EBITDA measures a company's profitability by excluding interest, taxes, depreciation, and amortization, providing insight into operational efficiency and cash flow potential. EBIT accounts for depreciation and amortization, offering a clearer picture of operating income and asset utilization. Comparing EBITDA versus EBIT helps investors evaluate a firm's core performance versus the impact of non-cash expenses on its earnings.

Table of Comparison

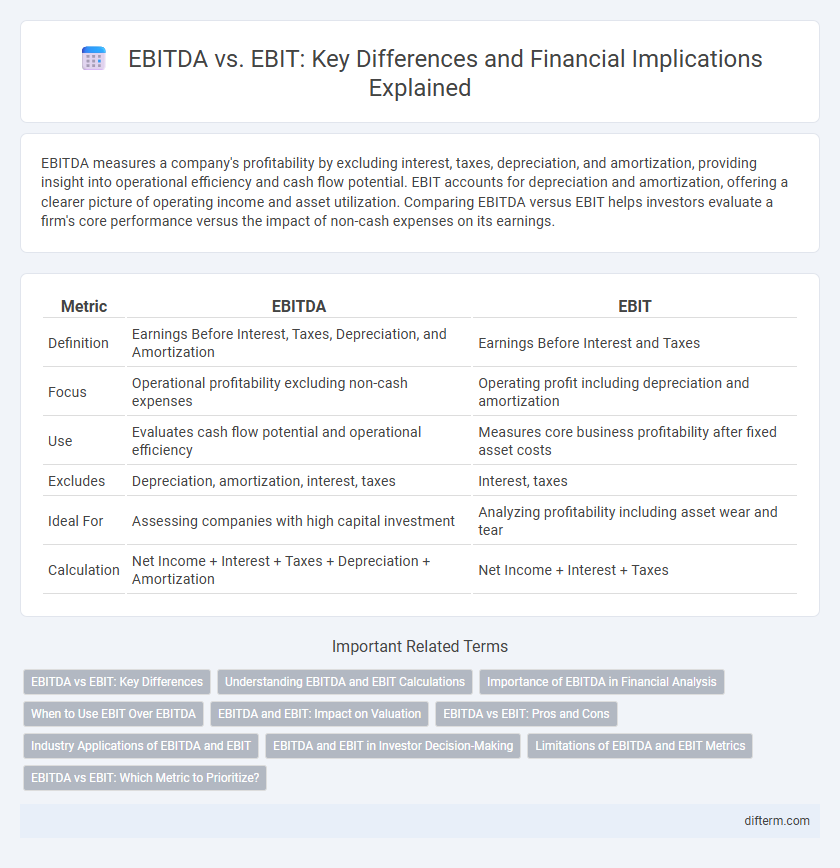

| Metric | EBITDA | EBIT |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Earnings Before Interest and Taxes |

| Focus | Operational profitability excluding non-cash expenses | Operating profit including depreciation and amortization |

| Use | Evaluates cash flow potential and operational efficiency | Measures core business profitability after fixed asset costs |

| Excludes | Depreciation, amortization, interest, taxes | Interest, taxes |

| Ideal For | Assessing companies with high capital investment | Analyzing profitability including asset wear and tear |

| Calculation | Net Income + Interest + Taxes + Depreciation + Amortization | Net Income + Interest + Taxes |

EBITDA vs EBIT: Key Differences

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) excludes non-cash expenses like depreciation and amortization, providing a clearer picture of operational cash flow than EBIT (Earnings Before Interest and Taxes). EBIT accounts for depreciation and amortization, reflecting the impact of capital expenditures on profitability and offering insight into core operating performance. Comparing EBITDA and EBIT helps investors evaluate cash-generating ability versus profitability after accounting for asset wear and tear.

Understanding EBITDA and EBIT Calculations

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-cash expenses like depreciation and amortization, providing a clearer view of cash flow potential. EBIT (Earnings Before Interest and Taxes) includes depreciation and amortization, reflecting the operating profit after accounting for asset wear and tear. Comparing EBITDA and EBIT helps investors evaluate operational efficiency and profitability, while understanding how non-cash expenses impact financial results.

Importance of EBITDA in Financial Analysis

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is crucial in financial analysis as it provides a clear view of a company's operational profitability by excluding non-cash expenses and financial structuring effects. Unlike EBIT, which includes depreciation and amortization, EBITDA offers a more standardized measure to compare performance across industries and companies with different capital investments. Investors and analysts rely on EBITDA to assess cash flow generation potential and operational efficiency before accounting for accounting and financing decisions.

When to Use EBIT Over EBITDA

EBIT is preferred over EBITDA when assessing companies with significant capital expenditures or depreciation costs, as it accounts for those expenses and provides a clearer picture of operating profitability. Investors and analysts use EBIT to evaluate operational efficiency without excluding the impact of non-cash charges that affect cash flow. EBIT offers better insight into companies in asset-heavy industries like manufacturing or utilities, where capital investments play a crucial role.

EBITDA and EBIT: Impact on Valuation

EBITDA and EBIT serve as critical metrics in financial valuation, with EBITDA reflecting earnings before interest, taxes, depreciation, and amortization, thus providing a clearer view of operational cash flow and profitability. EBITDA is favored in industries with significant non-cash expenses, as it offers a more standardized profitability measure by excluding depreciation and amortization, which can vary widely between companies. Conversely, EBIT includes depreciation and amortization, giving investors insight into the company's actual operating performance and asset utilization, which can impact valuation by highlighting capital expenditure intensity and long-term sustainability.

EBITDA vs EBIT: Pros and Cons

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, provides a clear view of a company's operational profitability by excluding non-cash expenses, making it useful for comparing companies with different capital structures. EBIT, or Earnings Before Interest and Taxes, accounts for depreciation and amortization, offering insight into the company's true profitability and asset utilization. EBITDA can overstate cash flow by ignoring capital expenditures, while EBIT offers a more conservative profitability measure but may understate operational performance by including non-cash charges.

Industry Applications of EBITDA and EBIT

EBITDA is widely utilized in industries with capital-intensive operations, such as manufacturing and telecommunications, to assess operational profitability by excluding depreciation and amortization. EBIT serves as a key metric in sectors like retail and services, providing insight into core earnings by including non-cash expenses that impact asset-heavy businesses. Both metrics help investors and analysts evaluate company performance, but EBITDA offers clearer cash flow visibility, while EBIT reflects true operational efficiency.

EBITDA and EBIT in Investor Decision-Making

EBITDA and EBIT are critical metrics for investor decision-making as they provide insights into a company's operating profitability and cash flow generation. EBITDA highlights earnings before interest, taxes, depreciation, and amortization, useful for comparing companies with different capital structures and depreciation policies. EBIT shows earnings before interest and taxes, reflecting a company's core operating performance after accounting for depreciation and amortization, enabling investors to assess operational efficiency and asset management.

Limitations of EBITDA and EBIT Metrics

EBITDA excludes depreciation and amortization, potentially overstating cash flow by ignoring capital expenditures and asset wear, which can mislead investors about a company's true profitability. EBIT includes these non-cash expenses but still overlooks financing costs and tax obligations, limiting its usefulness for assessing overall financial health. Both metrics fail to account for working capital changes and non-operating income, restricting their effectiveness in comprehensive performance evaluation.

EBITDA vs EBIT: Which Metric to Prioritize?

EBITDA and EBIT both measure corporate profitability but differ in scope; EBITDA excludes depreciation and amortization, highlighting operational cash flow, while EBIT includes these expenses, reflecting overall operating profitability. Prioritizing EBITDA suits industries with high capital expenditures for evaluating cash generation efficiency, whereas EBIT is preferable for assessing true operational performance including asset wear. Investors should consider industry characteristics and financial goals to determine which metric provides a clearer insight into company health.

EBITDA vs EBIT Infographic

difterm.com

difterm.com