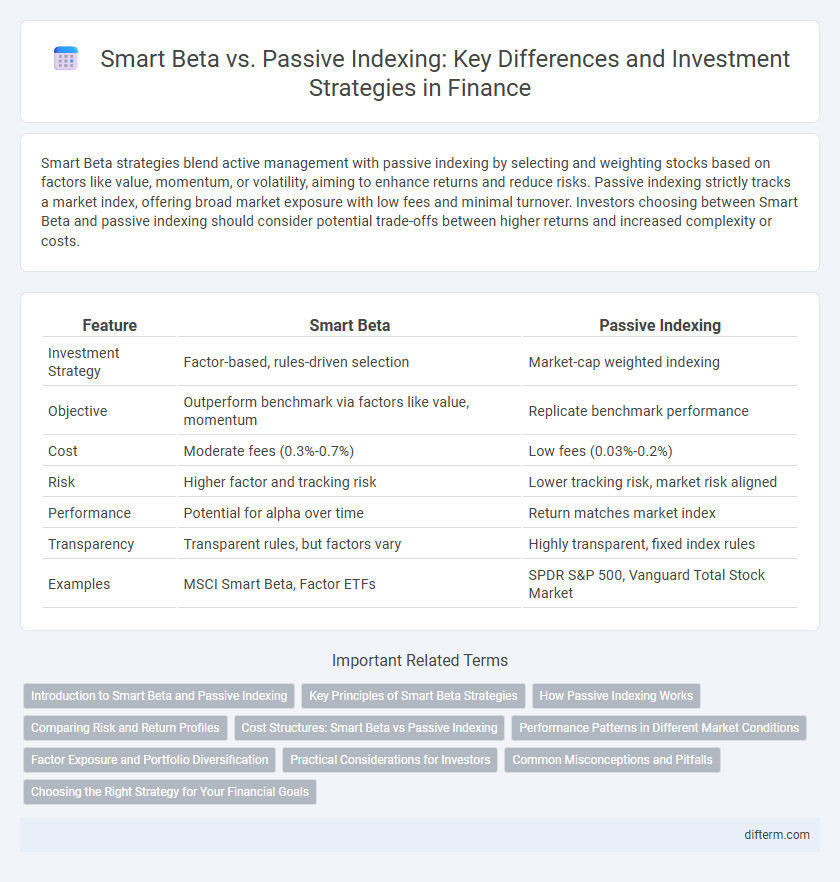

Smart Beta strategies blend active management with passive indexing by selecting and weighting stocks based on factors like value, momentum, or volatility, aiming to enhance returns and reduce risks. Passive indexing strictly tracks a market index, offering broad market exposure with low fees and minimal turnover. Investors choosing between Smart Beta and passive indexing should consider potential trade-offs between higher returns and increased complexity or costs.

Table of Comparison

| Feature | Smart Beta | Passive Indexing |

|---|---|---|

| Investment Strategy | Factor-based, rules-driven selection | Market-cap weighted indexing |

| Objective | Outperform benchmark via factors like value, momentum | Replicate benchmark performance |

| Cost | Moderate fees (0.3%-0.7%) | Low fees (0.03%-0.2%) |

| Risk | Higher factor and tracking risk | Lower tracking risk, market risk aligned |

| Performance | Potential for alpha over time | Return matches market index |

| Transparency | Transparent rules, but factors vary | Highly transparent, fixed index rules |

| Examples | MSCI Smart Beta, Factor ETFs | SPDR S&P 500, Vanguard Total Stock Market |

Introduction to Smart Beta and Passive Indexing

Smart Beta strategies integrate rule-based factors like value, size, momentum, and volatility to enhance returns and manage risks, contrasting with traditional Passive Indexing that replicates market-cap weighted benchmarks for low-cost, broad market exposure. These factor-based approaches aim to capture specific risk premia unaddressed by conventional indexing, offering a middle ground between active management and passive investing. Investors seeking diversification and potential outperformance consider Smart Beta as an alternative to pure Passive Indexing, balancing cost efficiency with strategic factor exposure.

Key Principles of Smart Beta Strategies

Smart Beta strategies combine rules-based investment approaches with factors like value, momentum, and volatility to enhance returns beyond traditional passive indexing. These strategies systematically exploit market inefficiencies by weighting securities based on fundamentals, rather than market capitalization alone. Key principles include transparent methodology, factor diversification, and cost efficiency to balance risk and improve portfolio performance.

How Passive Indexing Works

Passive indexing tracks a market index by replicating its components in the same proportion, minimizing trading activity and management costs. This approach relies on systematic rebalancing to match the index's performance, reducing the impact of market timing and stock selection errors. The strategy offers investors broad market exposure with lower expense ratios and consistent returns aligned with the underlying benchmark.

Comparing Risk and Return Profiles

Smart Beta strategies enhance traditional passive indexing by applying rules-based factors like value, momentum, or low volatility to optimize risk and return profiles. Unlike passive indexes that replicate market capitalization-weighted benchmarks, Smart Beta aims to outperform by targeting specific risk premia, often resulting in higher Sharpe ratios and potentially reduced drawdowns. Investors seeking a balance between active management and passive investing may find Smart Beta offers improved diversification and risk-adjusted returns compared to pure passive index funds.

Cost Structures: Smart Beta vs Passive Indexing

Smart Beta strategies often involve higher expense ratios compared to traditional passive indexing due to more complex portfolio construction and frequent rebalancing costs. Passive indexing typically benefits from lower management fees and minimal transaction expenses by tracking market-cap weighted indexes. Investors must weigh the potential for enhanced returns against the increased cost structures when choosing between Smart Beta and passive index funds.

Performance Patterns in Different Market Conditions

Smart Beta strategies often outperform passive indexing during volatile or sideways markets by systematically capturing factors like value, momentum, or low volatility. Passive indexing typically excels in trending bull markets where broad market growth drives returns. Historical data shows Smart Beta can reduce drawdowns and enhance risk-adjusted performance compared to traditional passive ETFs under fluctuating economic conditions.

Factor Exposure and Portfolio Diversification

Smart Beta strategies offer enhanced factor exposure by systematically targeting specific investment factors such as value, momentum, and low volatility, which can lead to improved risk-adjusted returns compared to Passive Indexing. Passive Indexing typically provides broad market diversification with weighted allocations based on market capitalization but lacks intentional factor tilts. Incorporating Smart Beta can increase portfolio diversification through multi-factor exposure, reducing concentration risk inherent in traditional capitalization-weighted indices.

Practical Considerations for Investors

Smart Beta strategies offer investors a rules-based approach that targets specific factors such as value, size, or momentum, aiming to outperform traditional market-cap weighted passive indexing. Investors should consider transaction costs, tax implications, and the potential for higher fees associated with Smart Beta funds compared to the generally lower-cost passive index funds. Portfolio diversification, risk tolerance, and investment horizon play critical roles in determining whether Smart Beta or passive indexing aligns better with an investor's financial goals.

Common Misconceptions and Pitfalls

Smart Beta strategies are often mistaken for active management due to their systematic approach, but they actually blend rules-based investing with targeted factor exposure, differing significantly from traditional passive indexing which solely tracks market-cap-weighted indices. A common misconception is that Smart Beta guarantees outperformance, yet it carries risks such as factor timing errors and increased turnover costs that passive indexing typically avoids. Investors should be cautious of overpaying fees and misjudging the complexity of factor-based portfolios, which can lead to unintended exposure and volatility compared to straightforward passive index funds.

Choosing the Right Strategy for Your Financial Goals

Smart Beta strategies enhance passive indexing by incorporating factor-based rules such as value, momentum, or low volatility to potentially improve risk-adjusted returns and reduce reliance on market-cap weighting. Passive indexing offers broad market exposure with lower fees and reduced turnover, making it suitable for long-term, cost-sensitive investors seeking market-average performance. Aligning your choice with financial goals involves balancing the desire for outperformance and cost efficiency while considering your risk tolerance and investment horizon.

Smart Beta vs Passive Indexing Infographic

difterm.com

difterm.com