Pre-tax income refers to the earnings a business or individual generates before any taxes are deducted, serving as the basis for calculating tax liabilities. After-tax income, often called net income, is the amount remaining once all applicable taxes have been subtracted, reflecting the true take-home earnings. Understanding the difference between pre-tax and after-tax income is crucial for accurate financial planning and assessing profitability.

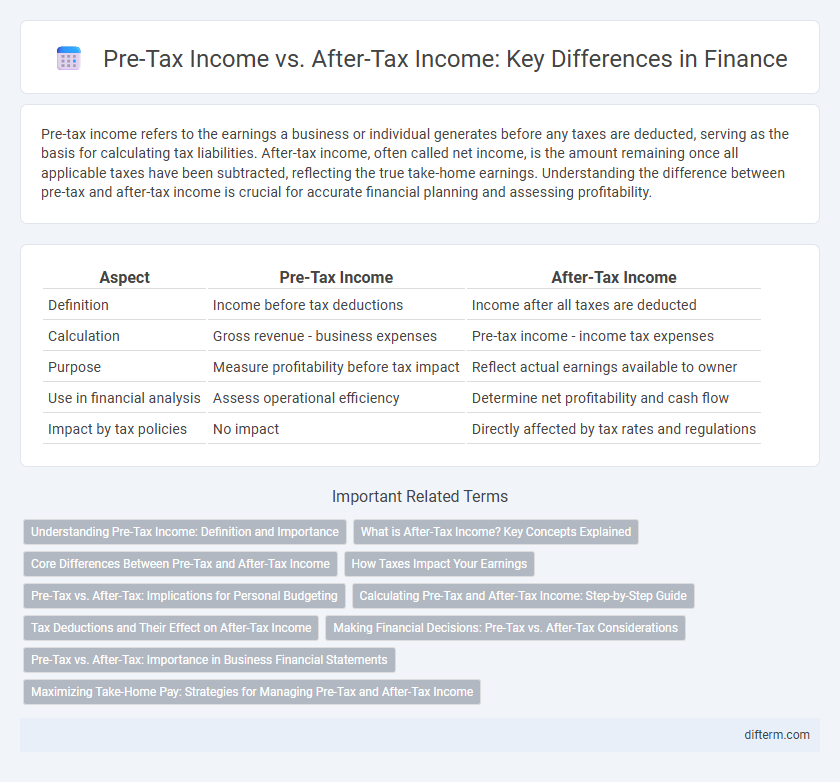

Table of Comparison

| Aspect | Pre-Tax Income | After-Tax Income |

|---|---|---|

| Definition | Income before tax deductions | Income after all taxes are deducted |

| Calculation | Gross revenue - business expenses | Pre-tax income - income tax expenses |

| Purpose | Measure profitability before tax impact | Reflect actual earnings available to owner |

| Use in financial analysis | Assess operational efficiency | Determine net profitability and cash flow |

| Impact by tax policies | No impact | Directly affected by tax rates and regulations |

Understanding Pre-Tax Income: Definition and Importance

Pre-tax income represents a company's earnings before income tax expenses are deducted, serving as a key indicator of operational profitability. It provides a clearer picture of a business's financial performance by excluding tax impacts, allowing investors and analysts to assess core profitability and compare companies across different tax environments. Understanding pre-tax income is essential for evaluating efficiency in generating earnings and making informed investment or management decisions.

What is After-Tax Income? Key Concepts Explained

After-tax income represents the amount of earnings retained by an individual or business after all applicable taxes, including federal, state, and local taxes, have been deducted from pre-tax income. This metric is crucial because it reflects the actual disposable income available for spending, saving, or investing and directly impacts budgeting, financial planning, and net profitability assessments. Understanding after-tax income allows for better evaluation of financial health and more accurate comparisons between gross earnings and real economic benefit.

Core Differences Between Pre-Tax and After-Tax Income

Pre-tax income represents the total earnings before any taxes are deducted, serving as a key indicator of a company's profitability and financial performance. After-tax income, also known as net income, reflects the actual earnings available to shareholders or individuals, calculated by subtracting federal, state, and local taxes from pre-tax income. Understanding the core difference between these two metrics is essential for accurate financial analysis, tax planning, and assessing true economic benefit.

How Taxes Impact Your Earnings

Pre-tax income represents the total earnings before any taxes are deducted, providing a clear picture of an individual's or company's gross revenue potential. After-tax income reflects the actual amount available to spend or invest, as it accounts for mandatory tax obligations such as federal, state, and local taxes. Understanding the difference between pre-tax and after-tax income is crucial for accurate financial planning and assessing true earning power.

Pre-Tax vs. After-Tax: Implications for Personal Budgeting

Pre-tax income represents total earnings before any taxes are deducted, while after-tax income reflects the actual amount available for personal spending and saving. Understanding the difference is crucial for accurate budgeting, as after-tax income determines disposable cash flow and affects decisions on expenses, debt repayment, and investments. Effective personal budgeting requires realistic projections based on after-tax income to ensure financial goals align with net earnings.

Calculating Pre-Tax and After-Tax Income: Step-by-Step Guide

Calculating pre-tax income involves summing all earnings before any deductions, including gross wages, business revenue, and investment returns. After-tax income is derived by subtracting federal, state, and local taxes, along with Social Security and Medicare contributions, from the pre-tax amount. Accurate computation requires detailed tax rates and applicable deductions to reflect the true disposable income for financial planning.

Tax Deductions and Their Effect on After-Tax Income

Tax deductions directly reduce taxable income, thereby lowering the amount of tax owed and increasing after-tax income. For example, if a taxpayer has $100,000 in pre-tax income and qualifies for $20,000 in deductions, their taxable income decreases to $80,000, resulting in a smaller tax liability. This reduction in taxes paid enhances the net earnings retained, demonstrating the crucial role deductions play in shaping after-tax income.

Making Financial Decisions: Pre-Tax vs. After-Tax Considerations

Pre-tax income represents earnings before any tax obligations, providing a clearer view of overall profitability, while after-tax income reflects the actual amount available for spending or reinvestment. Financial decisions, such as budgeting, investing, or loan repayment, should prioritize after-tax income to ensure accurate cash flow management. Understanding the tax implications on income helps optimize tax strategies and improve long-term financial planning.

Pre-Tax vs. After-Tax: Importance in Business Financial Statements

Pre-tax income represents a company's earnings before income tax expenses are deducted, providing a clear view of operational profitability and efficiency. After-tax income reflects the net earnings available to shareholders, capturing the impact of tax obligations on overall profitability. Understanding the distinction between pre-tax and after-tax income is crucial for assessing true financial performance and making informed business decisions.

Maximizing Take-Home Pay: Strategies for Managing Pre-Tax and After-Tax Income

Maximizing take-home pay requires understanding the difference between pre-tax income, which represents total earnings before taxes, and after-tax income, the actual amount available for spending or saving. Strategies such as contributing to tax-advantaged accounts like 401(k)s or IRAs reduce taxable income, increasing after-tax cash flow while building retirement savings. Effective tax planning, including deductions, credits, and income timing, further optimizes after-tax income, enhancing overall financial health.

Pre-tax income vs after-tax income Infographic

difterm.com

difterm.com