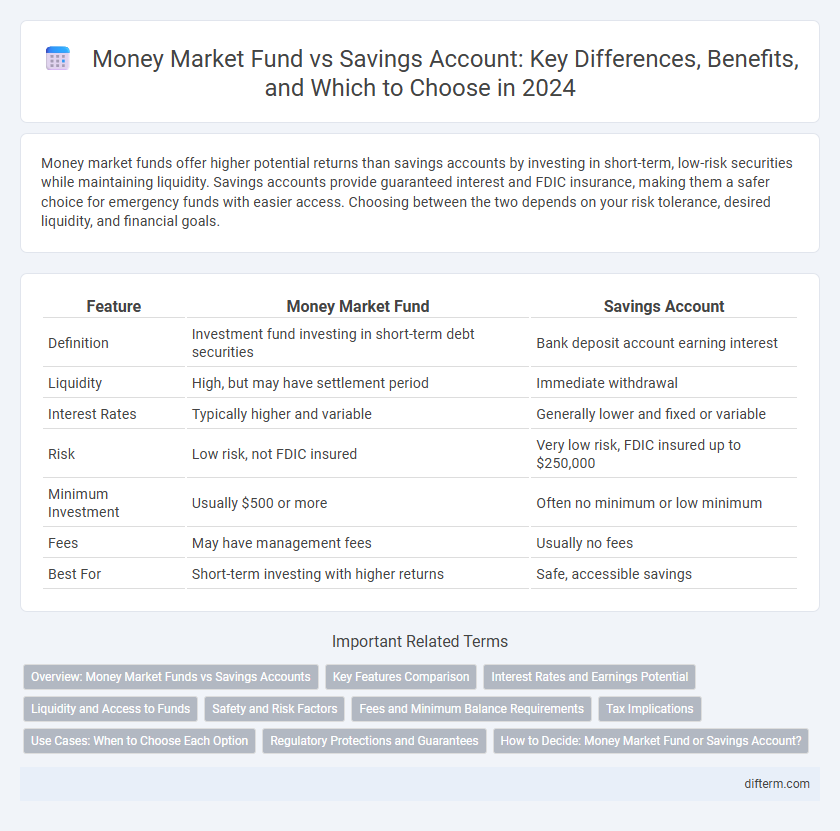

Money market funds offer higher potential returns than savings accounts by investing in short-term, low-risk securities while maintaining liquidity. Savings accounts provide guaranteed interest and FDIC insurance, making them a safer choice for emergency funds with easier access. Choosing between the two depends on your risk tolerance, desired liquidity, and financial goals.

Table of Comparison

| Feature | Money Market Fund | Savings Account |

|---|---|---|

| Definition | Investment fund investing in short-term debt securities | Bank deposit account earning interest |

| Liquidity | High, but may have settlement period | Immediate withdrawal |

| Interest Rates | Typically higher and variable | Generally lower and fixed or variable |

| Risk | Low risk, not FDIC insured | Very low risk, FDIC insured up to $250,000 |

| Minimum Investment | Usually $500 or more | Often no minimum or low minimum |

| Fees | May have management fees | Usually no fees |

| Best For | Short-term investing with higher returns | Safe, accessible savings |

Overview: Money Market Funds vs Savings Accounts

Money market funds invest in short-term, high-quality debt securities, offering potentially higher returns compared to traditional savings accounts. Savings accounts provide liquidity and federal insurance protection through the FDIC, making them a low-risk option for personal funds. Investors seeking a balance between accessibility and yield often evaluate interest rates, fees, and risk profiles when choosing between these two options.

Key Features Comparison

Money market funds typically offer higher interest rates than savings accounts due to investments in short-term, high-quality debt instruments such as Treasury bills and commercial paper. Savings accounts provide greater liquidity and FDIC insurance up to $250,000, ensuring principal protection, whereas money market funds carry minimal risk but are not federally insured. Expense ratios and minimum balance requirements are generally higher for money market funds, making savings accounts more accessible for everyday users.

Interest Rates and Earnings Potential

Money market funds typically offer higher interest rates than traditional savings accounts, attracting investors seeking better earnings potential. These funds invest in short-term debt securities, allowing for competitive yields that often outpace the modest rates provided by savings accounts. While savings accounts provide guaranteed returns with FDIC insurance, money market funds carry minimal risk but can fluctuate, potentially increasing overall earnings.

Liquidity and Access to Funds

Money market funds offer high liquidity with the ability to access funds quickly through check writing or electronic transfers, often providing more flexible withdrawal options than savings accounts. Savings accounts typically allow immediate access via ATM or branch withdrawals but may have limits on the number of monthly transactions. Both provide secure options for short-term cash management, but money market funds often yield higher returns while maintaining near-instant access to capital.

Safety and Risk Factors

Money market funds typically invest in low-risk, short-term debt instruments, offering higher returns than traditional savings accounts but with slightly increased exposure to market fluctuations. Savings accounts provide government-backed insurance, such as FDIC coverage up to $250,000, ensuring principal safety but usually yield lower interest rates. Investors prioritizing capital preservation and liquidity often prefer savings accounts, while those willing to accept minimal risk for potentially better returns may opt for money market funds.

Fees and Minimum Balance Requirements

Money market funds typically charge management fees ranging from 0.1% to 0.5% annually, while savings accounts usually have no fees but may impose monthly maintenance fees if a minimum balance is not maintained. Minimum balance requirements for money market funds often start at $1,000 or more, whereas savings accounts may require as little as $25 to avoid fees. Comparing these factors is crucial for optimizing returns and minimizing costs in short-term cash management strategies.

Tax Implications

Money market funds typically generate income taxable as ordinary dividends or capital gains, potentially subject to higher tax rates depending on the investor's bracket. Savings account interest is taxed as ordinary income, often reported on Form 1099-INT, and generally reflects lower returns compared to money market funds. Understanding the specific tax treatment and potential tax benefits, such as tax-exempt money market funds, is essential for optimizing after-tax investment returns.

Use Cases: When to Choose Each Option

Money market funds are ideal for investors seeking higher returns with moderate liquidity, suitable for short to medium-term goals or emergency funds needing quick access without risking principal. Savings accounts provide stability and FDIC insurance, making them preferable for conservative savers prioritizing capital preservation and immediate access to funds. Choosing between the two depends on risk tolerance, liquidity needs, and the desired balance between yield and safety.

Regulatory Protections and Guarantees

Money market funds are regulated under the Investment Company Act of 1940, offering a level of oversight but lack federal insurance, exposing investors to potential market risks. Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, providing strong protection against bank failures. This regulatory guarantee ensures principal safety in savings accounts, whereas money market funds rely on fund management and market conditions without explicit government backing.

How to Decide: Money Market Fund or Savings Account?

Evaluate liquidity needs and risk tolerance when deciding between a money market fund and a savings account; money market funds offer higher yields but come with investment risks, while savings accounts provide FDIC insurance and stable returns. Consider your short-term cash requirements, as savings accounts typically allow easier access without market fluctuations affecting principal. Analyze current interest rates, fees, and minimum balance requirements to select the option that maximizes both safety and growth based on your financial goals.

Money market fund vs savings account Infographic

difterm.com

difterm.com