degree, completion of a CFP Board-registered education program, and passing a comprehensive exam focusing on financial planning, taxes, retirement, and estate planning. Both designations emphasize ethics, but the CFA exam is heavily quantitative and investment-centric, whereas the CFP exam is broader, covering practical financial advisory skills.

Costs and Time Commitment

The CFA charter typically requires a financial investment of around $1,000 in exam fees across three levels, with candidates often spending over 300 hours per level studying, usually completing the program in 2 to 4 years. The CFP certification involves education costs averaging $5,000 to $7,000, including coursework and the final exam fee, with candidates dedicating approximately 1,000 hours to meet education, exam, and experience requirements, typically completing it within 1 to 2 years. Both certifications demand significant time and financial commitment, but the CFP focuses more on financial planning with a shorter timeline, while the CFA emphasizes investment management with a deeper and longer study path.

Salary and Job Prospects

Chartered Financial Analyst (CFA) holders typically command higher salaries, with median annual wages around $180,000, reflecting their expertise in investment management and financial analysis. Certified Financial Planner (CFP) professionals often earn between $70,000 and $120,000 annually, focusing on personal financial planning, retirement, and estate planning. Job prospects for CFAs are robust in asset management, hedge funds, and corporate finance, while CFPs find growing demand in wealth management, financial advisory, and insurance sectors.

Industry Recognition and Global Reach

The Chartered Financial Analyst (CFA) designation is globally recognized and highly regarded in investment management, portfolio analysis, and financial research, with widespread acceptance across major financial hubs including New York, London, and Hong Kong. In contrast, the Certified Financial Planner (CFP) credential is primarily acknowledged in personal financial planning and wealth management, enjoying strong industry recognition especially in North America, Europe, and parts of Asia. While the CFA has a broader global reach due to its emphasis on investment analysis and institutional finance, the CFP's strength lies in client-focused financial advice, making each certification distinctly valuable depending on career objectives.

Skill Sets Developed: CFA vs CFP

The CFA (Chartered Financial Analyst) program develops advanced skills in investment analysis, portfolio management, and financial modeling, equipping professionals with deep expertise in equity research, fixed income, derivatives, and ethical standards. In contrast, the CFP (Certified Financial Planner) certification emphasizes comprehensive financial planning skills, including retirement, tax, estate planning, and insurance, tailored for client-centric advisory roles. Both designations enhance strategic decision-making but cater to distinct career paths within finance, with CFA focusing on asset management and CFP on personal financial planning.

Which Credential is Right for You?

Choosing between the CFA and CFP credentials depends on your career goals within finance; the CFA is ideal for investment management, portfolio analysis, and research roles, emphasizing deep knowledge in financial analysis and asset valuation. The CFP focuses on personal financial planning, estate planning, and retirement strategies, making it suitable for those advising individuals and families on comprehensive financial goals. Assess your interest in either broad investment expertise or client-centered financial planning to determine which designation aligns best with your professional aspirations.

Final Verdict: CFA or CFP for Your Finance Career

Choosing between CFA and CFP depends on your finance career goals; CFA is ideal for investment management, equity research, and financial analysis, while CFP suits those focused on personal financial planning and wealth management. The CFA designation demands rigorous exams covering portfolio management, ethics, and financial reporting, positioning holders for roles in asset management and institutional investing. CFP certifies expertise in retirement, tax, and estate planning, making it optimal for advisors directly helping clients with comprehensive financial strategies.

CFA vs CFP Infographic

difterm.com

difterm.com