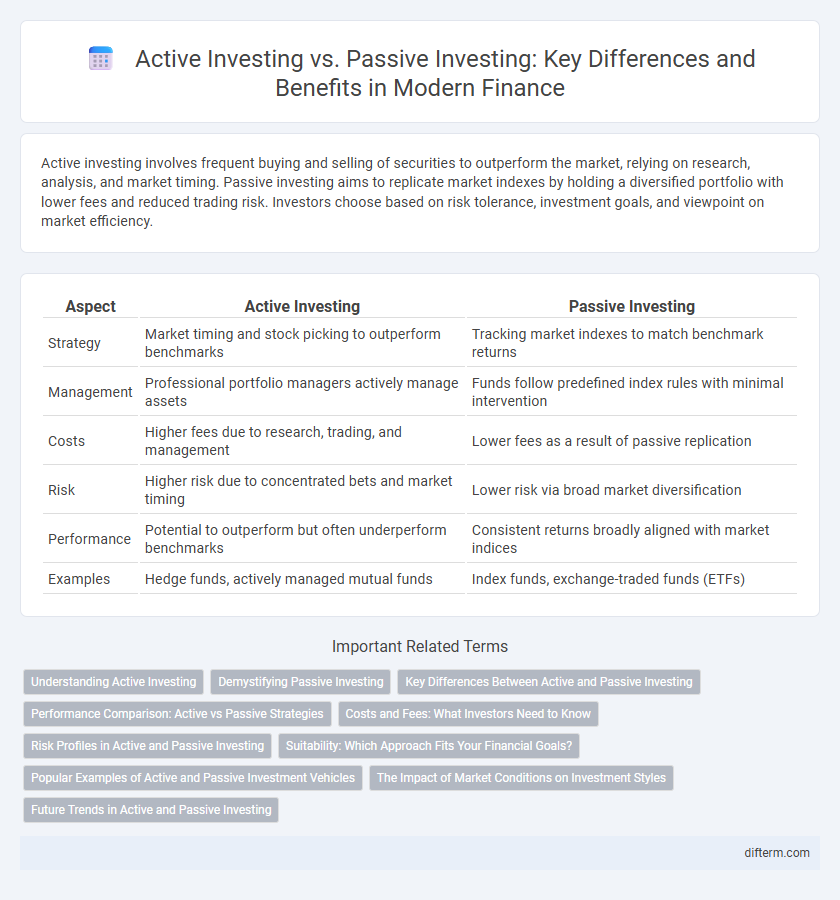

Active investing involves frequent buying and selling of securities to outperform the market, relying on research, analysis, and market timing. Passive investing aims to replicate market indexes by holding a diversified portfolio with lower fees and reduced trading risk. Investors choose based on risk tolerance, investment goals, and viewpoint on market efficiency.

Table of Comparison

| Aspect | Active Investing | Passive Investing |

|---|---|---|

| Strategy | Market timing and stock picking to outperform benchmarks | Tracking market indexes to match benchmark returns |

| Management | Professional portfolio managers actively manage assets | Funds follow predefined index rules with minimal intervention |

| Costs | Higher fees due to research, trading, and management | Lower fees as a result of passive replication |

| Risk | Higher risk due to concentrated bets and market timing | Lower risk via broad market diversification |

| Performance | Potential to outperform but often underperform benchmarks | Consistent returns broadly aligned with market indices |

| Examples | Hedge funds, actively managed mutual funds | Index funds, exchange-traded funds (ETFs) |

Understanding Active Investing

Active investing involves continuously analyzing and selecting securities to outperform market benchmarks by exploiting market inefficiencies. Portfolio managers use research, market forecasts, and timing strategies to buy undervalued assets and sell overvalued ones. This approach requires frequent trading and higher fees compared to passive investing, but aims to generate superior returns through skilled decision-making.

Demystifying Passive Investing

Passive investing focuses on replicating market indexes to minimize fees and reduce risk through broad diversification, relying on long-term market growth rather than individual stock selection. This strategy contrasts with active investing, where portfolio managers aim to outperform benchmarks by frequently buying and selling assets. Empirical data shows passive funds often deliver competitive returns with lower costs, making them particularly attractive for investors seeking simplicity and steady growth over time.

Key Differences Between Active and Passive Investing

Active investing involves frequent buying and selling of securities to outperform the market through expert stock selection and market timing, often resulting in higher fees due to active management. Passive investing, on the other hand, aims to replicate the performance of a market index using strategies like index funds or ETFs, offering lower costs and reduced transaction frequency. The key differences lie in management style, cost structure, risk levels, and potential for returns relative to market benchmarks.

Performance Comparison: Active vs Passive Strategies

Active investing aims to outperform benchmarks through stock picking and market timing, but often incurs higher fees and increased risk. Passive investing tracks market indices with lower costs, typically delivering returns closely aligned with overall market performance. Numerous studies show that over long-term horizons, passive strategies frequently outperform active management after accounting for fees.

Costs and Fees: What Investors Need to Know

Active investing often incurs higher costs and fees due to frequent trading, management expenses, and performance-based charges, which can erode overall returns. Passive investing typically involves lower fees as it tracks market indices with minimal trading and management intervention. Investors should carefully evaluate expense ratios, transaction costs, and tax implications when choosing between active and passive strategies to optimize net gains.

Risk Profiles in Active and Passive Investing

Active investing typically carries higher risk due to frequent trading and market timing aimed at outperforming benchmarks, exposing investors to potential volatility and market anomalies. Passive investing generally involves lower risk by tracking market indices with diversified holdings and minimal trading, reducing exposure to individual asset volatility. Risk tolerance levels should guide investors in choosing between the aggressive strategies of active investing and the steady, long-term approach of passive investing.

Suitability: Which Approach Fits Your Financial Goals?

Active investing suits investors seeking to outperform the market by leveraging research, analysis, and market timing, often requiring higher risk tolerance and time commitment. Passive investing aligns with those prioritizing lower fees, long-term growth, and diversified exposure through index funds or ETFs, minimizing trading activity. Evaluating investment horizon, risk appetite, and financial objectives determines which approach best fits your portfolio strategy.

Popular Examples of Active and Passive Investment Vehicles

Mutual funds and hedge funds represent popular examples of active investing vehicles, where fund managers actively select securities to outperform the market. Exchange-traded funds (ETFs) and index funds exemplify passive investing, tracking specific market indices to replicate performance with lower fees. These investment options cater to different risk tolerances and financial goals, influencing portfolio diversification strategies.

The Impact of Market Conditions on Investment Styles

Market conditions significantly influence the performance of active and passive investing strategies, with active investing often thriving in volatile or inefficient markets where skilled managers can exploit pricing anomalies. Passive investing tends to outperform during stable, efficient market conditions due to lower costs and broad market exposure. Understanding the cyclical nature of markets helps investors determine when active management may add value versus when passive strategies provide optimal risk-adjusted returns.

Future Trends in Active and Passive Investing

Emerging technologies like artificial intelligence and machine learning are reshaping active investing by enabling more precise market predictions and real-time portfolio adjustments. Passive investing is evolving with the integration of ESG criteria and thematic ETFs, responding to growing investor demand for sustainability and targeted exposure. Hybrid strategies combining elements of both active and passive approaches are gaining traction, reflecting a trend toward more personalized and adaptive investment solutions.

Active Investing vs Passive Investing Infographic

difterm.com

difterm.com