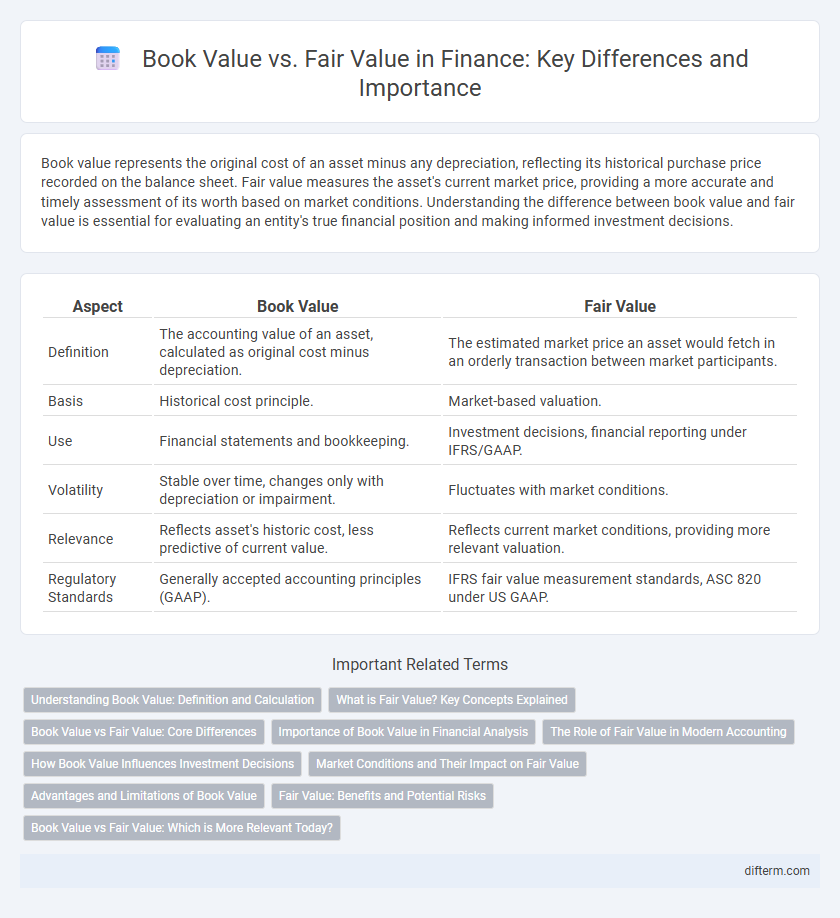

Book value represents the original cost of an asset minus any depreciation, reflecting its historical purchase price recorded on the balance sheet. Fair value measures the asset's current market price, providing a more accurate and timely assessment of its worth based on market conditions. Understanding the difference between book value and fair value is essential for evaluating an entity's true financial position and making informed investment decisions.

Table of Comparison

| Aspect | Book Value | Fair Value |

|---|---|---|

| Definition | The accounting value of an asset, calculated as original cost minus depreciation. | The estimated market price an asset would fetch in an orderly transaction between market participants. |

| Basis | Historical cost principle. | Market-based valuation. |

| Use | Financial statements and bookkeeping. | Investment decisions, financial reporting under IFRS/GAAP. |

| Volatility | Stable over time, changes only with depreciation or impairment. | Fluctuates with market conditions. |

| Relevance | Reflects asset's historic cost, less predictive of current value. | Reflects current market conditions, providing more relevant valuation. |

| Regulatory Standards | Generally accepted accounting principles (GAAP). | IFRS fair value measurement standards, ASC 820 under US GAAP. |

Understanding Book Value: Definition and Calculation

Book value represents the net asset value of a company calculated by subtracting total liabilities from total assets on the balance sheet. It reflects the historical cost of an asset less accumulated depreciation, amortization, or impairment costs, providing a baseline measure of intrinsic value. Investors use book value to assess whether a stock is undervalued or overvalued compared to its market price.

What is Fair Value? Key Concepts Explained

Fair value represents the estimated price at which an asset could be exchanged between knowledgeable, willing parties in an arm's length transaction. It reflects current market conditions and considers factors like liquidity, market demand, and potential risks, differing from book value which is based on historical costs minus depreciation. Key concepts include market participant assumptions, exit price perspective, and the use of observable inputs from active markets to ensure accuracy and relevance in financial reporting.

Book Value vs Fair Value: Core Differences

Book value represents the original cost of an asset minus accumulated depreciation, reflecting its historical accounting value on the balance sheet. Fair value indicates the current market price at which the asset could be sold, providing a more accurate and up-to-date valuation based on market conditions. The core difference lies in book value's reliance on historical costs versus fair value's emphasis on real-time market data, impacting financial analysis and reporting transparency.

Importance of Book Value in Financial Analysis

Book value provides a tangible measure of a company's net asset value by subtracting liabilities from total assets, serving as a foundation for assessing financial health and stability. Investors and analysts rely on book value to gauge the intrinsic worth of a company relative to its market price, enabling more informed decisions on undervalued or overvalued stocks. Despite market fluctuations affecting fair value, book value remains a critical baseline metric in financial analysis for evaluating long-term investment potential and solvency.

The Role of Fair Value in Modern Accounting

Fair value plays a critical role in modern accounting by providing a realistic and timely measure of an asset's current market value, which enhances the accuracy of financial statements. Unlike book value, which is based on historical cost and may become outdated, fair value reflects real-time market conditions and investors' perceptions. This approach facilitates better decision-making for stakeholders by capturing economic fluctuations and improving transparency in financial reporting.

How Book Value Influences Investment Decisions

Book value represents the net asset value of a company according to its balance sheet, providing a baseline for assessing financial health and stability. Investors use book value to identify undervalued stocks when the market price falls below book value, signaling potential investment opportunities. This metric influences decisions by highlighting the tangible worth of a company, helping investors gauge risk and make informed portfolio choices.

Market Conditions and Their Impact on Fair Value

Market conditions significantly influence fair value by reflecting current supply and demand dynamics, economic trends, and investor sentiment, which cause fluctuations in asset prices. Unlike book value, which is based on historical cost, fair value adjusts to real-time market data, providing a more accurate representation of an asset's worth during periods of volatility or economic change. This makes fair value a critical metric for financial reporting and investment decisions in dynamic markets.

Advantages and Limitations of Book Value

Book value represents the original cost of an asset minus accumulated depreciation, providing a reliable and objective measure based on historical data. Its advantages include stability, ease of calculation, and resistance to market fluctuations, making it useful for long-term financial analysis and balance sheet presentation. However, book value does not account for current market conditions or asset appreciation, limiting its relevance in assessing the true economic worth or fair value of an asset in dynamic markets.

Fair Value: Benefits and Potential Risks

Fair value provides a current market-based valuation that enhances transparency and relevance for investors and stakeholders, reflecting the true economic worth of assets and liabilities. Its benefits include improved decision-making accuracy and alignment with market conditions, aiding in risk assessment and financial reporting. Potential risks involve valuation subjectivity, increased volatility in financial statements, and reliance on estimates that may impact comparability and investor confidence.

Book Value vs Fair Value: Which is More Relevant Today?

Book value represents the original cost of an asset minus accumulated depreciation, reflecting its historical cost on financial statements, while fair value estimates the asset's current market price, providing a more accurate snapshot of its economic worth. In today's dynamic financial markets, fair value is often considered more relevant for investment decisions and financial reporting, as it captures real-time market conditions and potential risks. However, book value remains crucial for assessing a company's baseline net worth and financial stability over time.

Book Value vs Fair Value Infographic

difterm.com

difterm.com