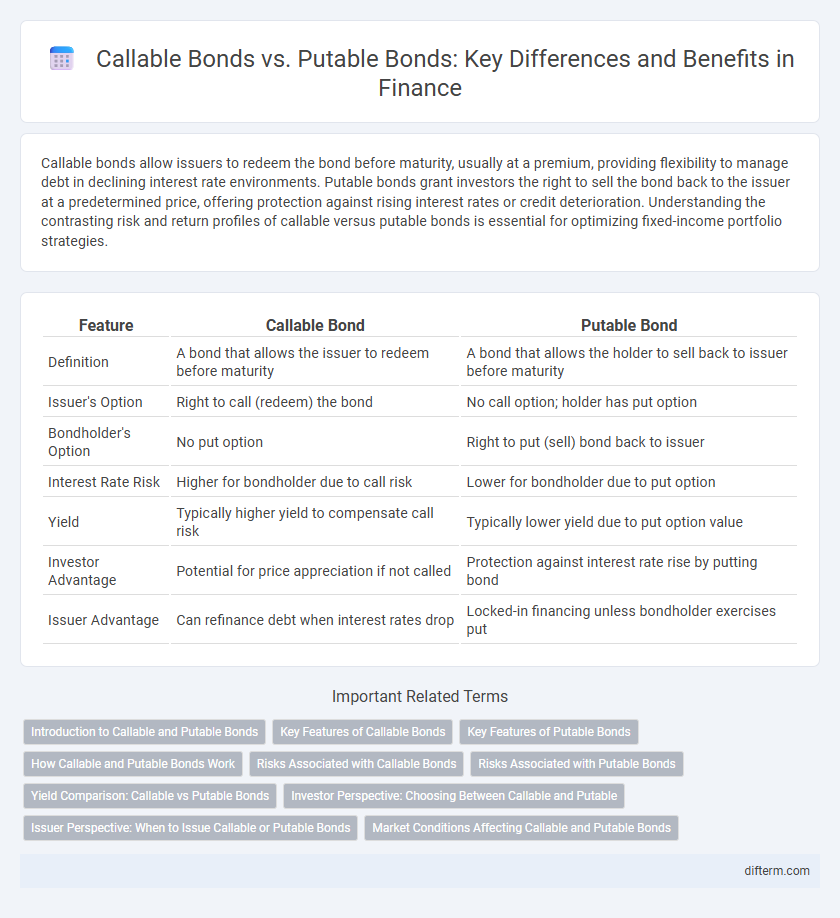

Callable bonds allow issuers to redeem the bond before maturity, usually at a premium, providing flexibility to manage debt in declining interest rate environments. Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price, offering protection against rising interest rates or credit deterioration. Understanding the contrasting risk and return profiles of callable versus putable bonds is essential for optimizing fixed-income portfolio strategies.

Table of Comparison

| Feature | Callable Bond | Putable Bond |

|---|---|---|

| Definition | A bond that allows the issuer to redeem before maturity | A bond that allows the holder to sell back to issuer before maturity |

| Issuer's Option | Right to call (redeem) the bond | No call option; holder has put option |

| Bondholder's Option | No put option | Right to put (sell) bond back to issuer |

| Interest Rate Risk | Higher for bondholder due to call risk | Lower for bondholder due to put option |

| Yield | Typically higher yield to compensate call risk | Typically lower yield due to put option value |

| Investor Advantage | Potential for price appreciation if not called | Protection against interest rate rise by putting bond |

| Issuer Advantage | Can refinance debt when interest rates drop | Locked-in financing unless bondholder exercises put |

Introduction to Callable and Putable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, typically benefiting from declining interest rates by refinancing debt at lower costs. Putable bonds provide investors the option to sell the bond back to the issuer prior to maturity, offering protection against rising interest rates or deteriorating credit quality. These embedded options significantly impact bond pricing, yield, and risk profiles in fixed income portfolios.

Key Features of Callable Bonds

Callable bonds grant the issuer the right to redeem the bond before maturity at a specified call price, providing flexibility to manage debt in declining interest rate environments. These bonds typically offer higher yields to compensate investors for the reinvestment risk associated with potential early redemption. The call provision can impact bond pricing, making callable bonds more sensitive to interest rate changes compared to non-callable or putable bonds.

Key Features of Putable Bonds

Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, reducing interest rate risk and providing downside protection. These bonds typically offer lower coupon rates compared to non-putable bonds due to the embedded put option's value. Key features include enhanced liquidity for bondholders, the ability to limit potential losses during market downturns, and increased flexibility in managing investment portfolios.

How Callable and Putable Bonds Work

Callable bonds allow issuers to redeem the bond before maturity at a predetermined call price, enabling them to capitalize on declining interest rates by refinancing debt at lower costs. Putable bonds grant bondholders the right to sell the bond back to the issuer at a specified price before maturity, offering protection against rising interest rates or issuer credit deterioration. These embedded options significantly influence bond pricing, yield calculations, and investment risk assessments in fixed-income portfolios.

Risks Associated with Callable Bonds

Callable bonds expose investors to reinvestment risk, as issuers may redeem the bond early when interest rates decline, forcing investors to reinvest at lower yields. Price risk increases because the bond's price appreciation is capped by the call feature, limiting potential capital gains compared to non-callable bonds. Moreover, callable bonds typically offer higher yields to compensate investors for the embedded call option and associated uncertainty in cash flow timing.

Risks Associated with Putable Bonds

Putable bonds expose investors to reinvestment risk, as the issuer may call the bond before maturity when interest rates drop, forcing investors to reinvest at lower yields; however, putable bonds allow investors to sell the bond back to the issuer at predetermined times, mitigating some market risk. The primary risk associated with putable bonds is the potential for reduced yield if the investor exercises the put option prematurely, especially in declining interest rate environments. Credit risk remains a concern since the issuer's ability to honor the put option depends on their financial health.

Yield Comparison: Callable vs Putable Bonds

Callable bonds typically offer higher yields compared to putable bonds due to the issuer's right to redeem the bond before maturity, which increases reinvestment risk for investors. Putable bonds provide investors with the option to sell the bond back to the issuer at a predetermined price, reducing interest rate risk and usually resulting in lower yields. Yield comparison reflects these risk premiums, with callable bonds compensating investors for potential early redemption, while putable bonds' yields are generally lower to account for the added investor protection.

Investor Perspective: Choosing Between Callable and Putable

Investors weigh callable bonds' higher yields against the risk of early redemption by issuers, which can limit potential returns. Putable bonds offer investors the security to sell back the bond to the issuer at predetermined times, reducing interest rate risk and providing flexibility in volatile markets. Choosing between callable and putable bonds depends on an investor's risk tolerance and desire for income stability or optionality in bond holdings.

Issuer Perspective: When to Issue Callable or Putable Bonds

Issuers prefer callable bonds when anticipating declining interest rates, allowing them to refinance debt at lower costs and reduce interest expenses. Putable bonds are issued to attract investors during uncertain markets by offering them the right to sell bonds back, thus lowering yield demands. Choosing between callable or putable bonds depends on the issuer's risk tolerance, cash flow flexibility, and interest rate forecasts.

Market Conditions Affecting Callable and Putable Bonds

Callable bonds typically thrive in declining interest rate environments as issuers are incentivized to redeem debt early and refinance at lower rates. Putable bonds gain appeal during rising interest rate periods, offering investors the option to sell the bond back to the issuer before maturity, thus reducing potential losses. Market volatility and credit risk shifts also influence investor preferences between callable and putable bonds, impacting pricing and demand dynamics.

Callable bond vs Putable bond Infographic

difterm.com

difterm.com