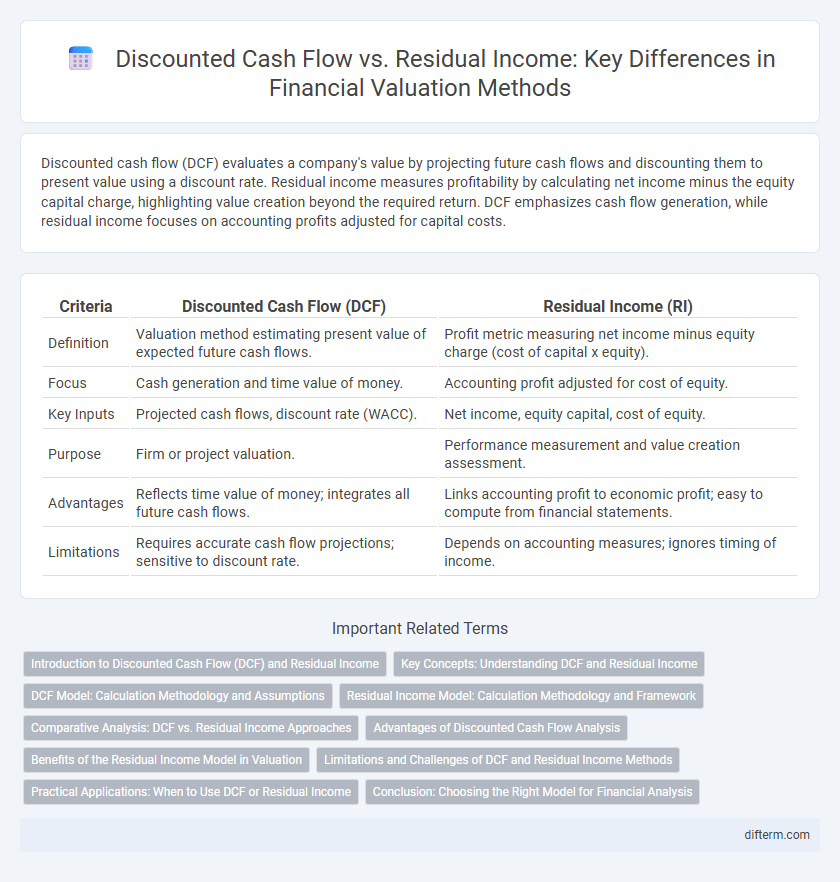

Discounted cash flow (DCF) evaluates a company's value by projecting future cash flows and discounting them to present value using a discount rate. Residual income measures profitability by calculating net income minus the equity capital charge, highlighting value creation beyond the required return. DCF emphasizes cash flow generation, while residual income focuses on accounting profits adjusted for capital costs.

Table of Comparison

| Criteria | Discounted Cash Flow (DCF) | Residual Income (RI) |

|---|---|---|

| Definition | Valuation method estimating present value of expected future cash flows. | Profit metric measuring net income minus equity charge (cost of capital x equity). |

| Focus | Cash generation and time value of money. | Accounting profit adjusted for cost of equity. |

| Key Inputs | Projected cash flows, discount rate (WACC). | Net income, equity capital, cost of equity. |

| Purpose | Firm or project valuation. | Performance measurement and value creation assessment. |

| Advantages | Reflects time value of money; integrates all future cash flows. | Links accounting profit to economic profit; easy to compute from financial statements. |

| Limitations | Requires accurate cash flow projections; sensitive to discount rate. | Depends on accounting measures; ignores timing of income. |

Introduction to Discounted Cash Flow (DCF) and Residual Income

Discounted Cash Flow (DCF) evaluates an investment's value by projecting future cash flows and discounting them to present value using a specific discount rate, reflecting the time value of money and investment risk. Residual Income measures net income exceeding the required return on equity, capturing the value created beyond the firm's cost of capital. Both methods provide intrinsic valuation approaches, with DCF focusing on cash generation and Residual Income emphasizing accounting profitability relative to capital costs.

Key Concepts: Understanding DCF and Residual Income

Discounted Cash Flow (DCF) values a company's future cash flows by estimating their present value using a discount rate, reflecting the time value of money and investment risk. Residual Income measures the net income generated beyond the required return on equity, highlighting value creation after covering capital costs. Both methods provide insights into firm valuation but emphasize different financial aspects: cash flow timing versus accounting profitability adjusted for cost of capital.

DCF Model: Calculation Methodology and Assumptions

The Discounted Cash Flow (DCF) model calculates the present value of expected future cash flows by applying a discount rate that reflects the risk and time value of money. Key assumptions include projecting free cash flows based on revenue growth, operating margins, capital expenditures, and changes in working capital, while selecting an appropriate weighted average cost of capital (WACC) as the discount rate. This method contrasts with residual income models by explicitly valuing cash inflows over time rather than focusing solely on accounting profits exceeding a required return.

Residual Income Model: Calculation Methodology and Framework

The Residual Income Model calculates firm value by estimating net income exceeding the required equity cost, discounting these residual incomes to present value while incorporating book value of equity. This framework uses residual income as the key driver, emphasizing economic profit beyond opportunity costs, contrasting with discounted cash flow which focuses solely on free cash flows. Residual income considers accounting measures and cost of equity, providing a more comprehensive valuation in scenarios with limited cash flow visibility or negative cash flows.

Comparative Analysis: DCF vs. Residual Income Approaches

Discounted Cash Flow (DCF) analysis values a company based on the present value of expected future cash flows, emphasizing intrinsic value derived from operational performance and capital expenditures. Residual Income (RI) focuses on the net income remaining after deducting a charge for the cost of equity, highlighting economic profit and value creation beyond required returns. While DCF captures overall business cash generation, RI provides insight into shareholder wealth by measuring profitability after accounting for the cost of capital, making both complementary tools for comprehensive financial valuation.

Advantages of Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) analysis provides a comprehensive valuation by incorporating the time value of money, offering precise forecasts of future cash flows discounted back to their present value. This method captures the intrinsic value of an investment, allowing for detailed sensitivity analysis tied to varying discount rates and growth assumptions. DCF's ability to reflect the timing and risk of cash inflows makes it highly effective for investment appraisal and strategic financial planning.

Benefits of the Residual Income Model in Valuation

The Residual Income Model enhances valuation accuracy by incorporating both the net income generated and the cost of equity capital, providing a clearer picture of economic profit. It addresses the limitations of Discounted Cash Flow (DCF) by explicitly accounting for the opportunity cost of invested capital, which improves performance measurement and reduces bias in valuation. This model is particularly useful for firms with irregular cash flows or negative free cash flows where traditional DCF methods may produce unreliable estimates.

Limitations and Challenges of DCF and Residual Income Methods

Discounted Cash Flow (DCF) analysis faces limitations such as high sensitivity to assumptions about future cash flows and discount rates, which can lead to valuation inaccuracies under uncertain market conditions. Residual income models encounter challenges related to the accurate estimation of the cost of equity and persistent earnings, making the method less reliable for firms with volatile profits or non-standard capital structures. Both approaches require precise financial forecasting and can be distorted by accounting policies, thereby complicating their application in dynamic economic environments.

Practical Applications: When to Use DCF or Residual Income

Discounted Cash Flow (DCF) is ideal for valuing companies with predictable free cash flows, such as mature businesses or projects with stable revenue streams. Residual Income models are better suited for firms with volatile cash flows but consistent accounting profits, offering a clearer picture of value creation beyond cost of capital. Choosing between DCF and Residual Income depends on data availability, business stability, and the specific valuation goals in financial analysis.

Conclusion: Choosing the Right Model for Financial Analysis

Discounted cash flow (DCF) provides a comprehensive valuation by estimating the present value of future cash flows, making it ideal for long-term investment decisions and firms with stable cash flows. Residual income models focus on measuring the economic profit beyond the required return on equity, offering sharper insight into value creation, especially for companies with unpredictable cash flows or strong accounting transparency. Selecting between DCF and residual income depends on the firm's cash flow stability, forecast reliability, and the specific financial analysis objective, ensuring accurate valuation and strategic decision-making.

discounted cash flow vs residual income Infographic

difterm.com

difterm.com