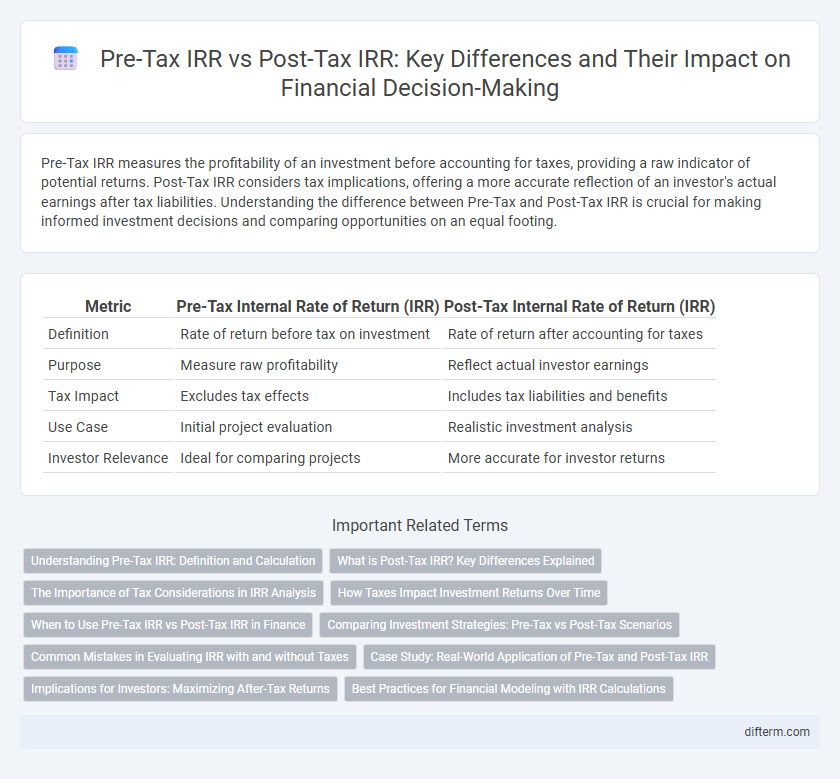

Pre-Tax IRR measures the profitability of an investment before accounting for taxes, providing a raw indicator of potential returns. Post-Tax IRR considers tax implications, offering a more accurate reflection of an investor's actual earnings after tax liabilities. Understanding the difference between Pre-Tax and Post-Tax IRR is crucial for making informed investment decisions and comparing opportunities on an equal footing.

Table of Comparison

| Metric | Pre-Tax Internal Rate of Return (IRR) | Post-Tax Internal Rate of Return (IRR) |

|---|---|---|

| Definition | Rate of return before tax on investment | Rate of return after accounting for taxes |

| Purpose | Measure raw profitability | Reflect actual investor earnings |

| Tax Impact | Excludes tax effects | Includes tax liabilities and benefits |

| Use Case | Initial project evaluation | Realistic investment analysis |

| Investor Relevance | Ideal for comparing projects | More accurate for investor returns |

Understanding Pre-Tax IRR: Definition and Calculation

Pre-Tax Internal Rate of Return (IRR) measures the profitability of an investment before accounting for taxes, reflecting the gross return rate. It is calculated by finding the discount rate that equates the net present value (NPV) of all cash inflows and outflows to zero, using the project's cash flows before tax deductions. This metric provides a clear view of an investment's performance, independent of tax impacts, essential for comparing projects on a consistent basis.

What is Post-Tax IRR? Key Differences Explained

Post-Tax IRR measures the internal rate of return on an investment after accounting for taxes, reflecting the actual profitability to investors. It differs from Pre-Tax IRR by incorporating tax effects such as capital gains tax, income tax on distributions, and depreciation recapture, providing a more accurate assessment of net returns. Understanding Post-Tax IRR helps investors evaluate investment performance by considering tax liabilities, enabling better comparison between projects with different tax impacts.

The Importance of Tax Considerations in IRR Analysis

Tax considerations significantly impact both Pre-Tax IRR and Post-Tax IRR calculations, affecting the true profitability of an investment. Ignoring tax effects can overstate returns, leading to suboptimal decision-making and inaccurate project valuation. Incorporating tax rates, depreciation, and tax shields into IRR analysis ensures more realistic financial assessments and better aligns investment evaluations with after-tax cash flows.

How Taxes Impact Investment Returns Over Time

Pre-tax IRR measures the investment's gross profitability without accounting for taxes, providing an initial benchmark for comparison. Post-tax IRR reflects the actual return after deducting income taxes, significantly impacting long-term investment performance by reducing net cash flows. Understanding the difference between pre-tax and post-tax IRR is crucial for investors to accurately assess the true value and tax efficiency of an investment over its lifespan.

When to Use Pre-Tax IRR vs Post-Tax IRR in Finance

Pre-Tax IRR is best used during initial project evaluation phases to assess raw profitability without the influence of tax effects, providing a clear view of operational performance. Post-Tax IRR offers a more accurate measure of investor returns by incorporating tax impacts, making it essential for final investment decisions and after-tax cash flow analysis. Understanding when to apply Pre-Tax IRR versus Post-Tax IRR ensures better alignment with financial goals and regulatory considerations.

Comparing Investment Strategies: Pre-Tax vs Post-Tax Scenarios

Pre-Tax IRR measures the investment's return before accounting for tax liabilities, offering a clear perspective on gross profitability, while Post-Tax IRR incorporates the impact of taxation, reflecting the actual net returns an investor receives. Comparing Pre-Tax and Post-Tax IRR enables investors to evaluate the effectiveness of tax-efficient strategies and optimize portfolio decisions based on after-tax benefits. Tax considerations such as capital gains rates, depreciation recapture, and tax credits significantly influence Post-Tax IRR, making it an essential metric for realistic investment performance analysis.

Common Mistakes in Evaluating IRR with and without Taxes

Confusing pre-tax IRR with post-tax IRR often leads to inaccurate investment assessments because pre-tax IRR ignores the impact of taxes on cash flows, overstating potential returns. Another common mistake is failing to adjust cash flows consistently for tax effects, resulting in mixed calculations that distort project profitability. Investors must also avoid using pre-tax discount rates when evaluating post-tax cash flows, which can severely bias IRR comparisons in capital budgeting decisions.

Case Study: Real-World Application of Pre-Tax and Post-Tax IRR

In a real-world finance case study, distinguishing between Pre-Tax IRR and Post-Tax IRR highlights the impact of taxation on investment returns, where Pre-Tax IRR reflects the gross profitability before tax liabilities while Post-Tax IRR accounts for tax deductions and credits, providing a more accurate measure of net investor gain. For example, a commercial real estate project with a Pre-Tax IRR of 15% might see its Post-Tax IRR reduced to 11% after applying corporate tax rates and depreciation benefits. This comparison is essential for investors to evaluate the true performance and cash flow of a project under varying tax environments, influencing capital budgeting and financing decisions.

Implications for Investors: Maximizing After-Tax Returns

Pre-Tax IRR highlights the gross profitability of an investment without tax considerations, while Post-Tax IRR reveals the actual returns investors receive after accounting for tax liabilities, crucial for accurate performance assessment. Investors focused on maximizing after-tax returns should prioritize Post-Tax IRR to better gauge the investment's net benefit and optimize portfolio strategies accordingly. Understanding the tax impact on cash flows enables more informed decisions, improving capital allocation and enhancing long-term wealth accumulation.

Best Practices for Financial Modeling with IRR Calculations

Best practices for financial modeling with IRR calculations emphasize distinguishing pre-tax IRR and post-tax IRR to accurately reflect project profitability and investor returns. Incorporate detailed tax impact assessments, including depreciation and deferred taxes, directly into cash flow projections to ensure post-tax IRR reflects real economic value. Use scenario analysis to evaluate sensitivities of both pre-tax and post-tax IRR under varying tax rates and capital structures, enhancing the robustness of investment decisions.

Pre-Tax IRR vs Post-Tax IRR Infographic

difterm.com

difterm.com