The Discounted Cash Flow (DCF) model values a company based on its projected free cash flows, capturing overall profitability and growth potential. The Dividend Discount Model (DDM) focuses exclusively on expected dividend payments, making it ideal for firms with stable dividend policies. DCF provides a broader valuation framework, while DDM suits investors prioritizing income from dividends.

Table of Comparison

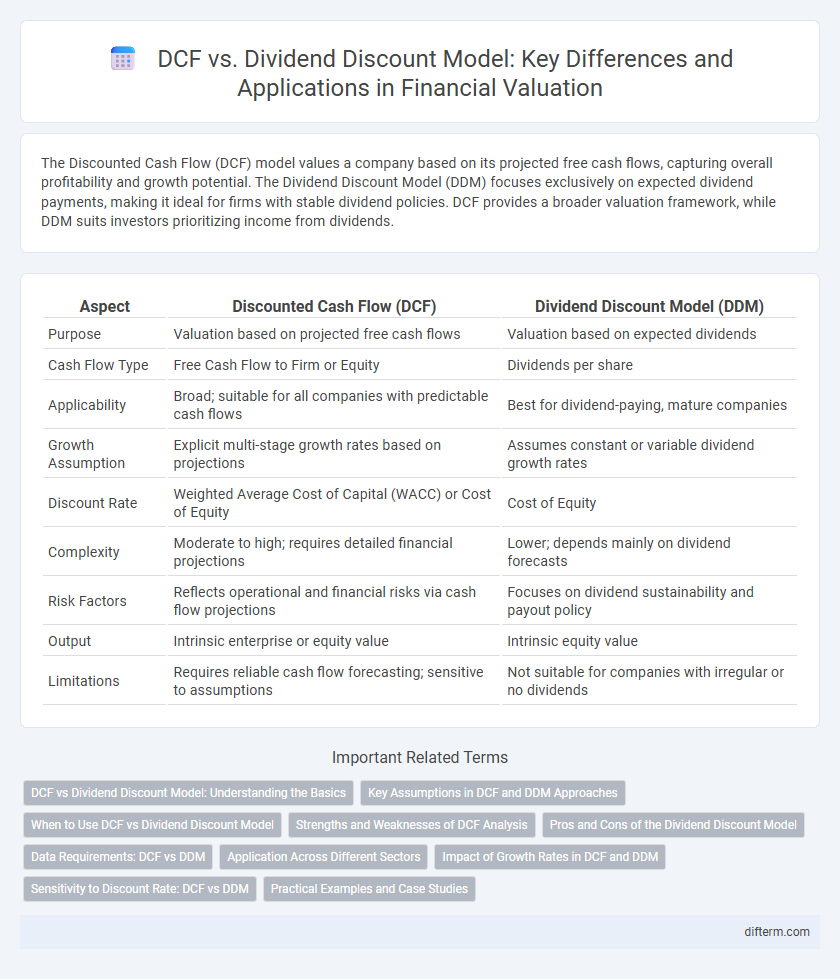

| Aspect | Discounted Cash Flow (DCF) | Dividend Discount Model (DDM) |

|---|---|---|

| Purpose | Valuation based on projected free cash flows | Valuation based on expected dividends |

| Cash Flow Type | Free Cash Flow to Firm or Equity | Dividends per share |

| Applicability | Broad; suitable for all companies with predictable cash flows | Best for dividend-paying, mature companies |

| Growth Assumption | Explicit multi-stage growth rates based on projections | Assumes constant or variable dividend growth rates |

| Discount Rate | Weighted Average Cost of Capital (WACC) or Cost of Equity | Cost of Equity |

| Complexity | Moderate to high; requires detailed financial projections | Lower; depends mainly on dividend forecasts |

| Risk Factors | Reflects operational and financial risks via cash flow projections | Focuses on dividend sustainability and payout policy |

| Output | Intrinsic enterprise or equity value | Intrinsic equity value |

| Limitations | Requires reliable cash flow forecasting; sensitive to assumptions | Not suitable for companies with irregular or no dividends |

DCF vs Dividend Discount Model: Understanding the Basics

The Discounted Cash Flow (DCF) model values a company based on its projected free cash flows, reflecting the firm's total value by estimating future operating cash flows discounted to present value. The Dividend Discount Model (DDM) focuses solely on expected future dividends, making it suitable for companies with stable and predictable dividend payout histories. While DCF captures overall business performance and growth potential, DDM is more limited and applicable primarily to dividend-paying firms with consistent dividend policies.

Key Assumptions in DCF and DDM Approaches

Key assumptions in the Discounted Cash Flow (DCF) model include projecting free cash flows, determining an appropriate discount rate, and estimating terminal value based on long-term growth rates. The Dividend Discount Model (DDM) primarily assumes constant or predictable dividend growth rates and requires an accurate cost of equity to discount expected dividends. Both models rely heavily on the accuracy of cash flow or dividend forecasts and the selection of discount rates to reflect risk and time value of money.

When to Use DCF vs Dividend Discount Model

Use the Discounted Cash Flow (DCF) model when valuing companies with irregular or unpredictable dividend payments, as it estimates intrinsic value based on free cash flows projected over time. The Dividend Discount Model (DDM) is best suited for mature, stable companies with consistent dividend payments, focusing on the present value of expected dividend streams. Choosing between DCF and DDM depends primarily on a firm's dividend policy and cash flow stability.

Strengths and Weaknesses of DCF Analysis

Discounted Cash Flow (DCF) analysis excels in evaluating a company's intrinsic value by projecting free cash flows and discounting them at a risk-adjusted rate, enabling comprehensive consideration of future growth and profitability. Its strength lies in flexibility, accommodating diverse financial scenarios and capturing value from reinvestment opportunities beyond dividends. However, DCF's accuracy is highly sensitive to assumptions about cash flow projections and discount rates, making it vulnerable to estimation errors and subjective inputs that can significantly skew valuation outcomes.

Pros and Cons of the Dividend Discount Model

The Dividend Discount Model (DDM) offers a straightforward approach for valuing companies with stable and predictable dividend payouts, making it highly suitable for mature firms in industries like utilities and financials. Its main advantage lies in its reliance on actual cash returns to shareholders, providing a clear measure of intrinsic value. However, the model's limitations include its inapplicability to firms that do not pay dividends or have irregular dividend policies, and its sensitivity to dividend growth rate assumptions, which can lead to valuation inaccuracies.

Data Requirements: DCF vs DDM

Discounted Cash Flow (DCF) requires detailed projections of a company's free cash flows and an appropriate discount rate, demanding extensive financial forecasts and assumptions. Dividend Discount Model (DDM) focuses solely on expected dividends and dividend growth rates, suitable for firms with consistent dividend policies. DCF is preferred for companies with variable cash flows, while DDM fits stable, dividend-paying entities, reflecting their distinct data prerequisites.

Application Across Different Sectors

The Discounted Cash Flow (DCF) model is widely applied across sectors with stable and predictable cash flows, such as utilities and manufacturing, due to its focus on free cash flow projections. The Dividend Discount Model (DDM) is more suitable for industries with consistent dividend policies, such as financial services and consumer staples, where shareholder payouts are a key valuation metric. Sector-specific characteristics like growth volatility and capital expenditure intensity influence the choice between DCF and DDM for accurate company valuation.

Impact of Growth Rates in DCF and DDM

Growth rates critically influence valuation in both the Discounted Cash Flow (DCF) and Dividend Discount Model (DDM) by directly affecting the projected cash flows and dividends used in calculations. In DCF, higher growth rates increase the forecasted free cash flows, amplifying the terminal value and overall company valuation. For DDM, growth rates determine future dividends, where sustained high growth can significantly boost present value, but instability in growth assumptions may lead to valuation inaccuracies.

Sensitivity to Discount Rate: DCF vs DDM

The Discounted Cash Flow (DCF) model exhibits higher sensitivity to the discount rate because it projects free cash flows over multiple periods, amplifying the impact of rate changes on valuation. In contrast, the Dividend Discount Model (DDM) relies primarily on expected dividends, typically providing a more stable valuation with less volatility from discount rate fluctuations. Investors often prefer DDM when stable dividend patterns exist, whereas DCF suits firms with volatile or reinvested earnings, despite its greater discount rate sensitivity.

Practical Examples and Case Studies

The Discounted Cash Flow (DCF) model assesses a company's value by projecting free cash flows and discounting them to present value, making it ideal for firms with fluctuating dividends or reinvestment needs, exemplified by Amazon's valuation during growth phases. The Dividend Discount Model (DDM) suits stable, dividend-paying companies like Coca-Cola, where dividends grow at a predictable rate, providing a clearer link between dividends and intrinsic value. Case studies demonstrate that tech startups often favor DCF for flexibility in capturing growth potential, while mature utilities rely on DDM for reliable income stream estimation.

DCF vs Dividend Discount Model Infographic

difterm.com

difterm.com