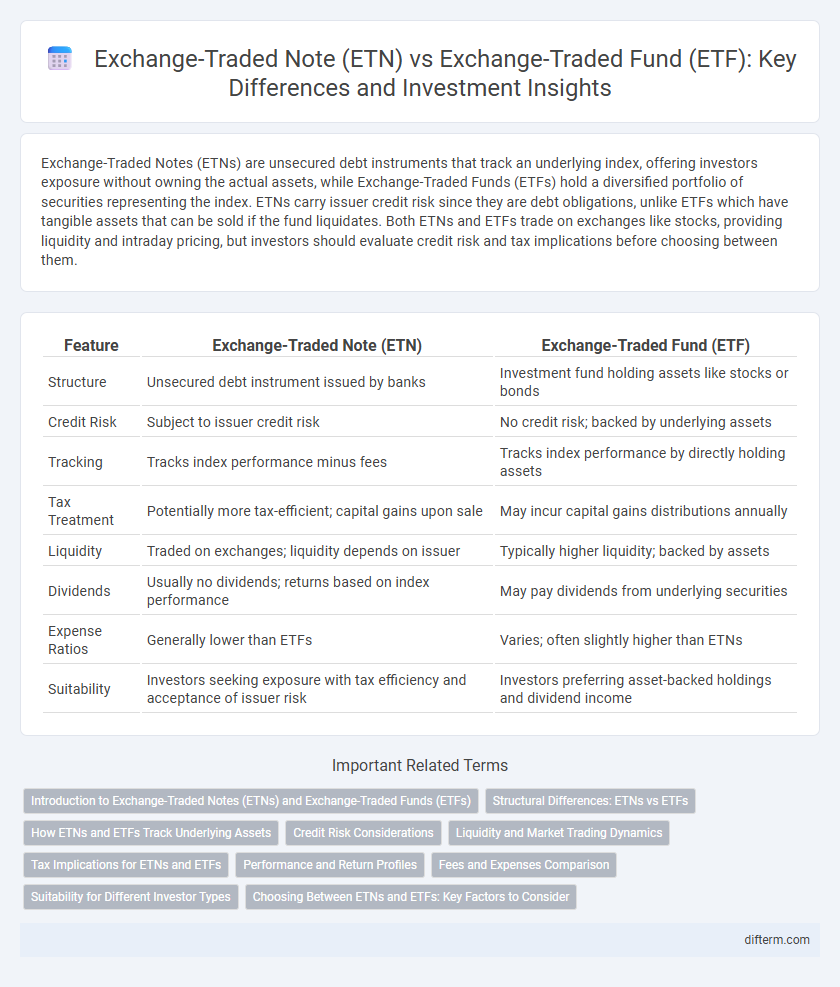

Exchange-Traded Notes (ETNs) are unsecured debt instruments that track an underlying index, offering investors exposure without owning the actual assets, while Exchange-Traded Funds (ETFs) hold a diversified portfolio of securities representing the index. ETNs carry issuer credit risk since they are debt obligations, unlike ETFs which have tangible assets that can be sold if the fund liquidates. Both ETNs and ETFs trade on exchanges like stocks, providing liquidity and intraday pricing, but investors should evaluate credit risk and tax implications before choosing between them.

Table of Comparison

| Feature | Exchange-Traded Note (ETN) | Exchange-Traded Fund (ETF) |

|---|---|---|

| Structure | Unsecured debt instrument issued by banks | Investment fund holding assets like stocks or bonds |

| Credit Risk | Subject to issuer credit risk | No credit risk; backed by underlying assets |

| Tracking | Tracks index performance minus fees | Tracks index performance by directly holding assets |

| Tax Treatment | Potentially more tax-efficient; capital gains upon sale | May incur capital gains distributions annually |

| Liquidity | Traded on exchanges; liquidity depends on issuer | Typically higher liquidity; backed by assets |

| Dividends | Usually no dividends; returns based on index performance | May pay dividends from underlying securities |

| Expense Ratios | Generally lower than ETFs | Varies; often slightly higher than ETNs |

| Suitability | Investors seeking exposure with tax efficiency and acceptance of issuer risk | Investors preferring asset-backed holdings and dividend income |

Introduction to Exchange-Traded Notes (ETNs) and Exchange-Traded Funds (ETFs)

Exchange-Traded Notes (ETNs) are unsecured debt securities issued by financial institutions that track the performance of a market index and are subject to the issuer's credit risk. Exchange-Traded Funds (ETFs) are investment funds that hold a diversified portfolio of assets, such as stocks or bonds, and trade on stock exchanges like individual shares. Unlike ETFs, ETNs do not hold underlying assets but offer investors exposure to index returns with potentially different tax treatment and liquidity characteristics.

Structural Differences: ETNs vs ETFs

Exchange-Traded Notes (ETNs) are unsecured debt securities issued by banks, whereas Exchange-Traded Funds (ETFs) are investment funds that hold a basket of assets like stocks or bonds. ETNs do not own underlying assets but promise returns linked to an index's performance, exposing investors to issuer credit risk, while ETFs provide direct ownership of underlying securities, reducing counterparty risk. The structural difference impacts liquidity, tax treatment, and risk profiles, with ETNs typically offering more precise index exposure but greater credit risk compared to the diversified, asset-backed nature of ETFs.

How ETNs and ETFs Track Underlying Assets

Exchange-Traded Notes (ETNs) are unsecured debt instruments issued by banks that track the performance of underlying assets through a promise to pay the return minus fees, without owning the assets directly. Exchange-Traded Funds (ETFs) are investment funds that physically hold or replicate baskets of securities to mirror the underlying index or asset's performance. Unlike ETFs, ETNs carry issuer credit risk since their value depends on the issuing bank's solvency, while ETFs' value is tied to the assets held within the fund.

Credit Risk Considerations

Exchange-Traded Notes (ETNs) carry issuer credit risk because they are unsecured debt obligations backed solely by the creditworthiness of the issuing bank, unlike Exchange-Traded Funds (ETFs) which hold a portfolio of assets providing collateral. Investors in ETNs face the risk of issuer default, potentially resulting in the loss of principal and accrued returns, whereas ETFs mitigate credit risk through diversified holdings of stocks, bonds, or commodities. Understanding the distinction between ETN credit exposure and ETF asset backing is crucial for managing investment risk within exchange-traded products.

Liquidity and Market Trading Dynamics

Exchange-Traded Notes (ETNs) often exhibit lower liquidity compared to Exchange-Traded Funds (ETFs) due to their structure as unsecured debt instruments, impacting bid-ask spreads and trading volumes. ETFs benefit from market maker mechanisms and creation/redemption processes, enhancing liquidity and enabling tighter spreads during market trading hours. Investors seeking intraday trading efficiency typically prefer ETFs for their higher liquidity and robust market dynamics.

Tax Implications for ETNs and ETFs

Exchange-Traded Notes (ETNs) are debt instruments that do not hold underlying assets, resulting in tax treatment of ETN gains as capital gains upon sale, often deferring taxes until liquidation. Exchange-Traded Funds (ETFs) generally offer better tax efficiency due to in-kind redemptions, minimizing capital gains distributions during the fund's operation. Investors in ETNs face potential issuer credit risk and taxable events upon early redemption, whereas ETF holders benefit from diversified asset ownership and usually incur taxes only when selling shares.

Performance and Return Profiles

Exchange-Traded Notes (ETNs) provide returns linked to the performance of an underlying index minus fees, exposing investors to issuer credit risk but often delivering precise tracking of complex strategies. Exchange-Traded Funds (ETFs) hold actual assets, offering dividend income and capital appreciation with typically lower credit risk, though tracking errors can occur due to management expenses and market dynamics. Investors seeking exact index replication favor ETNs, while those prioritizing asset-backed security and potential income may prefer ETFs for their historically stable return profiles.

Fees and Expenses Comparison

Exchange-Traded Notes (ETNs) typically have lower expense ratios than Exchange-Traded Funds (ETFs) due to their debt structure, avoiding management fees related to underlying assets. However, ETNs may incur bid-ask spreads and potential credit risk costs absent in ETFs, which passively track assets with transparent fees. Investors must weigh ETNs' lower ongoing fees against ETFs' operational expenses and underlying asset management for cost-effective portfolio diversification.

Suitability for Different Investor Types

Exchange-Traded Notes (ETNs) are more suitable for sophisticated investors comfortable with issuer credit risk and seeking specific market exposures without dividend payments. Exchange-Traded Funds (ETFs) attract a broader range of investors due to their diversification, lower risk profile, and regular income distributions. Conservative investors often prefer ETFs for long-term growth and income, while risk-tolerant investors may opt for ETNs to capitalize on niche strategies and tax efficiencies.

Choosing Between ETNs and ETFs: Key Factors to Consider

When choosing between Exchange-Traded Notes (ETNs) and Exchange-Traded Funds (ETFs), consider credit risk, as ETNs are unsecured debt obligations subject to issuer default risk, while ETFs hold underlying assets. Expense ratios and tax efficiency also play critical roles, with ETFs typically offering lower fees and more favorable tax treatment due to in-kind redemption processes. Liquidity and tracking accuracy should be evaluated, as ETFs often provide tighter bid-ask spreads and more precise index replication compared to ETNs.

Exchange-Traded Note vs Exchange-Traded Fund Infographic

difterm.com

difterm.com