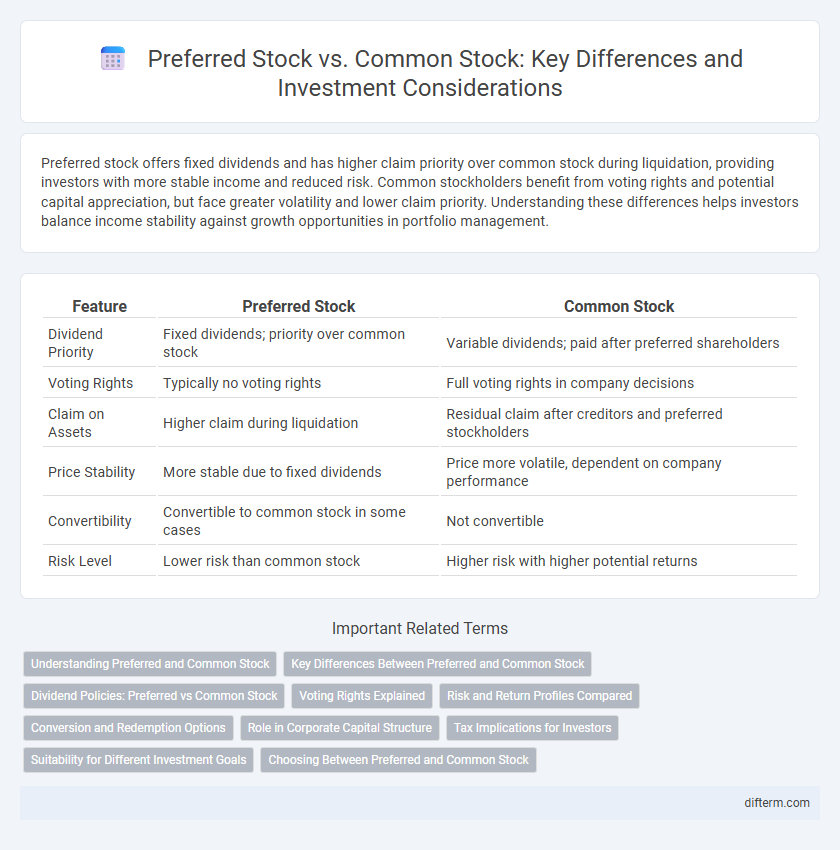

Preferred stock offers fixed dividends and has higher claim priority over common stock during liquidation, providing investors with more stable income and reduced risk. Common stockholders benefit from voting rights and potential capital appreciation, but face greater volatility and lower claim priority. Understanding these differences helps investors balance income stability against growth opportunities in portfolio management.

Table of Comparison

| Feature | Preferred Stock | Common Stock |

|---|---|---|

| Dividend Priority | Fixed dividends; priority over common stock | Variable dividends; paid after preferred shareholders |

| Voting Rights | Typically no voting rights | Full voting rights in company decisions |

| Claim on Assets | Higher claim during liquidation | Residual claim after creditors and preferred stockholders |

| Price Stability | More stable due to fixed dividends | Price more volatile, dependent on company performance |

| Convertibility | Convertible to common stock in some cases | Not convertible |

| Risk Level | Lower risk than common stock | Higher risk with higher potential returns |

Understanding Preferred and Common Stock

Preferred stock offers investors fixed dividends and priority over common stockholders in asset liquidation, providing more stability and lower risk. Common stock represents ownership with voting rights, allowing shareholders to influence corporate decisions while facing higher volatility and potential for greater capital gains. Understanding these key differences helps investors align their portfolios with their risk tolerance and income preferences.

Key Differences Between Preferred and Common Stock

Preferred stockholders receive fixed dividends before common shareholders and have priority during company liquidation, whereas common stockholders benefit from voting rights that influence corporate decisions. Common stock offers potential for higher capital gains due to price appreciation, while preferred stock generally provides more stable income through consistent dividend payments. Unlike common stock, preferred stock lacks significant voting power but often includes features like convertibility and callability, impacting investor flexibility and risk.

Dividend Policies: Preferred vs Common Stock

Preferred stockholders receive fixed dividend payments, typically paid before any dividends are distributed to common stockholders, ensuring a more stable income stream. Common stock dividends vary based on company profitability and board decisions, often resulting in fluctuating or no dividends during financial downturns. The priority of preferred stock dividends reduces risk for preferred shareholders but limits the upside potential compared to common stockholders who may benefit from higher variable dividends and capital appreciation.

Voting Rights Explained

Preferred stock typically grants limited or no voting rights compared to common stock, which provides shareholders with the ability to vote on corporate matters such as electing the board of directors. Common stockholders have a direct influence on company policies and strategic decisions, while preferred stockholders prioritize dividend payments and liquidation preferences over voting power. This distinction affects investor control and participation in corporate governance.

Risk and Return Profiles Compared

Preferred stock offers investors fixed dividends with lower risk compared to common stock, which typically provides variable dividends and greater exposure to market volatility. Common stockholders have higher potential returns, benefiting from capital appreciation and voting rights, but face greater downside risk during downturns. The risk and return trade-off between these equity types suits different investor preferences based on income stability versus growth opportunity.

Conversion and Redemption Options

Preferred stock often includes conversion options allowing shareholders to convert their shares into common stock, providing potential for capital appreciation. Redemption features in preferred stock grant the issuing company the right to repurchase shares at predetermined prices, offering investors a defined exit strategy. Common stock typically lacks conversion or redemption rights, emphasizing ownership and voting privileges over fixed income or exit mechanisms.

Role in Corporate Capital Structure

Preferred stock represents a hybrid capital instrument that provides fixed dividend payments and priority over common stockholders in asset liquidation, enhancing corporate financial stability. Common stock constitutes equity ownership with voting rights, influencing company control and long-term growth potential through residual profits. Together, these securities balance risk and control in the corporate capital structure, optimizing funding strategies and shareholder value.

Tax Implications for Investors

Preferred stock dividends are typically taxed as ordinary income, which may result in higher tax liabilities for investors compared to common stock dividends, often qualified for lower tax rates. Common stockholders may benefit from lower capital gains taxes when selling shares appreciated in value, whereas preferred stock gains can be taxed similarly but dividends lack preferential tax treatment. Understanding these distinctions helps investors optimize after-tax returns based on their individual tax situations and investment goals.

Suitability for Different Investment Goals

Preferred stock suits investors seeking steady income through fixed dividend payments and higher claim on assets during liquidation, making it ideal for conservative or income-focused portfolios. Common stock appeals to growth-oriented investors aiming for capital appreciation and voting rights, accepting higher volatility and risk in exchange for potential long-term gains. Understanding the differences in dividend priority, risk exposure, and ownership influence is crucial to aligning stock choices with specific financial objectives.

Choosing Between Preferred and Common Stock

Preferred stock offers fixed dividends and priority over common stock in asset liquidation, making it suitable for income-focused investors seeking stable returns. Common stock provides voting rights and potential for capital appreciation, appealing to investors aiming for long-term growth and influence in corporate decisions. Evaluating risk tolerance, investment goals, and income needs is crucial when choosing between preferred and common stock.

Preferred Stock vs Common Stock Infographic

difterm.com

difterm.com