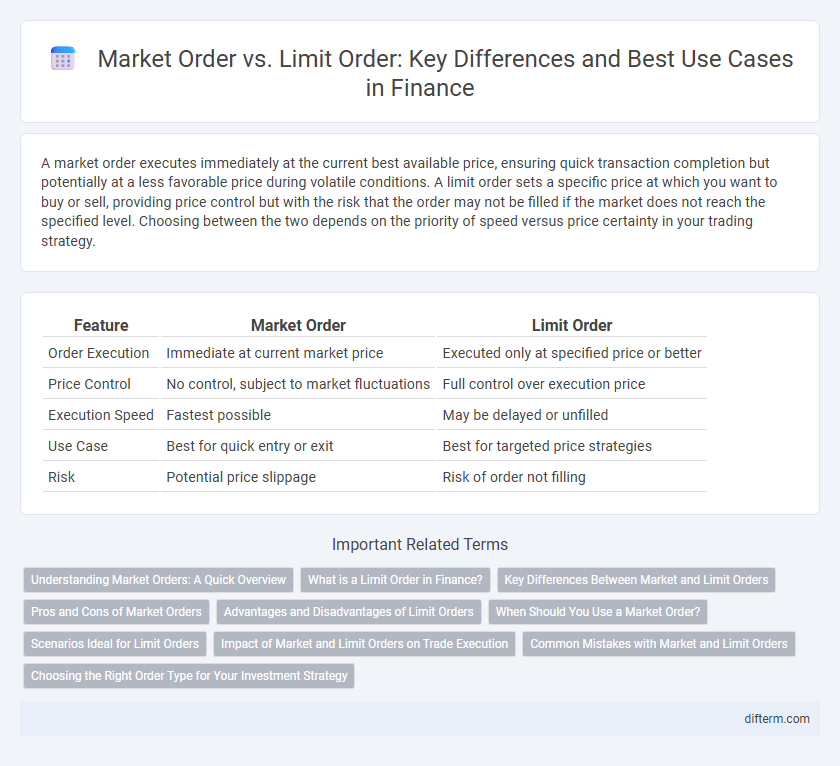

A market order executes immediately at the current best available price, ensuring quick transaction completion but potentially at a less favorable price during volatile conditions. A limit order sets a specific price at which you want to buy or sell, providing price control but with the risk that the order may not be filled if the market does not reach the specified level. Choosing between the two depends on the priority of speed versus price certainty in your trading strategy.

Table of Comparison

| Feature | Market Order | Limit Order |

|---|---|---|

| Order Execution | Immediate at current market price | Executed only at specified price or better |

| Price Control | No control, subject to market fluctuations | Full control over execution price |

| Execution Speed | Fastest possible | May be delayed or unfilled |

| Use Case | Best for quick entry or exit | Best for targeted price strategies |

| Risk | Potential price slippage | Risk of order not filling |

Understanding Market Orders: A Quick Overview

Market orders execute trades immediately at the best available price, ensuring rapid transaction completion in volatile markets. They prioritize speed over price control, making them ideal for investors seeking quick entry or exit positions. Understanding the differences between market orders and limit orders is crucial for effective trade execution and managing transaction costs.

What is a Limit Order in Finance?

A limit order in finance is an instruction to buy or sell a security at a specified price or better, ensuring price control during execution. Unlike market orders, limit orders are not guaranteed to execute immediately and only fill when the market price meets the set limit price. This tool helps traders manage risk by preventing purchases above or sales below desired price levels.

Key Differences Between Market and Limit Orders

Market orders execute immediately at the current best available price, prioritizing speed and certainty of trade completion. Limit orders specify a maximum or minimum price, ensuring execution only at the desired price or better, but with no guarantee of immediate fulfillment. The key difference lies in the trade-off between execution speed (market orders) and price control (limit orders), affecting risk management and trading strategies.

Pros and Cons of Market Orders

Market orders offer immediate execution, ensuring quick entry or exit in volatile markets where price certainty is secondary to speed. However, they carry the risk of slippage, as the final execution price may deviate significantly from the last quoted price due to rapid market fluctuations. This trade-off makes market orders suitable for highly liquid stocks but potentially costly in less liquid or highly volatile securities.

Advantages and Disadvantages of Limit Orders

Limit orders offer precise control over trade execution by allowing investors to set a specific price at which to buy or sell assets, reducing the risk of unfavorable price fluctuations. They provide protection against market volatility and help prevent overpaying or underselling, but the main disadvantage is the possibility of orders not being executed if the market price does not reach the specified limit, leading to missed trading opportunities. Furthermore, limit orders may take longer to fill compared to market orders, potentially delaying investment strategies in fast-moving markets.

When Should You Use a Market Order?

A market order is ideal when immediate execution is the top priority, especially in highly liquid markets where price fluctuations are minimal. Traders use market orders to quickly enter or exit positions without waiting for specific price levels, ensuring faster transaction completion. This order type suits volatile or fast-moving markets where capturing current market prices outweighs the benefits of precise price control.

Scenarios Ideal for Limit Orders

Limit orders are ideal in volatile markets where price control is crucial, allowing traders to specify the maximum purchase or minimum sale price to avoid unfavorable executions. Investors aiming to enter or exit a position at a target price, such as buying a stock dip or selling at a resistance level, benefit from the precision limit orders provide. This strategy minimizes slippage and ensures trades occur only at predefined price points, making it suitable for long-term investment strategies and careful risk management.

Impact of Market and Limit Orders on Trade Execution

Market orders guarantee immediate trade execution by matching buyers and sellers at the current best available price, ensuring rapid fulfillment but potentially facing price slippage in volatile markets. Limit orders prioritize price control by setting a specific execution price or better, which may delay or prevent order execution if the market does not reach the limit price. Trade execution quality depends on balancing immediacy and price certainty, with market orders offering speed and limit orders offering precision in achieving desired trade outcomes.

Common Mistakes with Market and Limit Orders

Investors often confuse market orders with limit orders, leading to unexpected trade executions or missed opportunities. A common mistake with market orders is ignoring potential slippage during volatile markets, which can result in buying or selling at unfavorable prices. With limit orders, traders frequently set limit prices too far from the current market price, causing orders to remain unfilled and missing timely entry or exit points.

Choosing the Right Order Type for Your Investment Strategy

Selecting the appropriate order type is crucial for aligning with your investment goals and market conditions. Market orders ensure immediate execution, ideal for fast trades during high liquidity, while limit orders provide price control, helping investors manage entry and exit points more precisely. Evaluating factors such as volatility, trade urgency, and desired price accuracy guides the choice between market and limit orders to optimize trade outcomes.

Market Order vs Limit Order Infographic

difterm.com

difterm.com