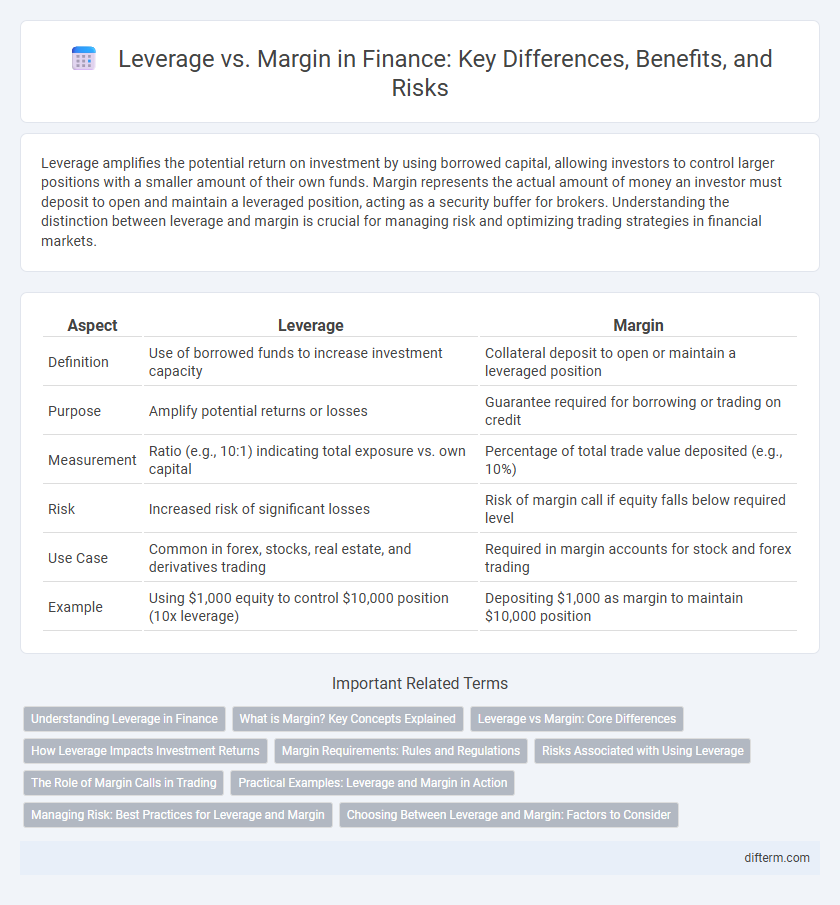

Leverage amplifies the potential return on investment by using borrowed capital, allowing investors to control larger positions with a smaller amount of their own funds. Margin represents the actual amount of money an investor must deposit to open and maintain a leveraged position, acting as a security buffer for brokers. Understanding the distinction between leverage and margin is crucial for managing risk and optimizing trading strategies in financial markets.

Table of Comparison

| Aspect | Leverage | Margin |

|---|---|---|

| Definition | Use of borrowed funds to increase investment capacity | Collateral deposit to open or maintain a leveraged position |

| Purpose | Amplify potential returns or losses | Guarantee required for borrowing or trading on credit |

| Measurement | Ratio (e.g., 10:1) indicating total exposure vs. own capital | Percentage of total trade value deposited (e.g., 10%) |

| Risk | Increased risk of significant losses | Risk of margin call if equity falls below required level |

| Use Case | Common in forex, stocks, real estate, and derivatives trading | Required in margin accounts for stock and forex trading |

| Example | Using $1,000 equity to control $10,000 position (10x leverage) | Depositing $1,000 as margin to maintain $10,000 position |

Understanding Leverage in Finance

Leverage in finance refers to the use of borrowed funds to increase the potential return of an investment, amplifying both gains and losses. It is commonly expressed as a ratio, such as 5:1, indicating the amount of debt used relative to equity. Effective leverage management is critical for investors and companies to optimize capital efficiency while controlling financial risk.

What is Margin? Key Concepts Explained

Margin refers to the collateral or funds that an investor must deposit with a broker to open and maintain a leveraged trading position. It acts as a security deposit that enables traders to control larger positions than their actual capital, amplifying both potential gains and losses. Understanding margin requirements, maintenance margin, and margin calls is crucial for managing risk effectively in leveraged financial markets.

Leverage vs Margin: Core Differences

Leverage amplifies the potential return on investment by using borrowed capital, while margin represents the actual amount of equity an investor must deposit to open a leveraged position. Leverage is expressed as a ratio (e.g., 5:1), indicating how much exposure is gained per unit of invested capital, whereas margin is typically a percentage of the total trade value required to maintain that position. Understanding the distinction is critical for managing risk, as leverage increases both potential gains and losses, while margin acts as a buffer to cover those positions.

How Leverage Impacts Investment Returns

Leverage amplifies investment returns by allowing investors to control larger positions with a smaller amount of capital, increasing both potential gains and risks. In contrast, margin is the actual borrowed amount or collateral required to access leverage in trading accounts. While leverage can magnify profits, it also escalates losses proportionally, making risk management essential for leveraged investments.

Margin Requirements: Rules and Regulations

Margin requirements are regulatory mandates that specify the minimum amount of equity investors must maintain when borrowing funds to trade securities. The Financial Industry Regulatory Authority (FINRA) enforces a standard initial margin requirement of 50%, while maintenance margin levels typically range from 25% to 30%, ensuring investors retain sufficient collateral to cover potential losses. Non-compliance with these rules triggers margin calls, compelling traders to deposit additional funds or liquidate positions to meet regulatory standards.

Risks Associated with Using Leverage

Leverage amplifies both potential gains and losses by increasing exposure to market movements using borrowed funds, which can lead to rapid financial distress if markets move against the position. Margin requirements mandate maintaining a minimum account balance; failure to meet margin calls triggers forced liquidation of assets, escalating losses. High leverage ratios significantly intensify risk, making risk management strategies like stop-loss orders essential to mitigate potential catastrophic financial outcomes.

The Role of Margin Calls in Trading

Margin calls play a crucial role in leveraged trading by requiring investors to deposit additional funds or liquidate positions when their account equity falls below the maintenance margin. This mechanism helps brokers manage risk by ensuring traders maintain sufficient collateral to cover potential losses from leveraged positions. Failure to meet margin calls can result in forced liquidation, amplifying losses and impacting overall trading strategies in financial markets.

Practical Examples: Leverage and Margin in Action

Leverage amplifies trading positions by allowing investors to control larger amounts of assets with a smaller capital base, such as using 10:1 leverage to trade $10,000 worth of stock with only $1,000. Margin represents the actual funds required to open and maintain these leveraged positions, exemplified when a trader deposits $500 as initial margin to borrow $4,500 for a $5,000 forex position. Practical application of leverage and margin enables traders to maximize potential returns but also increases exposure to significant losses if market movements are unfavorable.

Managing Risk: Best Practices for Leverage and Margin

Effective management of leverage and margin is essential to mitigate financial risks in trading and investment. Traders should establish strict stop-loss orders and maintain adequate margin to avoid margin calls and potential liquidation. Regularly monitoring market volatility and adjusting leverage ratios accordingly helps protect capital and sustain long-term portfolio growth.

Choosing Between Leverage and Margin: Factors to Consider

Choosing between leverage and margin depends on your risk tolerance, investment goals, and market volatility. Leverage amplifies potential gains and losses by borrowing capital, while margin involves using existing funds as collateral for trades. Assessing interest costs, margin requirements, and your ability to manage margin calls is essential for selecting the appropriate strategy in trading or investing.

Leverage vs Margin Infographic

difterm.com

difterm.com