Pre-money valuation refers to a company's estimated worth before receiving external funding or investment, while post-money valuation reflects the company's value immediately after the investment has been added. Understanding the distinction is crucial for investors and founders when negotiating equity stakes and ownership percentages. Accurately assessing these valuations impacts investment decisions, dilution effects, and long-term growth potential.

Table of Comparison

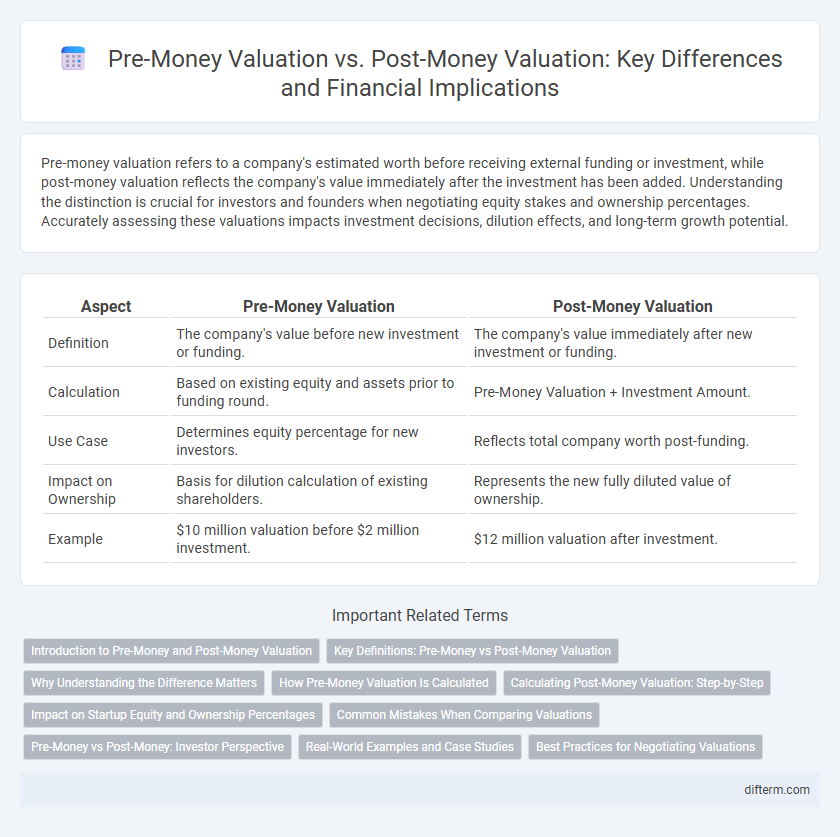

| Aspect | Pre-Money Valuation | Post-Money Valuation |

|---|---|---|

| Definition | The company's value before new investment or funding. | The company's value immediately after new investment or funding. |

| Calculation | Based on existing equity and assets prior to funding round. | Pre-Money Valuation + Investment Amount. |

| Use Case | Determines equity percentage for new investors. | Reflects total company worth post-funding. |

| Impact on Ownership | Basis for dilution calculation of existing shareholders. | Represents the new fully diluted value of ownership. |

| Example | $10 million valuation before $2 million investment. | $12 million valuation after investment. |

Introduction to Pre-Money and Post-Money Valuation

Pre-money valuation refers to the estimated value of a company before new external funding or investment is added, crucial for determining ownership stakes during funding rounds. Post-money valuation is calculated by adding the latest investment amount to the pre-money valuation, reflecting the company's value immediately after the funding round. Understanding these valuations helps investors and entrepreneurs assess dilution effects and negotiate equity shares accurately.

Key Definitions: Pre-Money vs Post-Money Valuation

Pre-money valuation refers to a company's estimated worth before receiving new investment or funding. Post-money valuation is the company's value immediately after the investment, calculated by adding the investment amount to the pre-money valuation. Understanding the difference between pre-money and post-money valuation is crucial for investors and founders in negotiating equity ownership and dilution.

Why Understanding the Difference Matters

Understanding the difference between pre-money valuation and post-money valuation is crucial for accurately assessing a startup's worth before and after investment. Pre-money valuation reflects the company's value prior to new funding, while post-money valuation includes the new capital injected, impacting ownership percentages and dilution. Accurate knowledge of these valuations influences negotiation strategies, investor expectations, and the overall capitalization table management.

How Pre-Money Valuation Is Calculated

Pre-money valuation is calculated by assessing the company's current worth before new capital investment, often using methods such as discounted cash flow (DCF), comparable company analysis, or precedent transactions. It excludes the value added from the new funding round, relying on metrics like revenue, earnings, market potential, and growth projections. Accurate pre-money valuation is critical for negotiating equity stakes and determining ownership dilution during investment rounds.

Calculating Post-Money Valuation: Step-by-Step

Calculating post-money valuation involves adding the total amount of new equity investment to the pre-money valuation, providing the company's value immediately after the funding round. For example, if a startup has a pre-money valuation of $8 million and raises $2 million in new funding, the post-money valuation becomes $10 million. This calculation is essential for determining ownership percentages and the dilution effect on existing shareholders.

Impact on Startup Equity and Ownership Percentages

Pre-money valuation determines the startup's value before new investment, impacting the equity percentage retained by existing shareholders, while post-money valuation reflects the value after investment, incorporating the capital added. Ownership dilution occurs as new shares are issued based on the post-money valuation, reducing founders' equity stakes proportionally. Understanding the distinction between pre-money and post-money valuations is crucial for founders and investors to negotiate ownership percentages accurately and assess control implications in financing rounds.

Common Mistakes When Comparing Valuations

Confusing pre-money valuation with post-money valuation leads to inaccurate assessments of a company's worth, as pre-money valuation excludes new investment, while post-money valuation includes it. Ignoring dilution effects when comparing valuations can cause overestimation of existing shareholders' ownership stakes. Equating valuation figures without considering investment rounds and option pools results in flawed financial decisions and misaligned expectations.

Pre-Money vs Post-Money: Investor Perspective

Pre-money valuation represents a company's value before receiving new investment capital, providing investors with a baseline to assess their ownership stake and potential dilution. Post-money valuation includes the new capital infusion, reflecting the company's updated worth immediately after the investment round. Investors prioritize pre-money valuation to negotiate equity percentage and evaluate investment risks, while post-money valuation determines the immediate ownership dilution and future exit value.

Real-World Examples and Case Studies

Pre-money valuation represents a company's value before new investment, while post-money valuation includes the capital injection, directly impacting equity percentages for investors and founders. For example, in the 2014 Uber funding round, the pre-money valuation was approximately $18 billion, which increased to a post-money valuation of around $22 billion after securing $1.2 billion in new investment. Case studies from startups like Airbnb illustrate how understanding these valuations influences negotiation strategies and ownership dilution during funding rounds.

Best Practices for Negotiating Valuations

Pre-money valuation reflects a company's value before new investment, while post-money valuation includes the invested capital, critical for setting ownership stakes. Negotiators should base valuations on robust financial models, market comparables, and growth projections to ensure realistic assessments. Transparent communication of assumptions and flexibility in deal terms promote trust and facilitate mutually beneficial agreements.

Pre-Money Valuation vs Post-Money Valuation Infographic

difterm.com

difterm.com