Short selling involves borrowing shares to sell them at a high price with the intention of buying them back cheaper, profiting from a decline in the stock's value. Margin trading allows investors to borrow funds from a broker to purchase securities, amplifying potential gains while also increasing the risk of losses. Understanding the distinct mechanisms and risks of short selling versus margin trading is crucial for effective risk management in investment strategies.

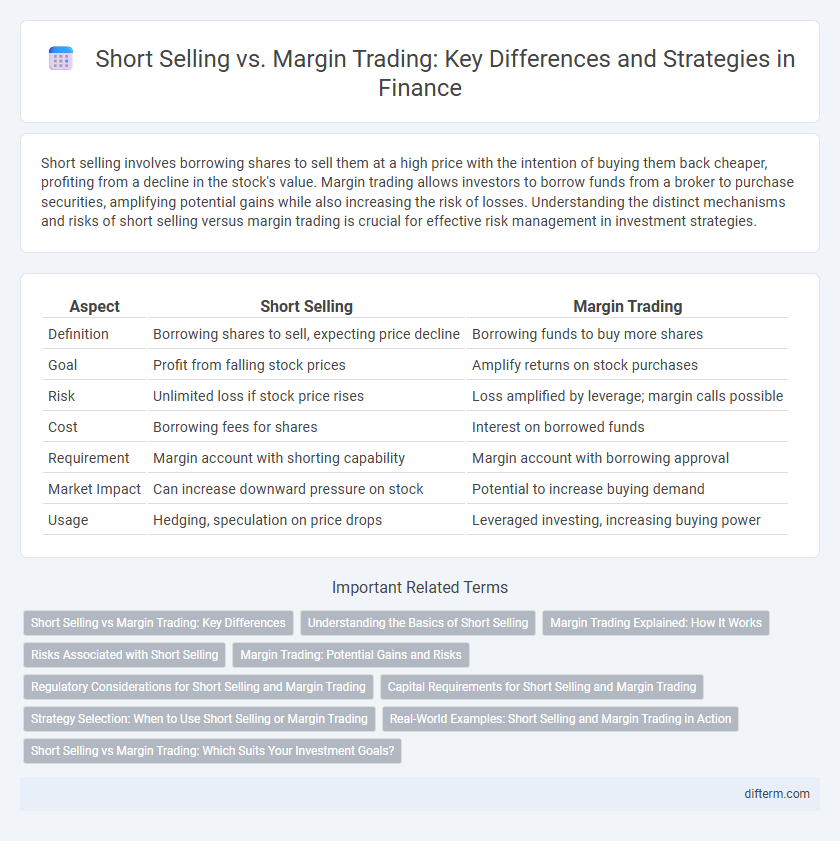

Table of Comparison

| Aspect | Short Selling | Margin Trading |

|---|---|---|

| Definition | Borrowing shares to sell, expecting price decline | Borrowing funds to buy more shares |

| Goal | Profit from falling stock prices | Amplify returns on stock purchases |

| Risk | Unlimited loss if stock price rises | Loss amplified by leverage; margin calls possible |

| Cost | Borrowing fees for shares | Interest on borrowed funds |

| Requirement | Margin account with shorting capability | Margin account with borrowing approval |

| Market Impact | Can increase downward pressure on stock | Potential to increase buying demand |

| Usage | Hedging, speculation on price drops | Leveraged investing, increasing buying power |

Short Selling vs Margin Trading: Key Differences

Short selling involves borrowing shares to sell them at the current price, hoping to buy them back at a lower price for profit, while margin trading allows investors to borrow funds to purchase more securities than their capital alone permits. The key difference lies in short selling's focus on profiting from price declines, in contrast to margin trading's leverage to amplify gains from price increases. Both strategies carry significant risk, including potential for unlimited losses in short selling and margin calls in margin trading.

Understanding the Basics of Short Selling

Short selling involves borrowing shares to sell them at the current price with the intention of buying them back at a lower price to profit from a decline in the stock's value. Margin trading allows investors to borrow funds from a broker to purchase securities, amplifying both potential gains and losses. Understanding the risks and mechanics of short selling is essential, as it requires a margin account and carries the possibility of unlimited losses if the stock price rises.

Margin Trading Explained: How It Works

Margin trading allows investors to borrow funds from a broker to purchase securities, amplifying their buying power beyond available capital. This leverage increases potential returns but also magnifies risks, as losses can exceed initial investments if the market moves against the position. Maintenance margin requirements ensure traders maintain a minimum equity level, triggering margin calls if the account value falls below the threshold.

Risks Associated with Short Selling

Short selling involves borrowing shares to sell at current prices, exposing investors to unlimited loss potential if the stock price rises significantly. Margin trading amplifies both gains and losses by using borrowed funds, but short selling uniquely faces risks like margin calls and the need to repurchase shares at higher prices. Forced buy-ins during short squeezes can lead to rapid, substantial losses, making risk management critical in short selling strategies.

Margin Trading: Potential Gains and Risks

Margin trading amplifies potential gains by allowing investors to borrow funds to increase their buying power, enabling larger positions than their cash balance permits. However, this leverage also magnifies losses, and margin calls can lead to forced liquidation if the account equity falls below required levels. Effective risk management strategies and constant monitoring of margin requirements are essential to mitigate the risks associated with margin trading.

Regulatory Considerations for Short Selling and Margin Trading

Regulatory considerations for short selling include strict reporting requirements, such as the SEC's Regulation SHO which mandates locating and borrowing shares before shorting to prevent "naked" short sales. Margin trading is regulated by frameworks like the Federal Reserve's Regulation T, which sets initial margin requirements and maintenance margin standards to control borrower risk and leverage exposure. Both activities are closely monitored to mitigate systemic risk and protect market integrity, with enforcement actions targeting violations like failure to meet margin calls or improper short selling practices.

Capital Requirements for Short Selling and Margin Trading

Short selling requires a margin account with a broker and typically mandates an initial capital requirement of 150% of the short sale value, including the borrowed shares and cash margin. Margin trading demands a minimum initial margin of 50% of the purchase price of securities, with maintenance margins usually set at 25% to 30%, ensuring sufficient collateral to cover potential losses. Regulatory bodies like FINRA and the SEC enforce these capital thresholds to mitigate risk exposure in both short selling and margin trading activities.

Strategy Selection: When to Use Short Selling or Margin Trading

Short selling is best utilized during anticipated declines in a stock's value to profit from falling prices by borrowing shares and selling them at the current market rate. Margin trading suits investors expecting a stock's price to rise, enabling them to leverage borrowed funds to increase purchasing power and potential gains. Selecting between these strategies depends on market outlook, risk tolerance, and investment goals, as short selling carries unlimited loss potential while margin trading can amplify both profits and losses.

Real-World Examples: Short Selling and Margin Trading in Action

Short selling involves borrowing shares to sell at the current price and repurchasing them later at a lower price, as seen in the 2020 GameStop saga where traders bet against the stock, causing a massive short squeeze. Margin trading allows investors to borrow funds to buy more stock than their capital permits, exemplified by Tesla investors leveraging margin accounts to amplify returns during its rapid price surge. Both strategies carry substantial risk, demonstrated by significant losses when markets move contrary to expectations, emphasizing the importance of risk management in leveraged trading.

Short Selling vs Margin Trading: Which Suits Your Investment Goals?

Short selling involves borrowing shares to sell them at a high price with the expectation of buying them back cheaper, ideal for bearish market strategies seeking profit from price declines. Margin trading allows investors to borrow funds to increase their buying power, suitable for those aiming to amplify gains in bullish markets while managing risk. Choosing between short selling and margin trading depends on whether your investment goals align with profiting from market downturns or leveraging assets for growth.

Short Selling vs Margin Trading Infographic

difterm.com

difterm.com