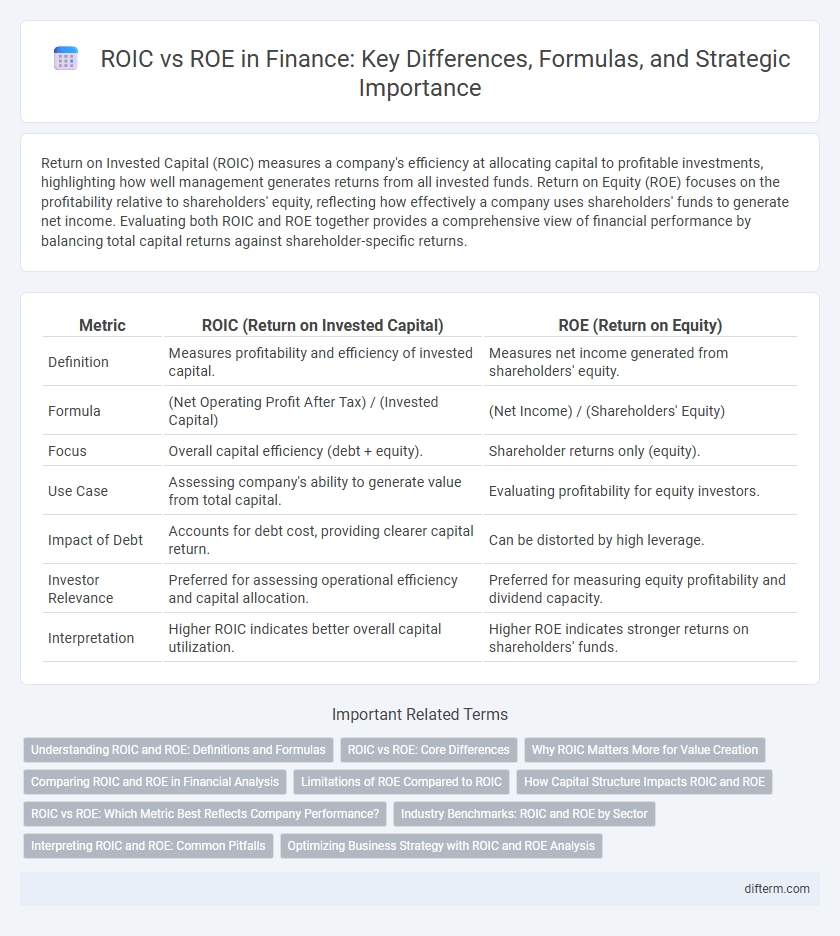

Return on Invested Capital (ROIC) measures a company's efficiency at allocating capital to profitable investments, highlighting how well management generates returns from all invested funds. Return on Equity (ROE) focuses on the profitability relative to shareholders' equity, reflecting how effectively a company uses shareholders' funds to generate net income. Evaluating both ROIC and ROE together provides a comprehensive view of financial performance by balancing total capital returns against shareholder-specific returns.

Table of Comparison

| Metric | ROIC (Return on Invested Capital) | ROE (Return on Equity) |

|---|---|---|

| Definition | Measures profitability and efficiency of invested capital. | Measures net income generated from shareholders' equity. |

| Formula | (Net Operating Profit After Tax) / (Invested Capital) | (Net Income) / (Shareholders' Equity) |

| Focus | Overall capital efficiency (debt + equity). | Shareholder returns only (equity). |

| Use Case | Assessing company's ability to generate value from total capital. | Evaluating profitability for equity investors. |

| Impact of Debt | Accounts for debt cost, providing clearer capital return. | Can be distorted by high leverage. |

| Investor Relevance | Preferred for assessing operational efficiency and capital allocation. | Preferred for measuring equity profitability and dividend capacity. |

| Interpretation | Higher ROIC indicates better overall capital utilization. | Higher ROE indicates stronger returns on shareholders' funds. |

Understanding ROIC and ROE: Definitions and Formulas

Return on Invested Capital (ROIC) measures a company's efficiency in allocating capital to profitable investments by dividing Net Operating Profit After Taxes (NOPAT) by Invested Capital, highlighting operational performance independent of financing structure. Return on Equity (ROE) calculates the profitability relative to shareholders' equity by dividing Net Income by Total Equity, reflecting the return generated on shareholders' investments. Both metrics provide critical insights into financial health, but ROIC offers a broader view of capital efficiency, while ROE emphasizes equity holder returns.

ROIC vs ROE: Core Differences

Return on Invested Capital (ROIC) measures a company's efficiency at allocating capital to profitable investments by comparing net operating profit after tax (NOPAT) to invested capital, while Return on Equity (ROE) evaluates net income generated from shareholders' equity. ROIC provides a more comprehensive view of value creation by incorporating both debt and equity financing, unlike ROE which can be skewed by leverage and focuses solely on equity returns. Firms with high ROIC relative to their cost of capital indicate superior operational performance, whereas high ROE might result from financial leverage rather than true profitability.

Why ROIC Matters More for Value Creation

ROIC (Return on Invested Capital) measures a company's efficiency in allocating capital to profitable investments, directly reflecting value creation by exceeding its weighted average cost of capital (WACC). In contrast, ROE (Return on Equity) can be influenced by leverage and accounting practices, potentially overstating profitability without signaling true economic value. Investors prioritize ROIC because it reveals how effectively management generates returns that surpass capital costs, ensuring sustainable growth and shareholder value.

Comparing ROIC and ROE in Financial Analysis

Return on Invested Capital (ROIC) measures a company's efficiency at allocating the capital under its control to profitable investments, capturing the return generated on both equity and debt. Return on Equity (ROE) focuses solely on the return generated on shareholders' equity, reflecting profitability for equity investors but potentially skewed by leverage. Comparing ROIC and ROE helps identify whether high shareholder returns are driven by genuine operational efficiency or by financial leverage, providing deeper insight into a company's financial health and investment quality.

Limitations of ROE Compared to ROIC

Return on Equity (ROE) can be misleading due to its sensitivity to financial leverage, which may inflate profitability metrics without reflecting true operational efficiency. Unlike Return on Invested Capital (ROIC), ROE does not account for debt and equity cost, potentially obscuring the actual value creation or destruction by the company. ROIC offers a more comprehensive measure by evaluating returns against total invested capital, providing clearer insights into management's effectiveness in generating sustainable profits.

How Capital Structure Impacts ROIC and ROE

Capital structure directly influences Return on Invested Capital (ROIC) and Return on Equity (ROE) by altering the mix of debt and equity financing a company uses. Increased leverage typically amplifies ROE due to the tax advantages of debt and reduced equity base, but it can diminish ROIC if the cost of debt outweighs operating returns. Optimal capital structure balances debt and equity to maximize ROIC while leveraging financial debt to enhance ROE without compromising overall financial stability.

ROIC vs ROE: Which Metric Best Reflects Company Performance?

Return on Invested Capital (ROIC) measures how efficiently a company generates profits from both equity and debt, providing a comprehensive view of overall capital effectiveness, while Return on Equity (ROE) focuses solely on shareholders' equity, reflecting profitability relative to net equity. ROIC is often considered a superior metric for evaluating company performance because it accounts for the total capital employed and highlights operational efficiency beyond just equity financing. Investors seeking to understand true economic value creation prefer ROIC, as it better captures how well management uses all invested capital to generate sustainable returns.

Industry Benchmarks: ROIC and ROE by Sector

ROIC and ROE vary significantly across industries, with capital-intensive sectors like utilities typically showing higher ROIC due to efficient asset use, while technology firms often record elevated ROE driven by strong equity returns. Financial institutions usually exhibit high ROE reflecting leverage impact, whereas manufacturing sectors balance both ratios to optimize operational efficiency and shareholder value. Benchmarking ROIC and ROE by sector enables investors to assess company performance relative to industry norms, guiding better capital allocation decisions.

Interpreting ROIC and ROE: Common Pitfalls

Interpreting Return on Invested Capital (ROIC) and Return on Equity (ROE) requires caution due to inherent differences in their focus; ROIC evaluates overall capital efficiency, including debt, while ROE solely measures shareholder equity returns. Common pitfalls include ignoring the impact of leverage on ROE, which can inflate returns without improving operational performance, and overlooking capital structure variations that affect comparability. Investors should analyze both metrics in conjunction with company-specific debt levels and industry benchmarks to avoid misleading conclusions about financial health and profitability.

Optimizing Business Strategy with ROIC and ROE Analysis

ROIC (Return on Invested Capital) measures a company's efficiency in allocating capital to profitable projects, while ROE (Return on Equity) evaluates profitability relative to shareholders' equity. Analyzing both ROIC and ROE allows businesses to identify capital allocation effectiveness and equity returns, guiding strategic decisions to enhance long-term value creation. Optimization of business strategy involves prioritizing investments with ROIC exceeding the cost of capital and driving ROE improvements through operational efficiency and financial leverage.

ROIC vs ROE Infographic

difterm.com

difterm.com