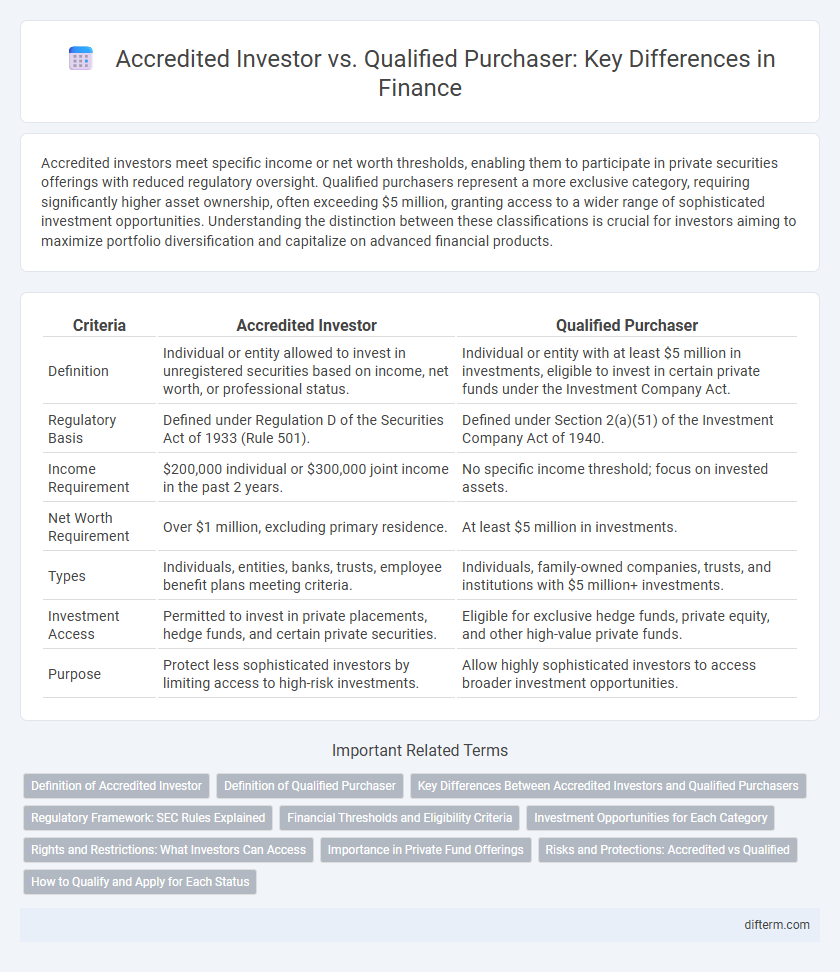

Accredited investors meet specific income or net worth thresholds, enabling them to participate in private securities offerings with reduced regulatory oversight. Qualified purchasers represent a more exclusive category, requiring significantly higher asset ownership, often exceeding $5 million, granting access to a wider range of sophisticated investment opportunities. Understanding the distinction between these classifications is crucial for investors aiming to maximize portfolio diversification and capitalize on advanced financial products.

Table of Comparison

| Criteria | Accredited Investor | Qualified Purchaser |

|---|---|---|

| Definition | Individual or entity allowed to invest in unregistered securities based on income, net worth, or professional status. | Individual or entity with at least $5 million in investments, eligible to invest in certain private funds under the Investment Company Act. |

| Regulatory Basis | Defined under Regulation D of the Securities Act of 1933 (Rule 501). | Defined under Section 2(a)(51) of the Investment Company Act of 1940. |

| Income Requirement | $200,000 individual or $300,000 joint income in the past 2 years. | No specific income threshold; focus on invested assets. |

| Net Worth Requirement | Over $1 million, excluding primary residence. | At least $5 million in investments. |

| Types | Individuals, entities, banks, trusts, employee benefit plans meeting criteria. | Individuals, family-owned companies, trusts, and institutions with $5 million+ investments. |

| Investment Access | Permitted to invest in private placements, hedge funds, and certain private securities. | Eligible for exclusive hedge funds, private equity, and other high-value private funds. |

| Purpose | Protect less sophisticated investors by limiting access to high-risk investments. | Allow highly sophisticated investors to access broader investment opportunities. |

Definition of Accredited Investor

An accredited investor is defined by the U.S. Securities and Exchange Commission (SEC) as an individual or entity meeting specific financial criteria, such as having a net worth exceeding $1 million excluding their primary residence or earning an annual income of over $200,000 individually or $300,000 jointly for the past two years. This status allows access to unregistered securities offerings and investment opportunities not available to the general public. Understanding the accredited investor criteria is essential for private placements and venture capital investments within the finance industry.

Definition of Qualified Purchaser

A Qualified Purchaser is an individual or entity that owns at least $5 million in investments, as defined under the Investment Company Act of 1940. This status grants access to private investment funds and securities offerings not available to non-qualified investors. Unlike Accredited Investors, Qualified Purchasers meet a higher net worth or asset threshold, reflecting greater financial sophistication and investment capability.

Key Differences Between Accredited Investors and Qualified Purchasers

Accredited investors are defined by the SEC based on income or net worth thresholds, such as having a net worth exceeding $1 million or an annual income over $200,000, allowing access to private investment opportunities. Qualified purchasers, a more exclusive category, must possess at least $5 million in investments, enabling participation in more complex and higher-risk private funds. The primary difference lies in the level of financial sophistication and wealth, with qualified purchasers subject to fewer regulatory protections due to their presumed greater investment experience.

Regulatory Framework: SEC Rules Explained

Accredited investors qualify under SEC Rule 501 of Regulation D by meeting income or net worth thresholds, such as having an annual income exceeding $200,000 or a net worth over $1 million excluding the primary residence. Qualified purchasers, defined in Section 2(a)(51) of the Investment Company Act of 1940, must own at least $5 million in investments, enabling access to a broader range of private funds. These regulatory frameworks establish investor eligibility, balancing investor protection with market access for sophisticated participants in private securities offerings.

Financial Thresholds and Eligibility Criteria

Accredited investors must meet specific financial thresholds, including an annual income exceeding $200,000 individually or $300,000 jointly, or having a net worth over $1 million excluding primary residence. Qualified purchasers face higher eligibility criteria, requiring at least $5 million in investments, emphasizing greater financial sophistication and investment capacity. These distinctions impact access to certain private investment opportunities and regulatory exemptions within the financial market.

Investment Opportunities for Each Category

Accredited investors gain access to private placements, hedge funds, and venture capital opportunities often restricted from the general public, enabling participation in high-risk, high-reward investments. Qualified purchasers, meeting higher financial thresholds, can invest in exclusive private funds, including certain hedge funds and pooled investment vehicles not available to accredited investors. These distinctions enhance diversification and potential returns by unlocking differentiated investment avenues tailored to each category's regulatory status.

Rights and Restrictions: What Investors Can Access

Accredited investors gain access to private placement investments, hedge funds, and venture capital funds exempt from SEC registration, enabling entry to exclusive offerings with fewer disclosure requirements. Qualified purchasers have broader rights, including the ability to invest in certain private investment funds with higher minimum thresholds, allowing access to more sophisticated and less regulated investment opportunities. The distinctions impose varying restrictions on fundraising exemptions and investor protection measures based on net worth, income, and investment sophistication criteria.

Importance in Private Fund Offerings

Accredited investors and qualified purchasers play crucial roles in private fund offerings by determining eligibility for investment and regulatory compliance. Accredited investors meet specific income or net worth thresholds, allowing broader participation in private placements under SEC Rule 501. Qualified purchasers represent a more exclusive category with higher asset requirements, enabling access to specialized private funds subject to less regulatory oversight.

Risks and Protections: Accredited vs Qualified

Accredited investors face fewer regulatory protections compared to qualified purchasers, who meet higher financial thresholds and thus gain access to more sophisticated, higher-risk investment opportunities. The increased net worth requirements for qualified purchasers often translate to enhanced risk tolerance but also greater scrutiny under securities laws to protect these investors from potential losses. While accredited status allows participation in private placements with limited oversight, qualified purchasers are typically subject to stricter disclosure standards and risk mitigation measures aimed at safeguarding substantial capital.

How to Qualify and Apply for Each Status

To qualify as an accredited investor, individuals must meet specific income thresholds such as earning at least $200,000 annually or possessing a net worth exceeding $1 million excluding their primary residence, and apply by submitting verification documents like tax returns or financial statements to the issuer or investment fund. Qualified purchasers require a higher asset threshold, typically owning at least $5 million in investments, with the application process involving detailed financial disclosures and certification by a registered investment adviser or legal counsel. Both statuses demand rigorous proof of financial sophistication to access specialized investment opportunities under SEC regulations.

Accredited investor vs Qualified purchaser Infographic

difterm.com

difterm.com