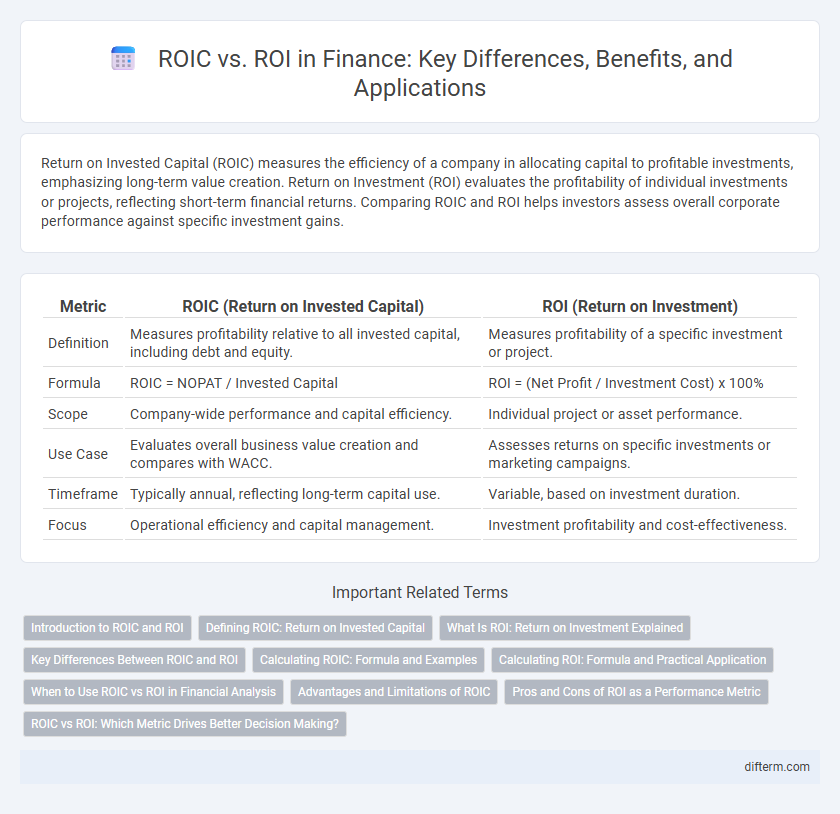

Return on Invested Capital (ROIC) measures the efficiency of a company in allocating capital to profitable investments, emphasizing long-term value creation. Return on Investment (ROI) evaluates the profitability of individual investments or projects, reflecting short-term financial returns. Comparing ROIC and ROI helps investors assess overall corporate performance against specific investment gains.

Table of Comparison

| Metric | ROIC (Return on Invested Capital) | ROI (Return on Investment) |

|---|---|---|

| Definition | Measures profitability relative to all invested capital, including debt and equity. | Measures profitability of a specific investment or project. |

| Formula | ROIC = NOPAT / Invested Capital | ROI = (Net Profit / Investment Cost) x 100% |

| Scope | Company-wide performance and capital efficiency. | Individual project or asset performance. |

| Use Case | Evaluates overall business value creation and compares with WACC. | Assesses returns on specific investments or marketing campaigns. |

| Timeframe | Typically annual, reflecting long-term capital use. | Variable, based on investment duration. |

| Focus | Operational efficiency and capital management. | Investment profitability and cost-effectiveness. |

Introduction to ROIC and ROI

Return on Invested Capital (ROIC) measures a company's efficiency at allocating the capital under its control to profitable investments, reflecting operational performance by comparing net operating profit after taxes to invested capital. Return on Investment (ROI) evaluates the profitability of an individual investment relative to its cost, expressed as a percentage, and is commonly used to assess specific projects or asset acquisitions. Understanding the difference between ROIC and ROI helps investors and managers make informed decisions by distinguishing overall capital efficiency from the success of discrete investments.

Defining ROIC: Return on Invested Capital

Return on Invested Capital (ROIC) measures the efficiency with which a company allocates capital to generate profits, calculated by dividing net operating profit after tax (NOPAT) by invested capital. Unlike Return on Investment (ROI), which broadly evaluates gains from an investment relative to its cost, ROIC specifically focuses on operating performance and capital utilization. ROIC offers investors critical insights into a firm's ability to create value above its cost of capital, serving as a key indicator of sustainable competitive advantage and long-term profitability.

What Is ROI: Return on Investment Explained

Return on Investment (ROI) measures the profitability of an investment by calculating the ratio of net profit to the initial investment cost, expressed as a percentage. Unlike Return on Invested Capital (ROIC), which evaluates efficiency in using capital to generate profits, ROI provides a straightforward metric to assess the overall gains or losses relative to the original amount invested. Investors and businesses use ROI to compare the performance of various investment opportunities and to make informed financial decisions.

Key Differences Between ROIC and ROI

ROIC (Return on Invested Capital) measures the efficiency with which a company generates profit from its invested capital, emphasizing long-term operational performance and capital allocation. ROI (Return on Investment) calculates the overall gain or loss relative to the initial investment, often used for evaluating specific projects or marketing campaigns. ROIC accounts for both debt and equity in its calculation, while ROI typically focuses solely on the investment's direct returns, making ROIC a more comprehensive metric for assessing corporate profitability.

Calculating ROIC: Formula and Examples

Return on Invested Capital (ROIC) measures the efficiency of capital deployment by calculating Net Operating Profit After Taxes (NOPAT) divided by Invested Capital, where Invested Capital includes equity and debt minus non-operating assets. The formula for ROIC is ROIC = NOPAT / Invested Capital, providing a precise metric for evaluating value creation from core operations. For example, if a company has a NOPAT of $5 million and Invested Capital of $25 million, its ROIC is 20%, indicating strong performance in utilizing invested resources.

Calculating ROI: Formula and Practical Application

Calculating ROI involves dividing the net profit generated from an investment by the initial cost of the investment, then multiplying by 100 to express it as a percentage. The formula ROI = (Net Profit / Investment Cost) x 100 helps investors evaluate the efficiency and profitability of various assets or projects. Practical applications of ROI include comparing investment options, assessing marketing campaign effectiveness, and guiding budget allocation in corporate finance.

When to Use ROIC vs ROI in Financial Analysis

ROIC (Return on Invested Capital) is best used when evaluating a company's efficiency at generating returns from its core capital investments, providing insight into long-term value creation. ROI (Return on Investment) is ideal for assessing the profitability of individual projects or short-term investments by measuring returns relative to the initial investment cost. Financial analysts prefer ROIC for comprehensive corporate performance analysis, while ROI is more suitable for comparing discrete financial decisions or marketing campaigns.

Advantages and Limitations of ROIC

Return on Invested Capital (ROIC) measures a company's efficiency in allocating capital to profitable investments, providing a clearer picture of value creation compared to Return on Investment (ROI). ROIC accounts for both equity and debt, offering a more comprehensive assessment of financial performance and capital utilization. However, its limitations include complexity in calculation and potential distortion from accounting adjustments, making it less straightforward for quick comparative analysis.

Pros and Cons of ROI as a Performance Metric

ROI measures the profitability of an investment relative to its cost, offering simplicity and ease of calculation for quick performance assessments. However, ROI fails to account for the time value of money and capital structure, potentially misleading stakeholders when comparing projects of different durations or risk profiles. Its focus on short-term gains can encourage suboptimal decisions, neglecting long-term value creation essential for sustainable financial growth.

ROIC vs ROI: Which Metric Drives Better Decision Making?

ROIC (Return on Invested Capital) offers a more precise measure of a company's efficiency in allocating capital to profitable investments compared to ROI (Return on Investment), which is broader and less focused on operational performance. ROIC accounts for both debt and equity capital, providing insights into value creation beyond simple profit margins captured by ROI. Investors and managers prefer ROIC as it better drives strategic decision-making by highlighting how effectively capital is used to generate sustainable returns.

ROIC vs ROI Infographic

difterm.com

difterm.com