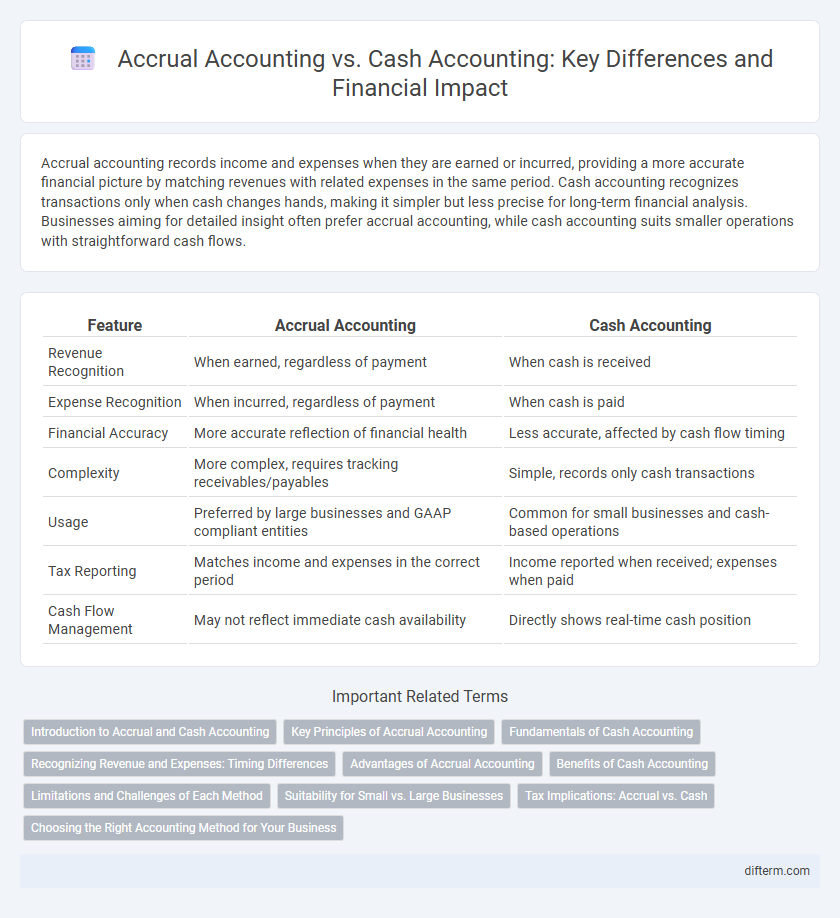

Accrual accounting records income and expenses when they are earned or incurred, providing a more accurate financial picture by matching revenues with related expenses in the same period. Cash accounting recognizes transactions only when cash changes hands, making it simpler but less precise for long-term financial analysis. Businesses aiming for detailed insight often prefer accrual accounting, while cash accounting suits smaller operations with straightforward cash flows.

Table of Comparison

| Feature | Accrual Accounting | Cash Accounting |

|---|---|---|

| Revenue Recognition | When earned, regardless of payment | When cash is received |

| Expense Recognition | When incurred, regardless of payment | When cash is paid |

| Financial Accuracy | More accurate reflection of financial health | Less accurate, affected by cash flow timing |

| Complexity | More complex, requires tracking receivables/payables | Simple, records only cash transactions |

| Usage | Preferred by large businesses and GAAP compliant entities | Common for small businesses and cash-based operations |

| Tax Reporting | Matches income and expenses in the correct period | Income reported when received; expenses when paid |

| Cash Flow Management | May not reflect immediate cash availability | Directly shows real-time cash position |

Introduction to Accrual and Cash Accounting

Accrual accounting records financial transactions when they are earned or incurred, providing a more accurate picture of a company's financial health by matching revenues and expenses to the relevant period. Cash accounting recognizes revenues and expenses only when cash is exchanged, offering simplicity and clear cash flow tracking but potentially misrepresenting financial status during periods with outstanding receivables or payables. Businesses often choose accrual accounting for comprehensive financial reporting, while small businesses and individuals may prefer cash accounting for its straightforward approach.

Key Principles of Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, ensuring a more accurate financial picture. Key principles include matching revenues with related expenses in the same accounting period and recognizing revenues when earned, not when received. This method provides better insights into a company's financial health, essential for compliance with GAAP and IFRS standards.

Fundamentals of Cash Accounting

Cash accounting records revenues and expenses only when cash is actually received or paid, providing a straightforward reflection of cash flow. It tracks inflows and outflows in real-time, making it simpler for small businesses and individuals to manage daily financial operations. This method excludes accounts receivable and payable from financial statements until cash transactions occur, offering clarity on available liquidity.

Recognizing Revenue and Expenses: Timing Differences

Accrual accounting recognizes revenue and expenses when they are incurred, matching income to related costs regardless of cash flow timing, which provides a more accurate financial position. Cash accounting records transactions only when cash changes hands, leading to potential timing mismatches in financial reporting. This distinction affects revenue recognition, expense matching, and ultimately the analysis of profitability and liquidity in financial statements.

Advantages of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording revenues and expenses when they are earned or incurred, regardless of cash flow timing, which enhances financial analysis and decision-making. It enables better matching of income and expenses within the same period, improving profitability assessment and compliance with GAAP (Generally Accepted Accounting Principles). Organizations using accrual accounting benefit from improved forecasting, budgeting, and ability to attract investors due to more transparent and reliable financial statements.

Benefits of Cash Accounting

Cash accounting provides clear visibility into actual cash flow, making it easier for small businesses to manage day-to-day finances and avoid cash shortages. It simplifies tax reporting by recognizing revenue and expenses only when money is exchanged, reducing the risk of owing taxes on income not yet received. This method enhances financial clarity for business owners by tracking tangible cash movements instead of accounting estimates.

Limitations and Challenges of Each Method

Accrual accounting faces limitations such as complexity in tracking revenues and expenses before actual cash transactions, potentially leading to cash flow mismanagement and requiring advanced accounting systems. Cash accounting is simpler but challenges include inaccurate financial health representation during periods of delayed payments or receipts, limiting its usefulness for long-term financial planning and analysis. Both methods can encounter difficulties in meeting regulatory compliance and providing timely insights for decision-making due to their inherent accounting treatment differences.

Suitability for Small vs. Large Businesses

Accrual accounting provides large businesses with accurate financial insights by recording revenues and expenses when they are earned or incurred, improving decision-making and compliance with GAAP standards. Small businesses often prefer cash accounting due to its simplicity and immediate cash flow tracking, which supports straightforward tax reporting and bookkeeping. The choice between accrual and cash accounting depends on business size, complexity, and regulatory requirements, with accrual favored for enterprises managing extensive inventory or receivables.

Tax Implications: Accrual vs. Cash

Accrual accounting recognizes income and expenses when they are earned or incurred, impacting taxable income by potentially accelerating tax liabilities due to earlier revenue recognition. Cash accounting records transactions only when cash changes hands, which can defer tax payments by delaying income recognition until payments are received. Businesses must carefully choose between accrual and cash accounting methods to optimize tax timing, compliance with IRS regulations, and overall cash flow management.

Choosing the Right Accounting Method for Your Business

Choosing the right accounting method depends on your business size, complexity, and regulatory requirements. Accrual accounting offers a more accurate financial picture by recording revenues and expenses when they are incurred, making it suitable for larger businesses or those with inventory. Cash accounting, simpler and more straightforward, records transactions only when cash changes hands, ideal for small companies seeking ease of use and immediate cash flow tracking.

Accrual accounting vs Cash accounting Infographic

difterm.com

difterm.com