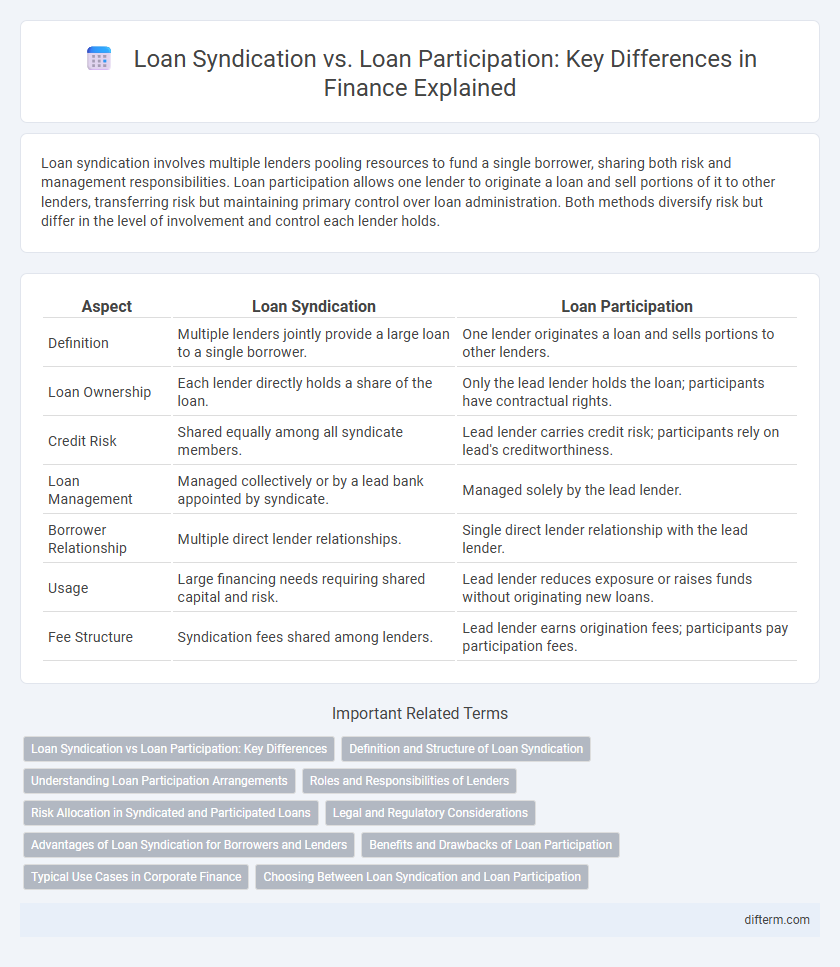

Loan syndication involves multiple lenders pooling resources to fund a single borrower, sharing both risk and management responsibilities. Loan participation allows one lender to originate a loan and sell portions of it to other lenders, transferring risk but maintaining primary control over loan administration. Both methods diversify risk but differ in the level of involvement and control each lender holds.

Table of Comparison

| Aspect | Loan Syndication | Loan Participation |

|---|---|---|

| Definition | Multiple lenders jointly provide a large loan to a single borrower. | One lender originates a loan and sells portions to other lenders. |

| Loan Ownership | Each lender directly holds a share of the loan. | Only the lead lender holds the loan; participants have contractual rights. |

| Credit Risk | Shared equally among all syndicate members. | Lead lender carries credit risk; participants rely on lead's creditworthiness. |

| Loan Management | Managed collectively or by a lead bank appointed by syndicate. | Managed solely by the lead lender. |

| Borrower Relationship | Multiple direct lender relationships. | Single direct lender relationship with the lead lender. |

| Usage | Large financing needs requiring shared capital and risk. | Lead lender reduces exposure or raises funds without originating new loans. |

| Fee Structure | Syndication fees shared among lenders. | Lead lender earns origination fees; participants pay participation fees. |

Loan Syndication vs Loan Participation: Key Differences

Loan syndication involves a group of lenders collectively providing a large loan to a single borrower, sharing the risk and loan management responsibilities, while loan participation occurs when one lender sells portions of an existing loan to other investors without altering the original loan agreement. In loan syndication, all participating lenders have direct contractual relationships with the borrower; conversely, loan participation participants interact primarily with the originating lender, not the borrower. Key differences include the level of borrower-lender interaction, risk distribution, and administrative roles, with syndication resulting in multiple contracts and participation typically featuring a single contract between borrower and lead lender.

Definition and Structure of Loan Syndication

Loan syndication involves a group of lenders collaborating to provide a large loan to a single borrower, where one lead bank structures and manages the loan while distributing portions of the credit risk among participants. This structured arrangement typically features a lead arranger or agent responsible for coordinating due diligence, documentation, and servicing, ensuring efficient capital allocation and risk sharing. Syndicated loans enable borrowers to access substantial funding amounts that exceed the capacity of individual lenders, optimizing liquidity and diversifying risk across multiple financial institutions.

Understanding Loan Participation Arrangements

Loan participation arrangements involve multiple lenders sharing portions of a single loan, allowing the lead bank to distribute risk without creating separate loans. Each participating institution holds an undivided interest in the loan, receiving proportional payments based on their share. This setup contrasts with loan syndication, where each lender issues a separate loan contract, making participation a flexible tool for risk management in financing large projects.

Roles and Responsibilities of Lenders

In loan syndication, the lead lender structures the loan, negotiates terms, and coordinates among multiple lenders who share the credit risk proportionally. Loan participants, however, primarily provide capital without direct involvement in loan administration or borrower monitoring, relying on the lead lender to manage these responsibilities. The lead lender retains the primary relationship with the borrower, manages disbursements, and enforces covenant compliance, ensuring coordinated risk management across the syndicate.

Risk Allocation in Syndicated and Participated Loans

Loan syndication distributes credit risk among multiple lenders by structuring a single loan agreement where each lender holds a portion of the loan, ensuring shared responsibility and collective monitoring. In contrast, loan participation involves one lead lender originating the loan and selling portions to participant lenders, with credit risk primarily borne by the originator who manages the borrower relationship. Syndicated loans offer more transparent risk allocation and shared control, while participated loans entail greater reliance on the lead lender's credit assessment and administration.

Legal and Regulatory Considerations

Loan syndication involves a lead bank underwriting and distributing portions of a loan to multiple lenders, requiring adherence to regulatory guidelines such as the Dodd-Frank Act and Basel III standards to ensure proper risk management and disclosure. Loan participation, where a bank sells portions of an existing loan to participants without changing the loan agreement, must comply with securities laws and participant eligibility rules to avoid regulatory violations. Both structures demand thorough legal documentation and due diligence to manage liability and ensure regulatory compliance across jurisdictions.

Advantages of Loan Syndication for Borrowers and Lenders

Loan syndication offers borrowers access to larger capital amounts by pooling funds from multiple lenders, reducing individual risk exposure and enhancing financing flexibility. For lenders, syndication diversifies risk across institutions while enabling participation in high-profile deals without overcommitting capital. This collective approach improves credit assessment efficiency, strengthens borrower relationships, and facilitates market entry for both emerging and established financial entities.

Benefits and Drawbacks of Loan Participation

Loan participation allows multiple lenders to share the risk of a single loan by purchasing portions of the loan from the lead lender, enhancing portfolio diversification and liquidity. Benefits include reduced credit exposure for participating lenders and streamlined access to large loan opportunities without direct borrower management. Drawbacks involve limited control over loan terms, dependency on the lead lender's servicing, and potential conflicts in decision-making during loan restructuring or defaults.

Typical Use Cases in Corporate Finance

Loan syndication is typically used by corporations seeking large-scale financing that exceeds a single lender's risk appetite, allowing multiple banks to share the exposure and provide substantial capital. Loan participation is common when a lender wants to mitigate risk by selling portions of an existing loan to other financial institutions without initiating a new loan agreement. Corporations often prefer syndication for initial large financings, while participation is favored for secondary market transactions and portfolio risk management.

Choosing Between Loan Syndication and Loan Participation

Choosing between loan syndication and loan participation hinges on risk distribution and control preferences. Loan syndication involves multiple lenders jointly underwriting a loan, offering shared risk and direct borrower relationships, while loan participation allows one lender to originate the loan and sell portions to participants, minimizing operational involvement. Evaluating factors like credit exposure, administrative responsibilities, and borrower engagement helps institutions determine the optimal structure for portfolio diversification and regulatory compliance.

Loan Syndication vs Loan Participation Infographic

difterm.com

difterm.com