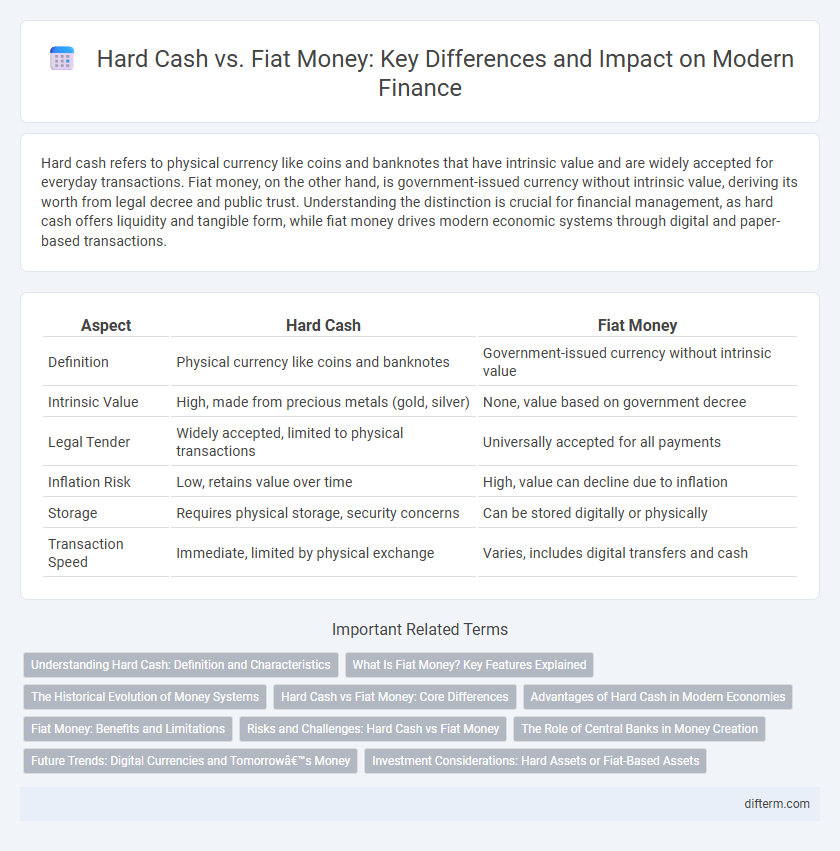

Hard cash refers to physical currency like coins and banknotes that have intrinsic value and are widely accepted for everyday transactions. Fiat money, on the other hand, is government-issued currency without intrinsic value, deriving its worth from legal decree and public trust. Understanding the distinction is crucial for financial management, as hard cash offers liquidity and tangible form, while fiat money drives modern economic systems through digital and paper-based transactions.

Table of Comparison

| Aspect | Hard Cash | Fiat Money |

|---|---|---|

| Definition | Physical currency like coins and banknotes | Government-issued currency without intrinsic value |

| Intrinsic Value | High, made from precious metals (gold, silver) | None, value based on government decree |

| Legal Tender | Widely accepted, limited to physical transactions | Universally accepted for all payments |

| Inflation Risk | Low, retains value over time | High, value can decline due to inflation |

| Storage | Requires physical storage, security concerns | Can be stored digitally or physically |

| Transaction Speed | Immediate, limited by physical exchange | Varies, includes digital transfers and cash |

Understanding Hard Cash: Definition and Characteristics

Hard cash refers to physical currency such as coins and banknotes that hold intrinsic value and are widely accepted for transactions without reliance on electronic systems. Unlike fiat money, which is government-issued currency backed by legal decree rather than physical commodities, hard cash provides tangible liquidity and immediate settlement. Key characteristics include durability, portability, divisibility, and universal acceptance within a given economy.

What Is Fiat Money? Key Features Explained

Fiat money is government-issued currency that lacks intrinsic value and is not backed by a physical commodity like gold or silver, deriving its worth solely from government decree and public trust. Key features include its status as legal tender mandated for all financial transactions, its unlimited supply controlled by central banks through monetary policies, and its susceptibility to inflation, which can erode purchasing power over time. Unlike hard cash, which refers to physical currency such as coins and banknotes, fiat money encompasses both physical forms and digital balances maintained by financial institutions.

The Historical Evolution of Money Systems

The historical evolution of money systems shows a transition from hard cash, typically represented by precious metals like gold and silver, to fiat money, which is government-issued currency not backed by physical commodities. Ancient economies relied heavily on hard cash due to its intrinsic value and portability, while modern financial systems embrace fiat money to enable flexible monetary policies and economic growth. This shift has transformed global finance, allowing central banks to regulate money supply and stabilize economies more effectively.

Hard Cash vs Fiat Money: Core Differences

Hard cash refers to physical currency such as coins and banknotes issued by government authorities, retaining intrinsic or face value, whereas fiat money is government-issued currency without intrinsic value, relying solely on trust and legal decree for its worth. Hard cash transactions offer immediate liquidity and privacy without reliance on electronic systems, while fiat money primarily circulates through digital banking infrastructures with regulatory oversight. The core difference lies in tangibility and value backing: hard cash is tangible and universally accepted for immediate exchange, whereas fiat money's value emanates from government regulation and economic stability.

Advantages of Hard Cash in Modern Economies

Hard cash offers distinct advantages in modern economies by providing immediate liquidity and universal acceptance without the need for digital infrastructure. It enables privacy in transactions, protecting users from data breaches and surveillance commonly associated with electronic payments. Furthermore, hard cash is resilient during electronic system failures, ensuring continuous economic activity in crises or power outages.

Fiat Money: Benefits and Limitations

Fiat money, issued and regulated by governments, offers the benefit of widespread acceptance and stability, facilitating efficient economic transactions and monetary policy implementation. Its value relies on trust and legal mandates rather than intrinsic worth, allowing central banks to control inflation and supply. However, fiat currency can be subject to inflationary pressures and devaluation, affecting purchasing power and creating risks in unstable economic environments.

Risks and Challenges: Hard Cash vs Fiat Money

Hard cash faces risks such as theft, loss, and physical damage, which can impact liquidity and security. Fiat money, while more convenient for digital transactions, is vulnerable to inflation, central bank policies, and potential digital fraud. Both forms carry distinct challenges; hard cash lacks traceability, whereas fiat money depends heavily on financial system stability and regulatory frameworks.

The Role of Central Banks in Money Creation

Central banks play a pivotal role in the creation of fiat money by controlling monetary policy and regulating the money supply through mechanisms like open market operations and setting reserve requirements. Unlike hard cash, which is physical currency with intrinsic value, fiat money derives its value from government decree and central bank authority, allowing for flexible economic management. This distinction enables central banks to influence inflation, interest rates, and liquidity in the financial system effectively.

Future Trends: Digital Currencies and Tomorrow’s Money

Future trends in finance emphasize the transition from traditional hard cash and fiat money to digital currencies, driven by blockchain technology and central bank digital currencies (CBDCs). Digital currencies offer enhanced security, faster transactions, and global accessibility, which are reshaping monetary policies and financial systems worldwide. The increasing adoption of cryptocurrencies and CBDCs signals a move towards a predominantly digital financial ecosystem, reducing reliance on physical cash and transforming future economic exchanges.

Investment Considerations: Hard Assets or Fiat-Based Assets

Hard cash, such as physical gold or silver, offers intrinsic value and protection against currency inflation, making it a stable investment during economic volatility. Fiat-based assets, including stocks and bonds, provide greater liquidity and potential for growth but are susceptible to inflation and government monetary policies. Investors must balance the security of hard assets with the flexibility and return potential of fiat-denominated financial instruments based on their risk tolerance and market outlook.

Hard Cash vs Fiat Money Infographic

difterm.com

difterm.com