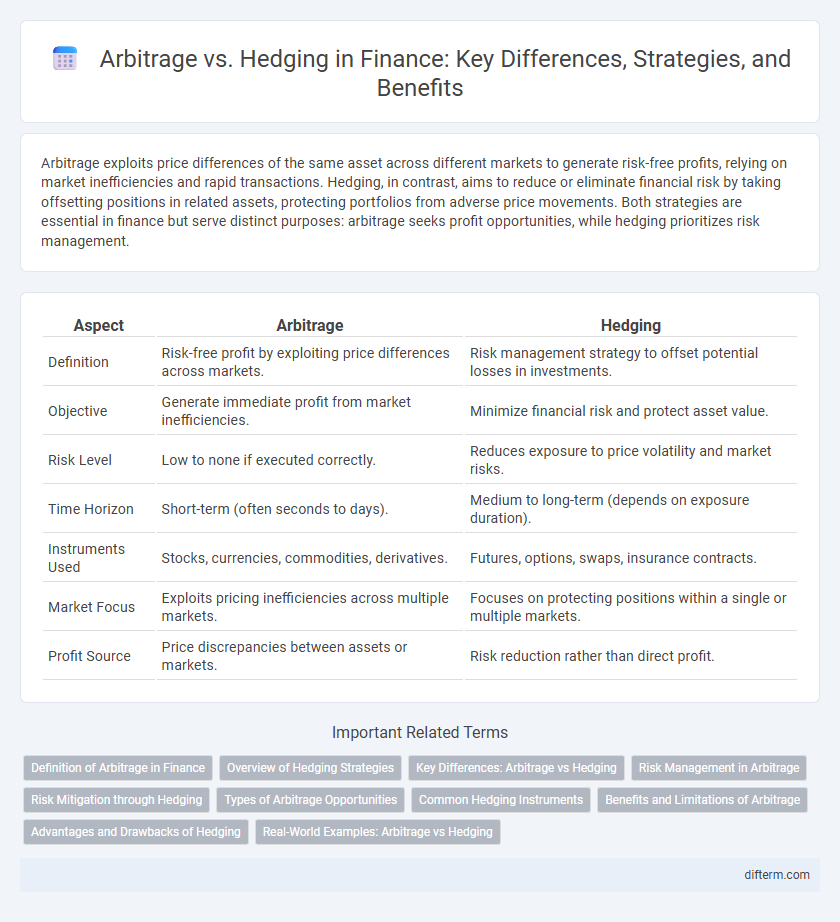

Arbitrage exploits price differences of the same asset across different markets to generate risk-free profits, relying on market inefficiencies and rapid transactions. Hedging, in contrast, aims to reduce or eliminate financial risk by taking offsetting positions in related assets, protecting portfolios from adverse price movements. Both strategies are essential in finance but serve distinct purposes: arbitrage seeks profit opportunities, while hedging prioritizes risk management.

Table of Comparison

| Aspect | Arbitrage | Hedging |

|---|---|---|

| Definition | Risk-free profit by exploiting price differences across markets. | Risk management strategy to offset potential losses in investments. |

| Objective | Generate immediate profit from market inefficiencies. | Minimize financial risk and protect asset value. |

| Risk Level | Low to none if executed correctly. | Reduces exposure to price volatility and market risks. |

| Time Horizon | Short-term (often seconds to days). | Medium to long-term (depends on exposure duration). |

| Instruments Used | Stocks, currencies, commodities, derivatives. | Futures, options, swaps, insurance contracts. |

| Market Focus | Exploits pricing inefficiencies across multiple markets. | Focuses on protecting positions within a single or multiple markets. |

| Profit Source | Price discrepancies between assets or markets. | Risk reduction rather than direct profit. |

Definition of Arbitrage in Finance

Arbitrage in finance refers to the simultaneous purchase and sale of an asset across different markets to exploit price discrepancies for risk-free profit. This practice capitalizes on market inefficiencies, ensuring prices converge and maintaining market equilibrium. Effective arbitrage requires quick execution and access to multiple trading platforms to identify and act on price differences instantaneously.

Overview of Hedging Strategies

Hedging strategies involve the use of financial instruments such as options, futures, and swaps to reduce or eliminate the risk of adverse price movements in assets. Companies and investors implement hedging to protect against fluctuations in currency exchange rates, interest rates, and commodity prices, thereby stabilizing cash flow and earnings. Effective hedging balances risk exposure while minimizing costs, ensuring more predictable financial outcomes.

Key Differences: Arbitrage vs Hedging

Arbitrage involves exploiting price discrepancies of identical assets across different markets to generate risk-free profits, whereas hedging aims to mitigate potential losses by taking offsetting positions in related securities. While arbitrage seeks immediate gains through market inefficiencies, hedging focuses on risk reduction over time by protecting against adverse price movements. Key differences include arbitrage's reliance on price convergence and hedging's role in portfolio insurance within financial risk management.

Risk Management in Arbitrage

Arbitrage in finance involves exploiting price discrepancies between markets to secure risk-free profits, while hedging focuses on minimizing potential losses by offsetting exposure. Risk management in arbitrage requires careful monitoring of market conditions, transaction costs, and timing to avoid unforeseen risks such as execution delays or liquidity constraints. Effective arbitrage strategies integrate quantitative models and real-time data analysis to ensure consistent returns while mitigating exposure to market volatility.

Risk Mitigation through Hedging

Hedging serves as a strategic risk mitigation tool by using financial instruments such as options, futures, and swaps to offset potential losses in an asset's value. Unlike arbitrage, which exploits price discrepancies for profit, hedging minimizes exposure to market volatility, interest rate fluctuations, and currency risks. Effective hedging strategies help protect portfolios from adverse movements, ensuring more stable financial performance and reduced uncertainty.

Types of Arbitrage Opportunities

Arbitrage opportunities in finance include spatial arbitrage, where traders exploit price differences of the same asset across different markets, and triangular arbitrage, which involves currency conversions among three currencies to profit from discrepancies. Statistical arbitrage uses complex algorithms and historical data to identify mispricings between securities, while merger arbitrage capitalizes on price inefficiencies during mergers and acquisitions. These diverse arbitrage strategies enable investors to achieve riskless profits by leveraging temporary market inefficiencies.

Common Hedging Instruments

Common hedging instruments in finance include futures contracts, options, and swaps, which help investors mitigate risks associated with price fluctuations and market volatility. These instruments provide a mechanism to lock in prices or rates, effectively managing exposure to currency, interest rate, and commodity risks. Unlike arbitrage, which exploits price discrepancies for profit, hedging focuses on risk reduction and portfolio protection.

Benefits and Limitations of Arbitrage

Arbitrage offers the benefit of risk-free profit by exploiting price discrepancies across different markets, enhancing market efficiency and liquidity. Its limitations include the requirement for significant capital, rapid execution to capitalize on fleeting opportunities, and exposure to execution risk or transaction costs that can erode gains. Despite these constraints, arbitrage plays a crucial role in correcting mispricings and maintaining price equilibrium in financial markets.

Advantages and Drawbacks of Hedging

Hedging offers significant advantages by minimizing potential losses in volatile markets, providing financial stability and risk management for portfolios and businesses. However, hedging can be costly due to premiums paid for derivatives like options and futures, which may reduce overall returns. Drawbacks also include the possibility of missed opportunities if markets move favorably, as hedging strategies often limit profit potential.

Real-World Examples: Arbitrage vs Hedging

Arbitrage in finance involves exploiting price differences of identical assets across different markets to achieve risk-free profits, exemplified by currency arbitrage where traders simultaneously buy a currency in one market and sell it in another. Hedging, by contrast, aims to reduce risk exposure, as demonstrated by airlines using fuel futures contracts to lock in prices and protect against volatile oil price fluctuations. While arbitrage seeks immediate gains from market inefficiencies, hedging focuses on long-term risk management through strategic financial instruments.

Arbitrage vs Hedging Infographic

difterm.com

difterm.com