Callable preferred stock allows the issuing company to repurchase shares at a predetermined price after a specified date, providing flexibility to manage capital structure and reduce dividend obligations. Convertible preferred stock grants investors the option to exchange preferred shares for a fixed number of common shares, offering potential upside through equity participation while maintaining priority on dividends. Understanding these features helps investors evaluate risk, return, and control in preferred stock investments.

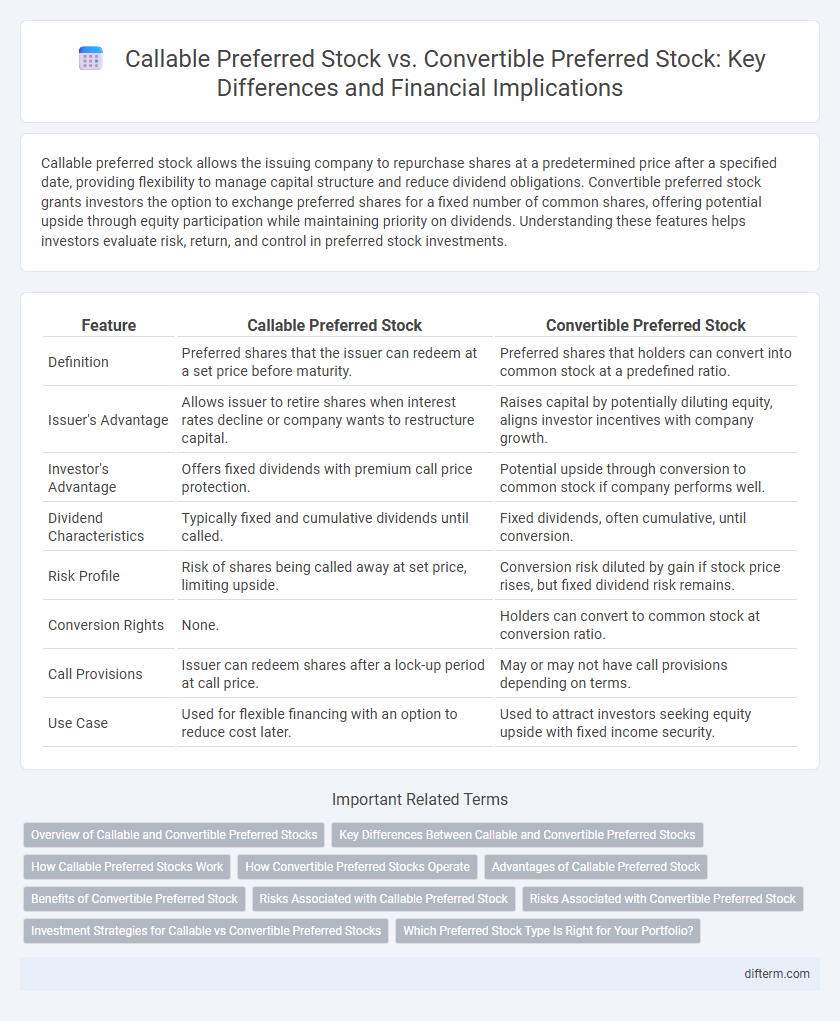

Table of Comparison

| Feature | Callable Preferred Stock | Convertible Preferred Stock |

|---|---|---|

| Definition | Preferred shares that the issuer can redeem at a set price before maturity. | Preferred shares that holders can convert into common stock at a predefined ratio. |

| Issuer's Advantage | Allows issuer to retire shares when interest rates decline or company wants to restructure capital. | Raises capital by potentially diluting equity, aligns investor incentives with company growth. |

| Investor's Advantage | Offers fixed dividends with premium call price protection. | Potential upside through conversion to common stock if company performs well. |

| Dividend Characteristics | Typically fixed and cumulative dividends until called. | Fixed dividends, often cumulative, until conversion. |

| Risk Profile | Risk of shares being called away at set price, limiting upside. | Conversion risk diluted by gain if stock price rises, but fixed dividend risk remains. |

| Conversion Rights | None. | Holders can convert to common stock at conversion ratio. |

| Call Provisions | Issuer can redeem shares after a lock-up period at call price. | May or may not have call provisions depending on terms. |

| Use Case | Used for flexible financing with an option to reduce cost later. | Used to attract investors seeking equity upside with fixed income security. |

Overview of Callable and Convertible Preferred Stocks

Callable preferred stock grants the issuing company the right to redeem shares at a predetermined price after a specified date, enabling management to refinance or eliminate higher-cost capital during favorable market conditions. Convertible preferred stock offers shareholders the option to convert their preferred shares into a fixed number of common shares, providing potential equity participation and upside if the company's common stock appreciates. Both instruments balance fixed-income characteristics with strategic flexibility, catering to different investor objectives in capital structure management.

Key Differences Between Callable and Convertible Preferred Stocks

Callable preferred stock allows the issuer to redeem shares at a predetermined price after a specified date, providing flexibility to manage debt and capital structure. Convertible preferred stock grants shareholders the option to convert their preferred shares into a fixed number of common shares, enabling potential participation in equity appreciation. The key differences lie in issuer control versus investor conversion rights, impacting risk, return, and capital strategy in corporate finance.

How Callable Preferred Stocks Work

Callable preferred stocks grant the issuing company the right to repurchase shares at a predetermined call price after a specified date, typically at a premium above the issue price. Investors receive fixed dividends, but the issuing company can redeem these shares, often to refinance at lower rates or restructure capital during favorable market conditions. This call feature introduces reinvestment risk for investors, as they might be forced to reinvest proceeds at lower yields if the stock is called early.

How Convertible Preferred Stocks Operate

Convertible preferred stocks operate by granting shareholders the option to convert their preferred shares into a predetermined number of common shares, typically at specific times or under certain conditions. This conversion feature allows investors to benefit from potential equity appreciation while still receiving fixed dividends characteristic of preferred stock. The conversion ratio, conversion price, and timing terms are defined at issuance, providing a structured pathway for transitioning from fixed-income preference to equity ownership.

Advantages of Callable Preferred Stock

Callable preferred stock offers issuers the advantage of financial flexibility by allowing them to redeem shares at predetermined prices, often resulting in cost savings when interest rates decline. This feature enables companies to manage capital structure more effectively by replacing higher-cost equity with cheaper financing alternatives. Investors benefit from attractive dividend yields while issuers retain control over capital costs and future financing strategies.

Benefits of Convertible Preferred Stock

Convertible preferred stock offers investors the advantage of participating in equity appreciation by allowing conversion into common shares, which can lead to higher returns if the company's stock price rises. This feature provides a potential upside while maintaining the fixed dividend payments typical of preferred stock, balancing income and growth opportunities. Furthermore, conversion flexibility can improve liquidity and diversify investment risk by shifting from fixed-income characteristics to equity exposure.

Risks Associated with Callable Preferred Stock

Callable preferred stock carries the risk of redemption by the issuer at a predetermined price, potentially forcing investors to reinvest proceeds at lower interest rates during declining market conditions. This call feature limits price appreciation and can result in an opportunity cost if the stock is redeemed before favorable market changes occur. Investors may also face uncertainty regarding the timing of redemption, complicating portfolio planning and income predictability.

Risks Associated with Convertible Preferred Stock

Convertible preferred stock carries the risk of dilution for common shareholders when conversion into common shares occurs, potentially reducing ownership percentage and earnings per share. Market volatility can affect the conversion value, leading to uncertainty in the stock's price and investor returns. Unlike callable preferred stock, convertible shares expose investors to both interest rate risk and equity market risk due to their hybrid fixed-income and equity characteristics.

Investment Strategies for Callable vs Convertible Preferred Stocks

Callable preferred stock offers investors potential for income through higher yields but carries the risk of call premiums being exercised when interest rates fall, making it suitable for conservative income-focused strategies. Convertible preferred stock provides the opportunity for capital appreciation by converting shares into common stock, appealing to growth-oriented investors seeking exposure to equity upside while maintaining preferred stock privileges. Strategic allocation between callable and convertible preferred stocks depends on balancing income stability with growth potential amid changing market conditions.

Which Preferred Stock Type Is Right for Your Portfolio?

Callable preferred stock allows issuers to redeem shares at a set price after a certain date, providing potential income stability but limiting upside gains, while convertible preferred stock offers the option to convert shares into common stock, enabling participation in equity appreciation with added income features. Investors seeking predictable income with downside protection might favor callable preferred stock, whereas those aiming for capital growth alongside fixed dividends may prefer convertible preferred stock. Assessing your portfolio goals, risk tolerance, and market outlook helps determine which preferred stock type aligns with your investment strategy.

Callable preferred stock vs Convertible preferred stock Infographic

difterm.com

difterm.com