Micro cap stocks typically have market capitalizations between $50 million and $300 million, offering higher growth potential but with increased volatility and lower liquidity compared to larger stocks. Nano cap stocks represent the smallest segment, usually valued under $50 million, presenting even greater risk due to limited financial transparency and market presence. Investors targeting micro cap and nano cap equities should conduct thorough due diligence to navigate these highly speculative investment opportunities.

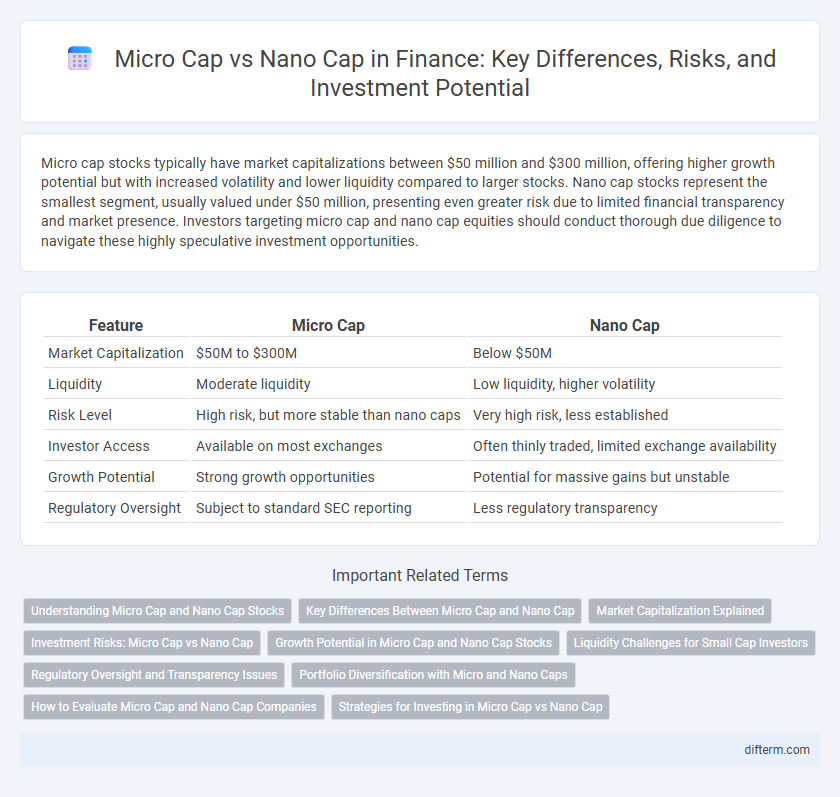

Table of Comparison

| Feature | Micro Cap | Nano Cap |

|---|---|---|

| Market Capitalization | $50M to $300M | Below $50M |

| Liquidity | Moderate liquidity | Low liquidity, higher volatility |

| Risk Level | High risk, but more stable than nano caps | Very high risk, less established |

| Investor Access | Available on most exchanges | Often thinly traded, limited exchange availability |

| Growth Potential | Strong growth opportunities | Potential for massive gains but unstable |

| Regulatory Oversight | Subject to standard SEC reporting | Less regulatory transparency |

Understanding Micro Cap and Nano Cap Stocks

Micro cap stocks typically have a market capitalization between $50 million and $300 million, while nano cap stocks are even smaller, usually under $50 million. These equities often exhibit higher volatility and lower liquidity compared to larger-cap stocks, making them riskier but potentially rewarding investments. Investors should thoroughly analyze company fundamentals and market conditions to navigate the unique challenges and opportunities associated with micro cap and nano cap stocks.

Key Differences Between Micro Cap and Nano Cap

Micro cap stocks typically have a market capitalization ranging from $50 million to $300 million, while nano cap stocks are valued below $50 million, indicating a significant difference in company size and market presence. Micro caps generally offer greater liquidity and more established financial histories compared to the highly speculative and volatile nature of nano cap stocks. Investors often face higher risk with nano caps due to limited analyst coverage, lower trading volumes, and greater vulnerability to market manipulation.

Market Capitalization Explained

Market capitalization measures a company's total market value, calculated by multiplying its share price by the number of outstanding shares. Micro-cap stocks typically have a market capitalization between $50 million and $300 million, while nano-cap stocks are valued under $50 million, often experiencing higher volatility and lower liquidity. Investors assess market cap to understand risk exposure and potential growth, with nano-caps generally representing smaller, less established firms compared to micro-caps.

Investment Risks: Micro Cap vs Nano Cap

Micro cap stocks, typically valued between $50 million and $300 million, carry higher liquidity risk but generally have more established business models compared to nano cap stocks, which are valued under $50 million and are prone to extreme volatility and limited market presence. Nano caps often face significant regulatory scrutiny and financial instability, increasing the likelihood of price manipulation and investor losses. Due to their market size and operational uncertainties, both micro and nano caps present elevated investment risks, requiring thorough due diligence and risk tolerance.

Growth Potential in Micro Cap and Nano Cap Stocks

Micro cap stocks, typically valued between $50 million and $300 million, often offer higher growth potential due to greater market inefficiencies and emerging business models compared to nano cap stocks, which generally have market capitalizations below $50 million. Nano cap stocks carry increased volatility and risk, resulting from limited financial resources and lower liquidity, yet they may provide significant returns if the company successfully scales. Understanding the distinct growth trajectories and risk profiles of micro cap versus nano cap stocks is essential for investors seeking opportunities in small-cap equity markets.

Liquidity Challenges for Small Cap Investors

Micro cap stocks, typically valued between $50 million and $300 million, often present moderate liquidity, enabling relatively easier transactions compared to nano cap stocks, which usually have market caps under $50 million and face severe liquidity constraints. Investors in nano cap stocks encounter wider bid-ask spreads and lower trading volumes, increasing the risk of price manipulation and difficulty in executing large trades without impacting prices. These liquidity challenges necessitate careful portfolio diversification and limit order strategies to mitigate potential losses in small cap investing.

Regulatory Oversight and Transparency Issues

Micro-cap stocks, typically valued between $50 million and $300 million, face moderate regulatory oversight from the SEC, requiring periodic financial disclosures that enhance transparency for investors. Nano-cap stocks, often valued below $50 million, encounter minimal regulatory scrutiny and frequently have limited financial reporting, leading to higher opacity and greater risks of misinformation or fraud. This disparity in oversight and transparency makes micro-cap stocks generally more reliable for investors seeking insight into company finances compared to the largely opaque nano-cap sector.

Portfolio Diversification with Micro and Nano Caps

Micro cap stocks, typically valued between $50 million and $300 million, offer higher growth potential with moderate liquidity, while nano cap stocks, valued under $50 million, carry greater volatility and risk due to limited market presence. Incorporating both micro and nano caps into a portfolio enhances diversification by spreading exposure across different market capitalizations, reducing overall portfolio risk. This strategy leverages the growth opportunities of nano caps and the relative stability of micro caps to optimize returns in small-cap investing.

How to Evaluate Micro Cap and Nano Cap Companies

Evaluating micro cap and nano cap companies requires thorough analysis of financial statements, with particular attention to liquidity ratios, debt levels, and cash flow stability to mitigate higher risk profiles. Investors should assess market capitalization, as micro caps typically range from $50 million to $300 million, while nano caps fall below $50 million, reflecting greater volatility and limited market liquidity. Fundamental metrics such as earnings growth, competitive positioning, and management effectiveness are critical to discerning potential value in these small capitalization stocks.

Strategies for Investing in Micro Cap vs Nano Cap

Investing strategies for micro cap stocks often emphasize thorough fundamental analysis and liquidity assessment due to their relatively higher market capitalization and trading volume compared to nano caps. Nano cap investments require heightened risk tolerance and a focus on potential high growth opportunities, with an emphasis on diversification to mitigate extreme volatility. Both asset classes benefit from targeted research on company management and financial health to identify undervalued opportunities with long-term appreciation potential.

Micro cap vs Nano cap Infographic

difterm.com

difterm.com